Answered step by step

Verified Expert Solution

Question

1 Approved Answer

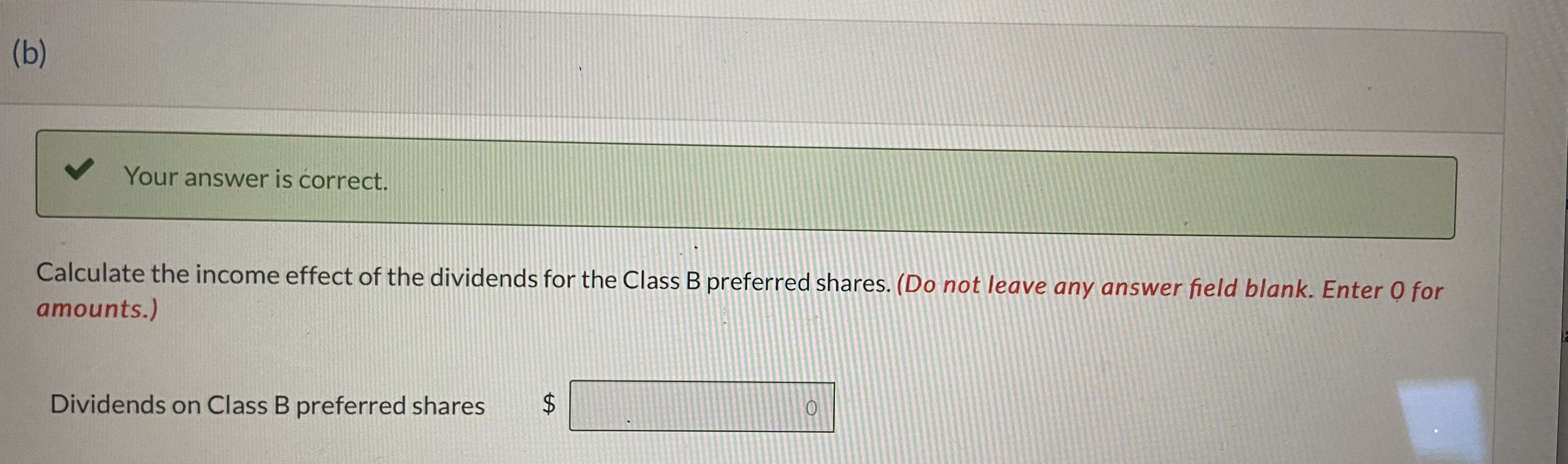

Your answer is correct. Calculate the income effect of the dividends for the Class B preferred shares. (Do not leave any answer field blank. Enter

