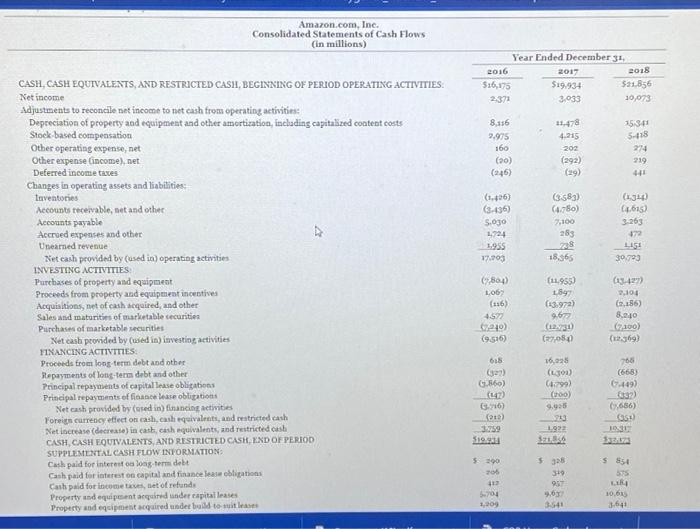

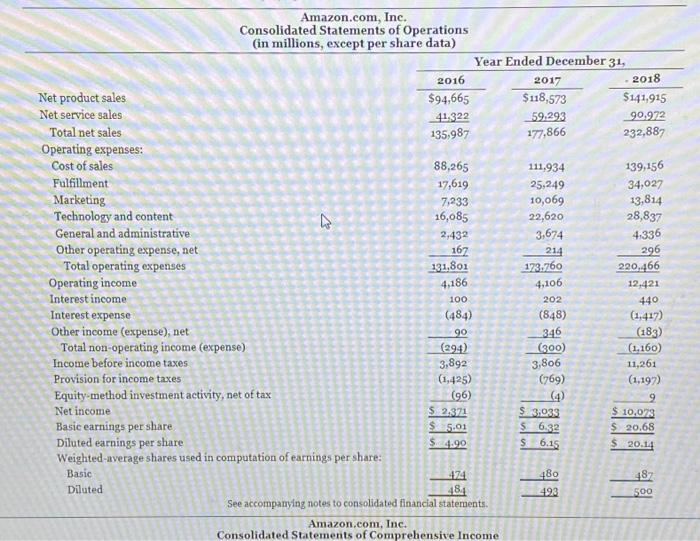

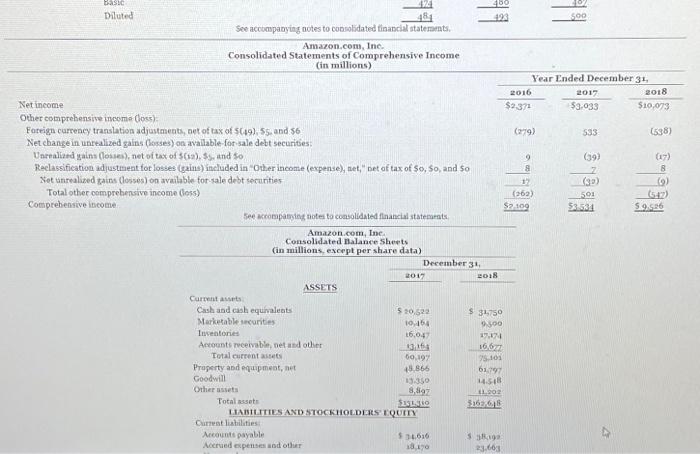

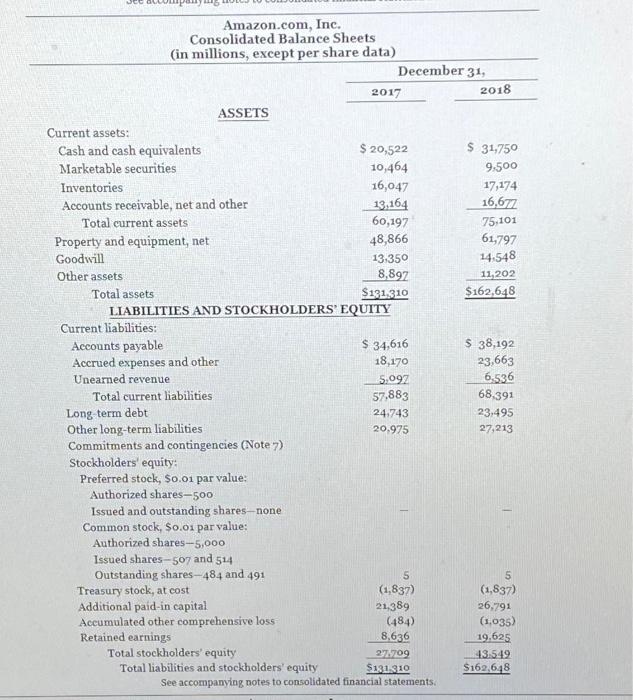

