Answered step by step

Verified Expert Solution

Question

1 Approved Answer

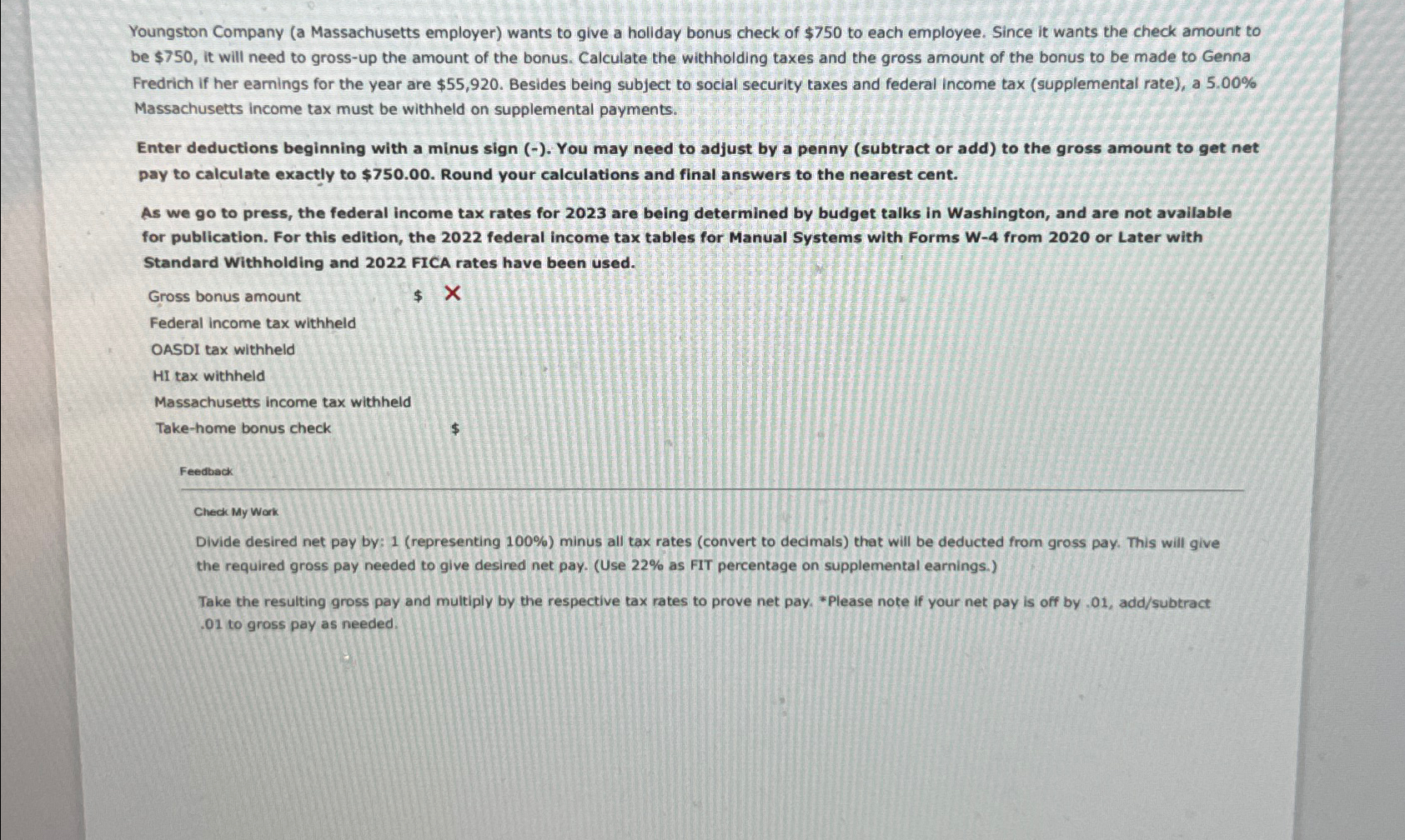

Youngston Company ( a Massachusetts employer ) wants to give a holiday bonus check of $ 7 5 0 to each employee. Since it wants

Youngston Company a Massachusetts employer wants to give a holiday bonus check of $ to each employee. Since it wants the check amount to be $ it will need to grossup the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to Genna Fredrich if her earnings for the year are $ Besides being subject to social security taxes and federal income tax supplemental rate a Massachusetts income tax must be withheld on supplemental payments.

Enter deductions beginning with a minus sign You may need to adjust by a penny subtract or add to the gross amount to get net pay to calculate exactly to $ Round your calculations and final answers to the nearest cent.

As we go to press, the federal income tax rates for are being determined by budget talks in Washington, and are not available for publication. For this edition, the federal income tax tables for Manual Systems with Forms W from or Later with Standard Withholding and FICA rates have been used.

Gross bonus amount

$

Federal income tax withheld

OASDI tax withheld

HI tax withheld

Massachusetts income tax withheld

Takehome bonus check

$

Feedback

Check My Work

Divide desired net pay by: representing minus all tax rates convert to decimals that will be deducted from gross pay. This will give the required gross pay needed to give desired net pay. Use as FIT percentage on supplemental earnings.

Take the resulting gross pay and multiply by the respective tax rates to prove net pay. Please note if your net pay is off by addsubtract to gross pay as needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started