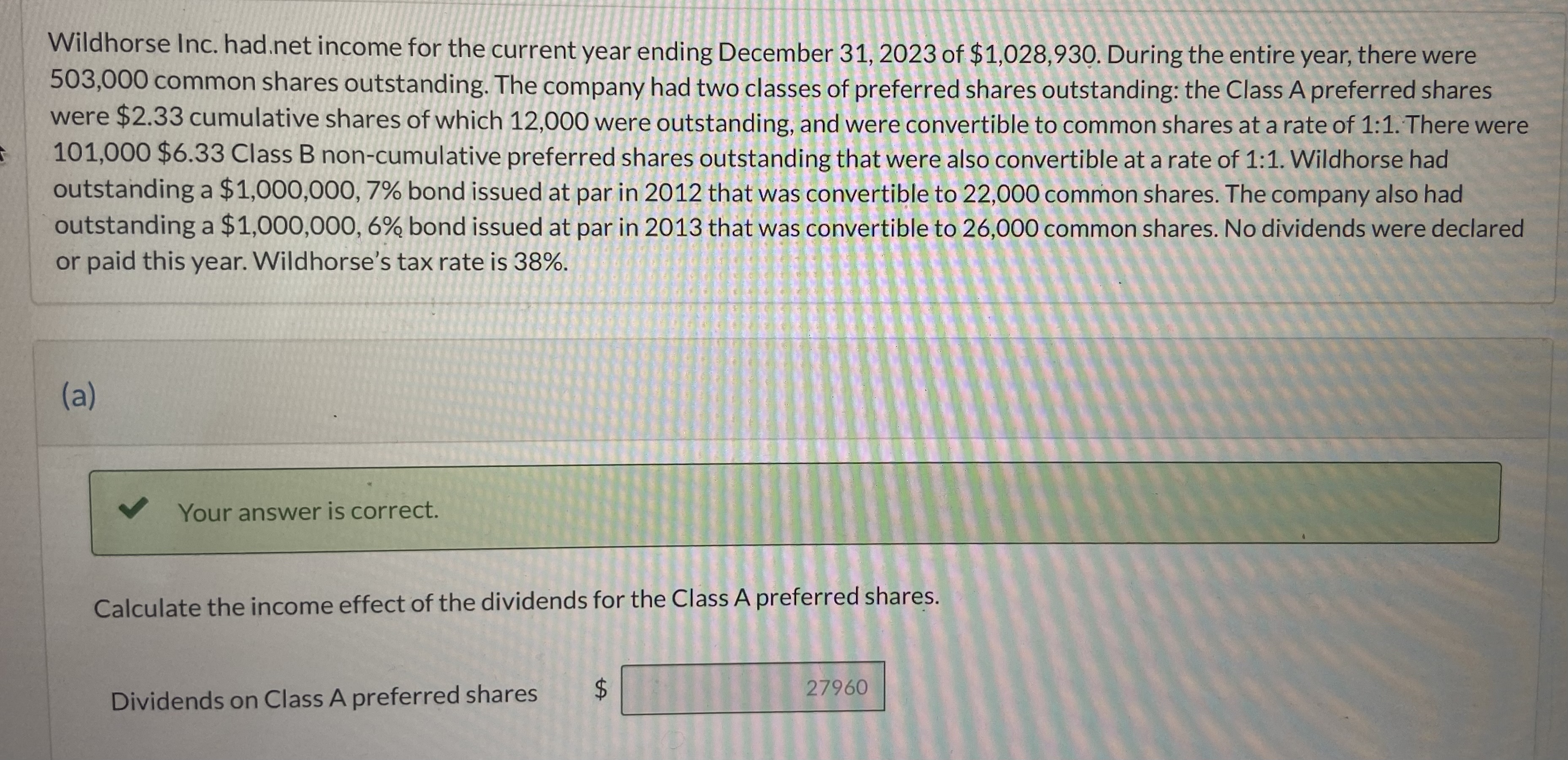

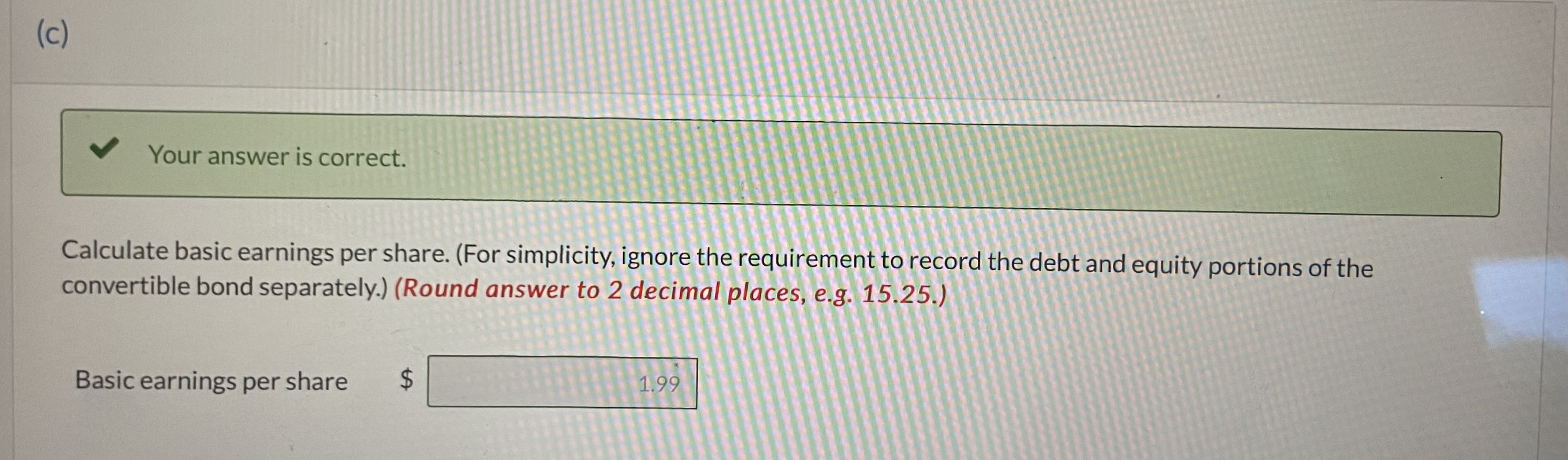

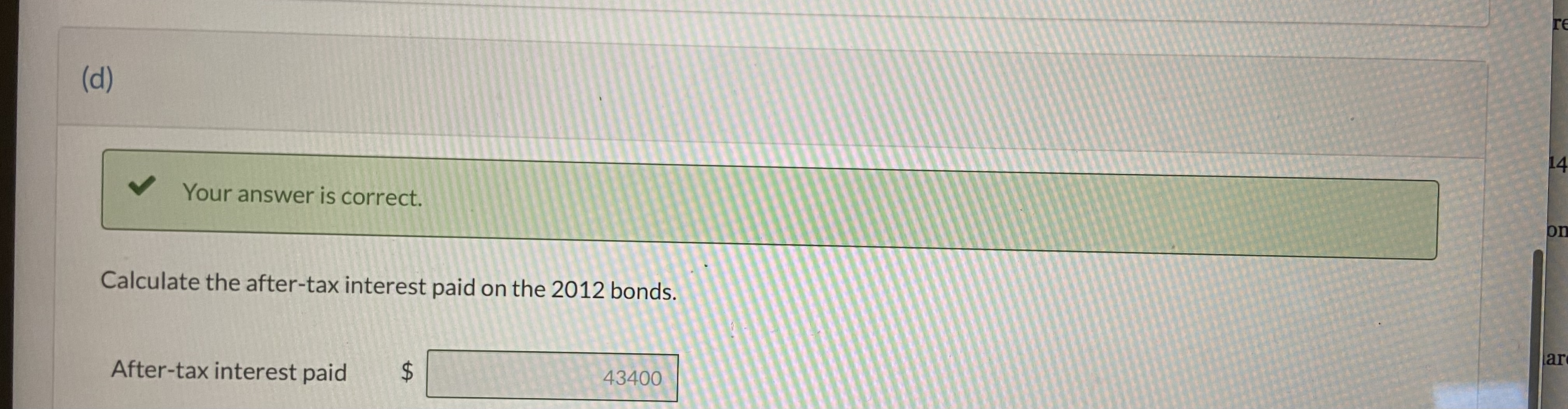

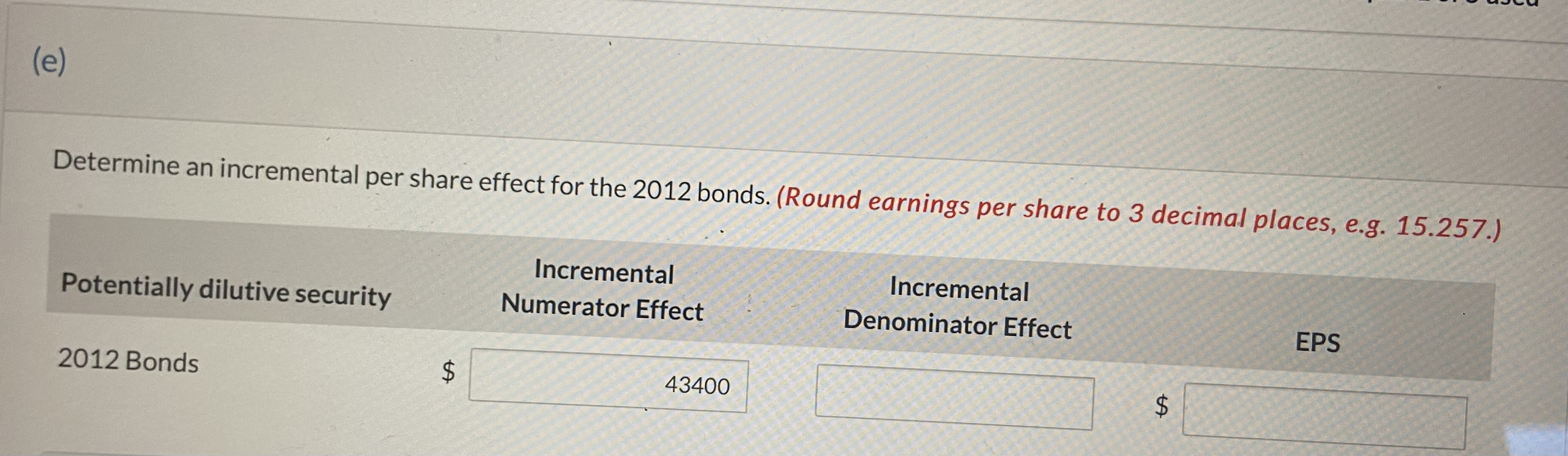

Your answer is correct. Calculate the income effect of the dividends for the Class B preferred shares. (Do not leave any answer field blank. Enter O for amounts.) Dividends on Class B preferred shares Determine an incremental per share effect for the 2012 bonds. (Round earnings per share to 3 decimal places. e.q 15 257 Your answer is correct. Calculate the after-tax interest paid on the 2012 bonds. After-tax interest paid Your answer is correct. Calculate basic earnings per share. (For simplicity, ignore the requirement to record the debt and equity portions of the convertible bond separately.) (Round answer to 2 decimal places, e.g. 15.25.) Basic earnings per share Wildhorse Inc. had. net income for the current year ending December 31,2023 of $1,028,930. During the entire year, there were 503,000 common shares outstanding. The company had two classes of preferred shares outstanding: the Class A preferred shares were $2.33 