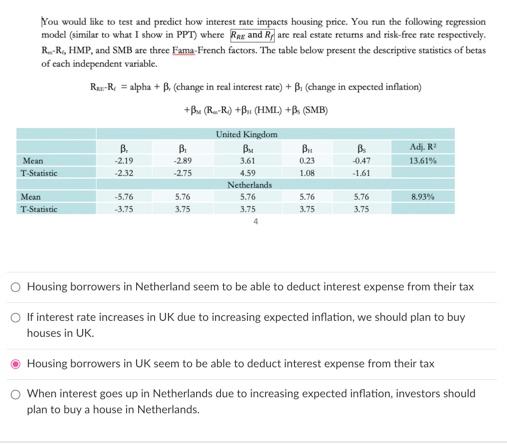

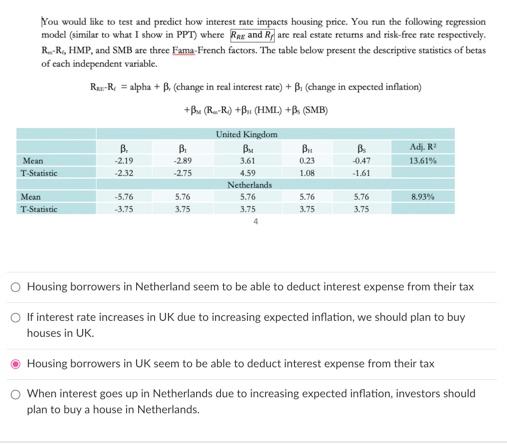

You would like to test and predict how interest rate impacts housing price. You run the following regression model (similar to what I show in PPT) where Rex and R, are real estate returns and risk-free rate respectively. R-R, HMP, and SMB are three Fama French factors. The table below present the descriptive statistics of betas of each independent variable. Re-Re = alpha + B (change in real interest rate) + B. (change in expected inflation) +B ( RR) +B (HMI) +B (SMB) B. -2.19 -2.32 B. -289 -2.75 B 0.23 Mean T Statistic Adj. R 13,61% B -0.47 -1.61 United Kingdom Bu 3.61 4.59 Netherlands 5.76 3.75 4 1.08 8.93% Mean T-Statistic -5.76 -3.75 5.76 3.75 5.76 3.75 5.76 3.75 Housing borrowers in Netherland seem to be able to deduct interest expense from their tax If interest rate increases in UK due to increasing expected inflation, we should plan to buy houses in UK Housing borrowers in UK seem to be able to deduct interest expense from their tax When interest goes up in Netherlands due to increasing expected inflation, investors should plan to buy a house in Netherlands. You would like to test and predict how interest rate impacts housing price. You run the following regression model (similar to what I show in PPT) where Rex and R, are real estate returns and risk-free rate respectively. R-R, HMP, and SMB are three Fama French factors. The table below present the descriptive statistics of betas of each independent variable. Re-Re = alpha + B (change in real interest rate) + B. (change in expected inflation) +B ( RR) +B (HMI) +B (SMB) B. -2.19 -2.32 B. -289 -2.75 B 0.23 Mean T Statistic Adj. R 13,61% B -0.47 -1.61 United Kingdom Bu 3.61 4.59 Netherlands 5.76 3.75 4 1.08 8.93% Mean T-Statistic -5.76 -3.75 5.76 3.75 5.76 3.75 5.76 3.75 Housing borrowers in Netherland seem to be able to deduct interest expense from their tax If interest rate increases in UK due to increasing expected inflation, we should plan to buy houses in UK Housing borrowers in UK seem to be able to deduct interest expense from their tax When interest goes up in Netherlands due to increasing expected inflation, investors should plan to buy a house in Netherlands