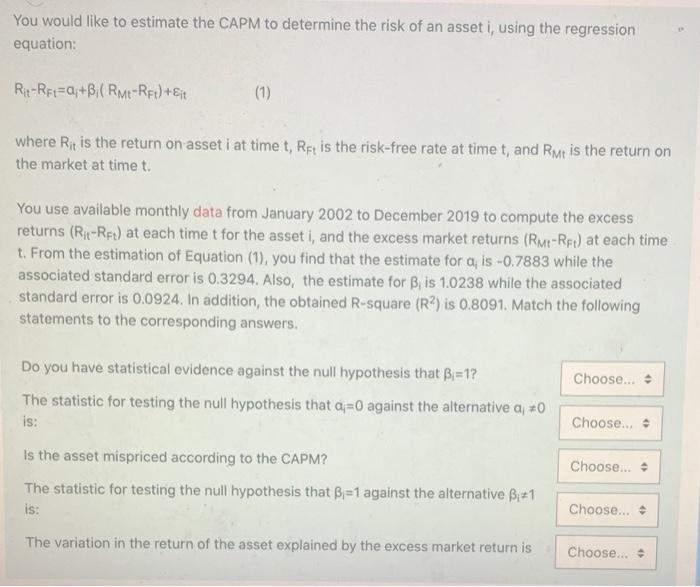

You would like to estimate the CAPM to determine the risk of an asset i, using the regression equation: Rit-RFz=0;+B:( Rme-RFI) +Eit (1) where Rit is the return on asset i at time t, Rft is the risk-free rate at time t, and Rme is the return on the market at timet You use available monthly data from January 2002 to December 2019 to compute the excess returns (Rit-Red) at each time t for the asset i, and the excess market returns (RM-Rp) at each time t. From the estimation of Equation (1), you find that the estimate for ais -0.7883 while the associated standard error is 0.3294. Also, the estimate for B, is 1.0238 while the associated standard error is 0.0924. In addition, the obtained R-square (R2) is 0.8091. Match the following statements to the corresponding answers. Choose... Do you have statistical evidence against the null hypothesis that Bi=1? The statistic for testing the null hypothesis that j=0 against the alternative aj #0 is: Choose... - Choose... Is the asset mispriced according to the CAPM? The statistic for testing the null hypothesis that Bi=1 against the alternative Bi +1 is: Choose.... The variation in the return of the asset explained by the excess market return is Choose... You would like to estimate the CAPM to determine the risk of an asset i, using the regression equation: Rit-RFz=0;+B:( Rme-RFI) +Eit (1) where Rit is the return on asset i at time t, Rft is the risk-free rate at time t, and Rme is the return on the market at timet You use available monthly data from January 2002 to December 2019 to compute the excess returns (Rit-Red) at each time t for the asset i, and the excess market returns (RM-Rp) at each time t. From the estimation of Equation (1), you find that the estimate for ais -0.7883 while the associated standard error is 0.3294. Also, the estimate for B, is 1.0238 while the associated standard error is 0.0924. In addition, the obtained R-square (R2) is 0.8091. Match the following statements to the corresponding answers. Choose... Do you have statistical evidence against the null hypothesis that Bi=1? The statistic for testing the null hypothesis that j=0 against the alternative aj #0 is: Choose... - Choose... Is the asset mispriced according to the CAPM? The statistic for testing the null hypothesis that Bi=1 against the alternative Bi +1 is: Choose.... The variation in the return of the asset explained by the excess market return is Choose