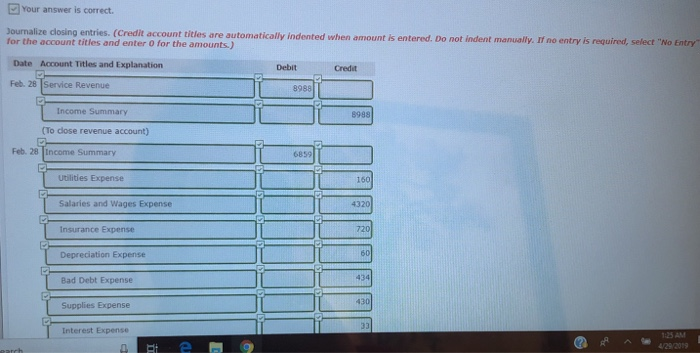

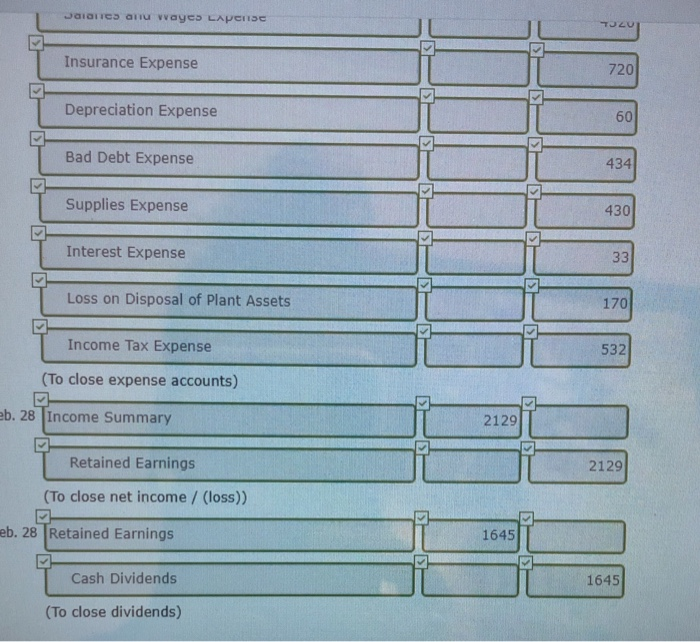

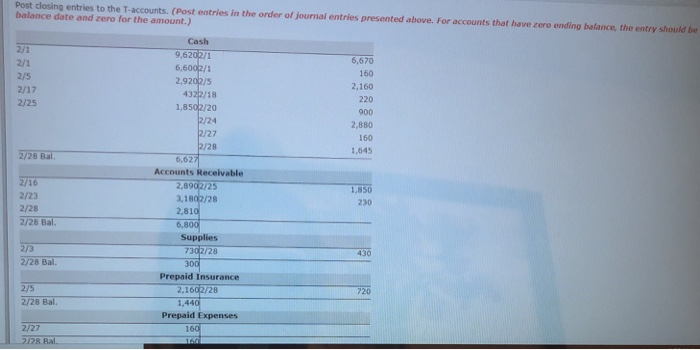

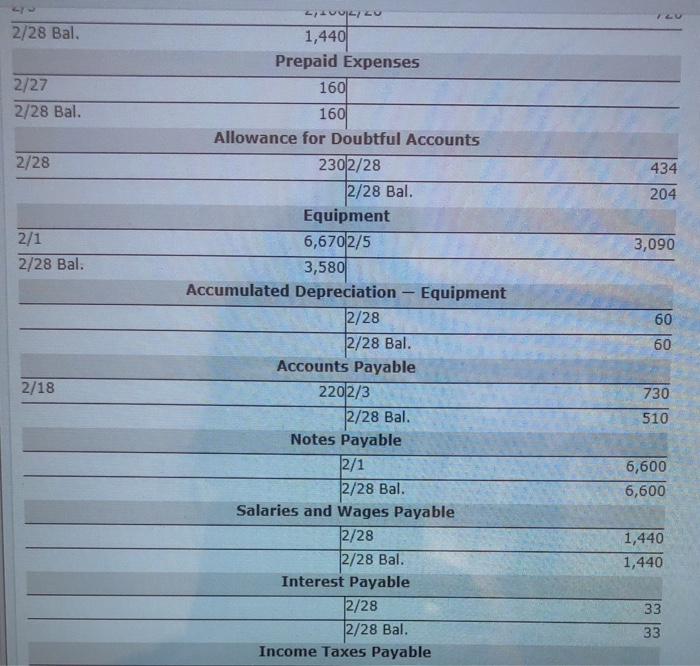

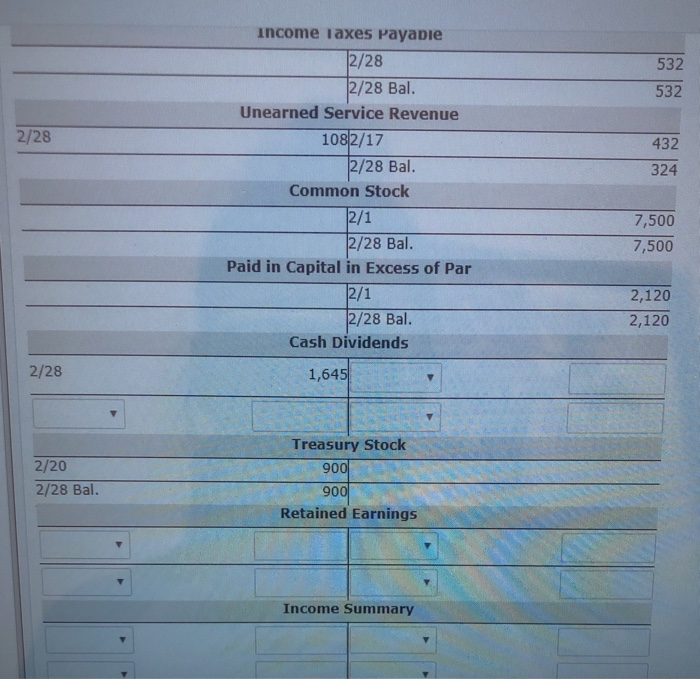

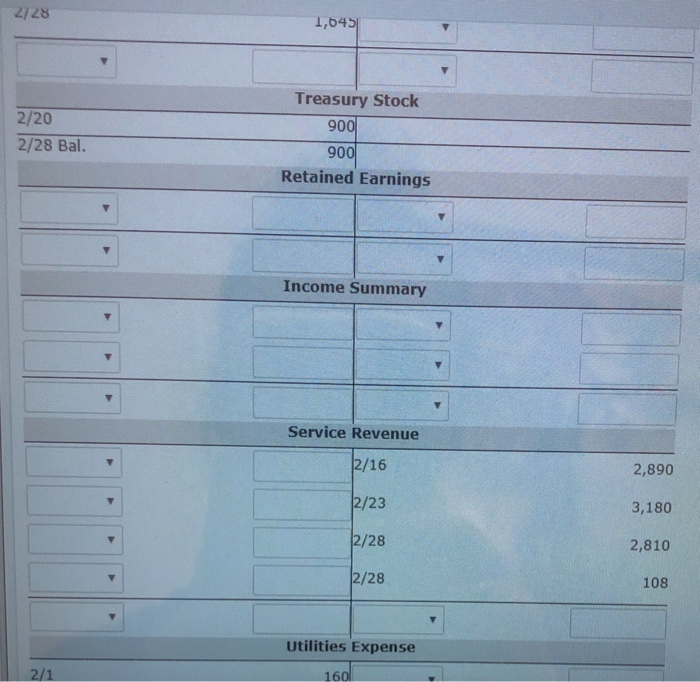

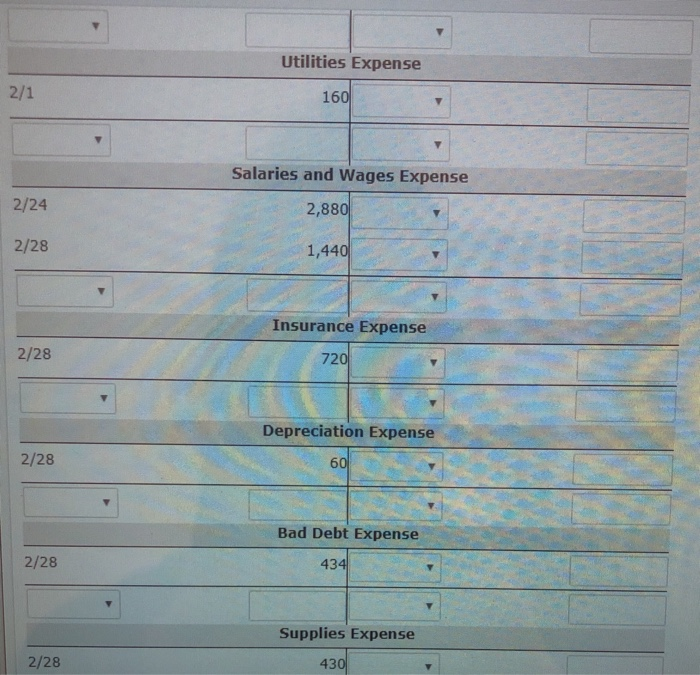

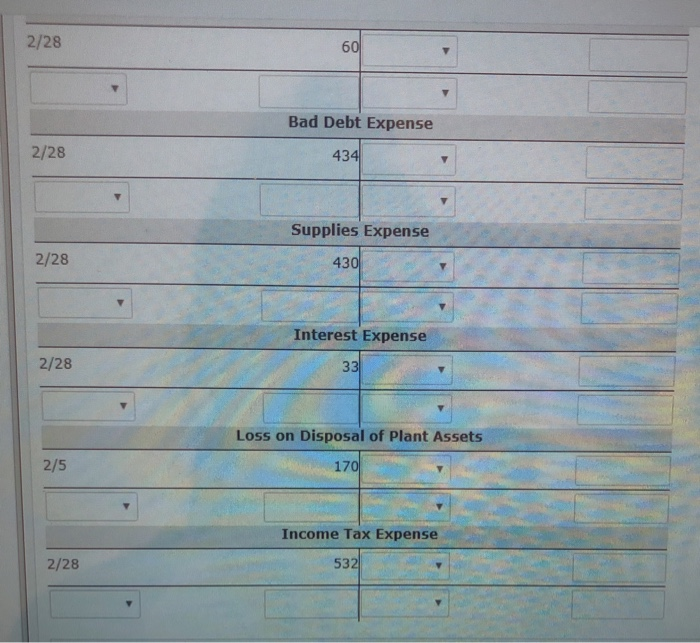

Your answer is correct. closing entries. (Credit account titles are automatically indented when amount is Dournalize closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manualy. for the account titles and enter O for the amounts.) entered. Do not indent manually. If no entry is required, select "No Entry Date Account Titles and Explanation Debit Credit Feb. 28 Service Revenue Income Summary 8988 (To close revenue account) Feb. 28 |Income Summary 6859 Utilities Expense 160 Salaries and Wages Expense Insurance Expense Depreciation Expense Bad Debt Expense Supplies Expense Interest Expense 4/29/2019 Insurance Expense