Answered step by step

Verified Expert Solution

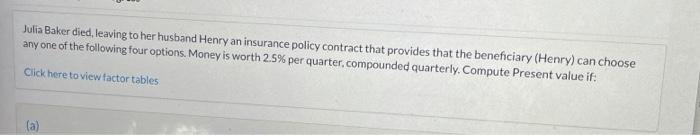

Question

1 Approved Answer

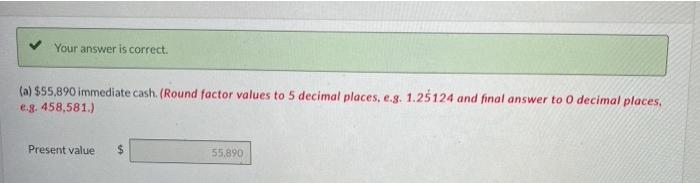

Your answer is correct. (a) $55,890 immediate cash. (Round factor values to 5 decimal places, e.g. 1.2124 and final answer to 0 decimal places, e.8.458.581.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started