Answered step by step

Verified Expert Solution

Question

1 Approved Answer

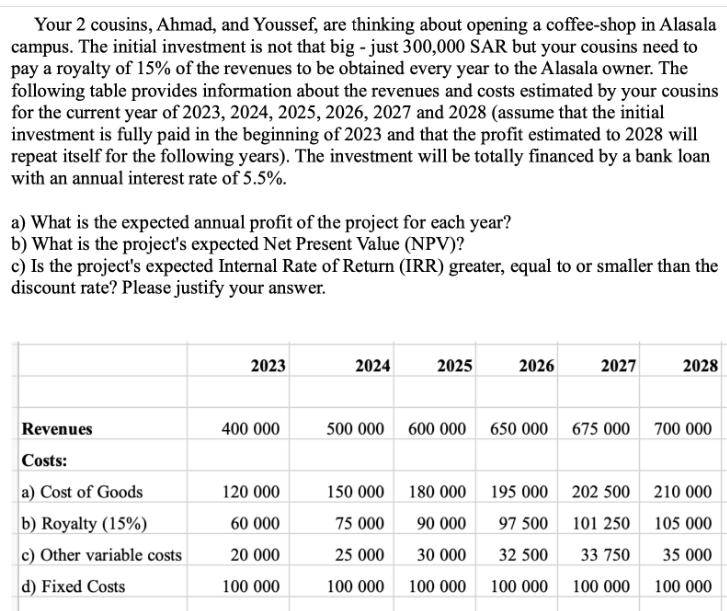

Your 2 cousins, Ahmad, and Youssef, are thinking about opening a coffee-shop in Alasala campus. The initial investment is not that big - just

Your 2 cousins, Ahmad, and Youssef, are thinking about opening a coffee-shop in Alasala campus. The initial investment is not that big - just 300,000 SAR but your cousins need to pay a royalty of 15% of the revenues to be obtained every year to the Alasala owner. The following table provides information about the revenues and costs estimated by your cousins for the current year of 2023, 2024, 2025, 2026, 2027 and 2028 (assume that the initial investment is fully paid in the beginning of 2023 and that the profit estimated to 2028 will repeat itself for the following years). The investment will be totally financed by a bank loan with an annual interest rate of 5.5%. a) What is the expected annual profit of the project for each year? b) What is the project's expected Net Present Value (NPV)? c) Is the project's expected Internal Rate of Return (IRR) greater, equal to or smaller than the discount rate? Please justify your answer. Revenues Costs: a) Cost of Goods b) Royalty (15%) c) Other variable costs d) Fixed Costs 2023 400 000 120 000 60 000 20 000 100 000 2024 2025 150 000 75 000 25 000 100 000 2026 500 000 600 000 650 000 675 000 180 000 90 000 30 000 100 000 2027 195 000 97 500 32 500 100 000 202 500 101 250 33 750 100 000 2028 700 000 210 000 105 000 35 000 100 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started