Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your analysis of the contributions receivable as of December 31, 20X4, determined that there were unrecognized contributions for the following: Unrestricted use $ 41,400 Cancer

- Your analysis of the contributions receivable as of December 31, 20X4, determined that there were unrecognized contributions for the following:

| Unrestricted use | $ | 41,400 | |

| Cancer research | 11,700 | ||

| Purchase of equipment | 21,700 | ||

| Permanently restricted endowment principal | 31,500 | ||

| Total | $ | 106,300 | |

- Short-term investments at year-end consist of $150,900 of funds without donor restrictions and $50,800 of funds restricted for future cancer research. All of the long-term investments are held in the permanently restricted endowment fund.

- Land is carried at its current market value of $121,800. The original owner purchased the land for $71,300, and at the time of donation to the hospital, it had an appraised value of $95,700.

- Buildings purchased 11 years ago for $610,500 had an estimated useful life of 30 years. Equipment costing $155,700 was purchased 7 years ago and had an expected life of 10 years. The controller had improperly increased the reported values of the buildings and equipment to their current fair value of $936,000 and had incorrectly computed the accumulated depreciation.

- The board of directors voted on December 29, 20X4, to designate $100,200 of funds without donor restrictions invested in short-term investments for developing a drug rehabilitation center.

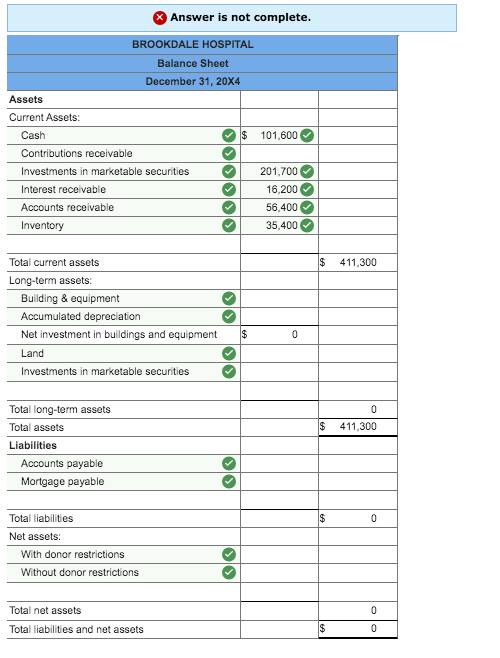

Required: Prepare a balance sheet for Brookdale Hospital at December 31, 20X4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started