Depreciation Expense Bad Debt Expense Supplies Expense 720 60 434 430 Interest Expense Loss on Disposal of Plant Assets 170 Income Tax Expense 532 (To close expense accounts) b. 28 Income Summary 2129 Retained Earnings 2129 (To close net income / (loss)) eb. 28 Retained Earnings 1645 Cash Dividends 1645 (To close dividends) Post closing entries to the T-accounts. (Post entries in the order of journal entries presented above. For accounts that have zero ending balance, the entry should be balance date and zero for the amount.) Cash 6,670 160 2,160 220 900 2,880 160 1,645 2,92 2/5 4322/18 1,8502/20 2/24 2/27 2/28 2/25 2/28 Bal Accounts Receivable 1,850 230 2/16 2/23 2/28 2/28 Bal. 2,81 6,8 Supplies 430 2/28 B Prepaid Insurance 2,1602/28 720 2/5 2/28 Bal. Prepaid Expenses 2/27 2/28 Bal. 1,44 Prepaid Expenses 2/27 2/28 Bal. 16 16 Allowance for Doubtful Accounts 2302/28 2/28 434 204 2/28 Bal. Equipment 6,6702/5 3,58 3,090 2/28 Bal. Accumulated Depreciation Equipment 2/28 2/28 Bal. 60 60 Accounts Payable 2/18 730 510 2/28 Bal Notes Payable 6,600 6,600 /28 Bal. Salaries and Wages Payable 2/28 2/28 Bal. 1,440 1,440 Interest Payable 2/28 2/28 Bal Income Taxes Payable income iaxes payapie 2/28 2/28 Bal. 532 532 Unearned Service Revenue 2/28 1082/17 432 28 Bal Common Stock 324 7,500 7,500 2/28 Bal. Paid in Capital in Excess of Par 2,120 2,120 2/28 Bal. Cash Dividends 2/28 1,645 Treasury Stock 2/20 2/28 Bal. 900 900 Retained Earnings Income Summary 28 1,64 Treasury Stock 2/20 2/28 Bal. 90 90 Retained Earnings Income Summary Service Revenue 2,890 3,180 2,810 108 2/16 2/23 2/28 2/28 Utilities Expense 16 Utilities Expense 160 Salaries and Wages Expense 2/24 2,880 2/28 1,440 Insurance Expense 2/28 72 Depreciation Expense 2/28 6 Bad Debt Expense 2/28 434 Supplies Expense 430 2/28 2/28 60 Bad Debt Expense 2/28 434 Supplies Expense 2/28 430 Interest Expense 2/28 Loss on Disposal of Plant Assets 2/5 17 Income Tax Expense 53 2 2/28