cumulative shares of which 12,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 101,000$6.33 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Wildhorse had outstanding a $1,000,000,7% bond issued at par in 2012 that was convertible to 22,000 common shares. The company also had outstanding a $1,000,000,6% bond issued at par in 2013 that was convertible to 26,000 common shares. No dividends were declared or paid this year. Wildhorse's tax rate is 38%. (a) Your answer is correct. Calculate the income effect of the dividends for the Class A preferred shares. Dividends on Class A preferred shares $

Your answer is correct. Calculate the income effect of the dividends for the Class B preferred shares. (Do not leave any answer field blank. Enter O for amounts.) Dividends on Class B preferred shares Determine an incremental per share effect for the 2012 bonds. (Round earnings per share to 3 decimal places. e.q 15 257 Your answer is correct. Calculate the after-tax interest paid on the 2012 bonds. After-tax interest paid Your answer is correct. Calculate basic earnings per share. (For simplicity, ignore the requirement to record the debt and equity portions of the convertible bond separately.) (Round answer to 2 decimal places, e.g. 15.25.) Basic earnings per share Wildhorse Inc. had. net income for the current year ending December 31,2023 of $1,028,930. During the entire year, there were 503,000 common shares outstanding. The company had two classes of preferred shares outstanding: the Class A preferred shares were $2.33 cumulative shares of which 12,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 101,000$6.33 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Wildhorse had outstanding a $1,000,000,7% bond issued at par in 2012 that was convertible to 22,000 common shares. The company also had outstanding a $1,000,000,6% bond issued at par in 2013 that was convertible to 26,000 common shares. No dividends were declared or paid this year. Wildhorse's tax rate is 38%. (a) Your answer is correct. Calculate the income effect of the dividends for the Class A preferred shares. Dividends on Class A preferred shares $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started