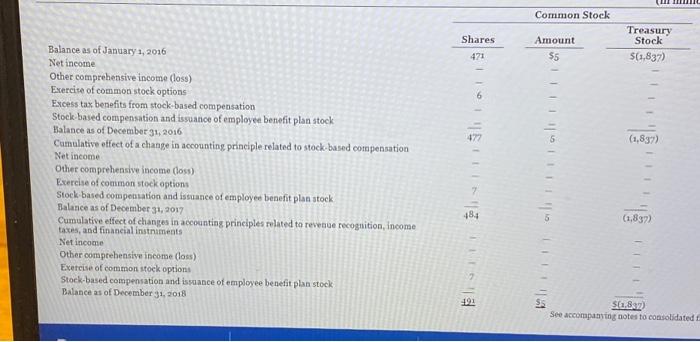

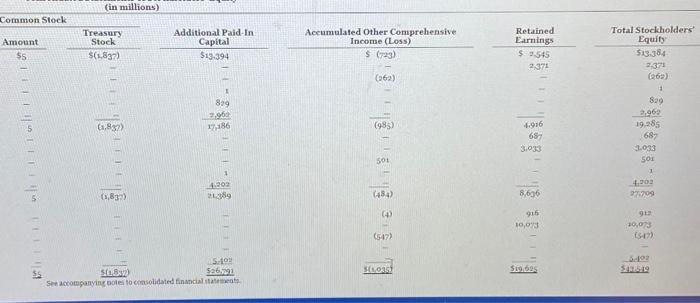

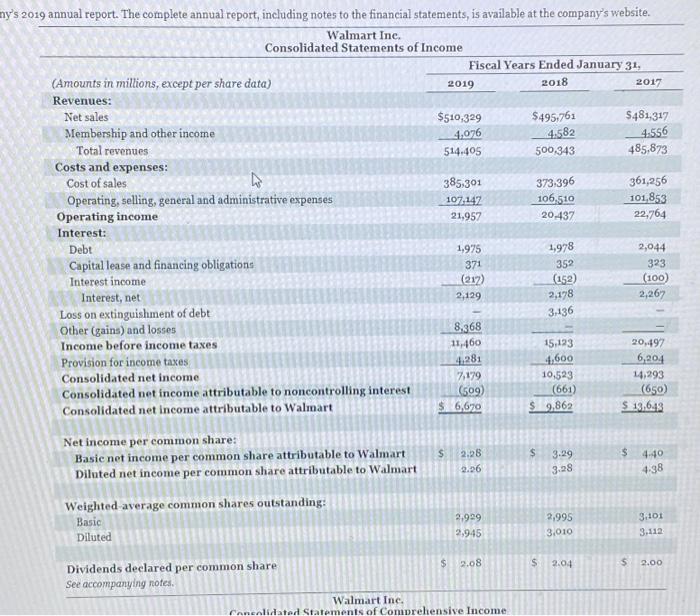

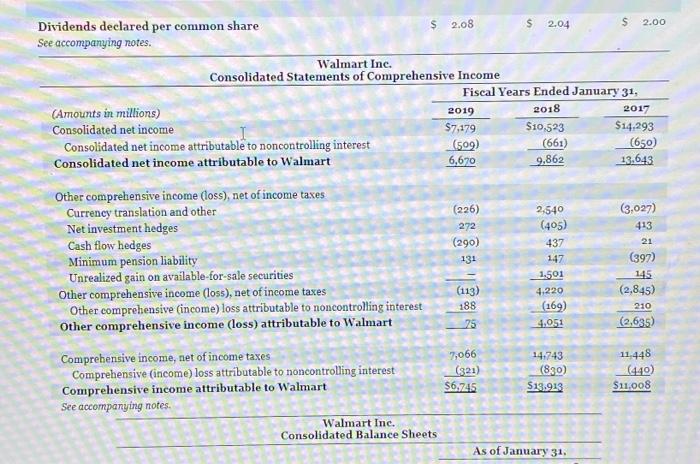

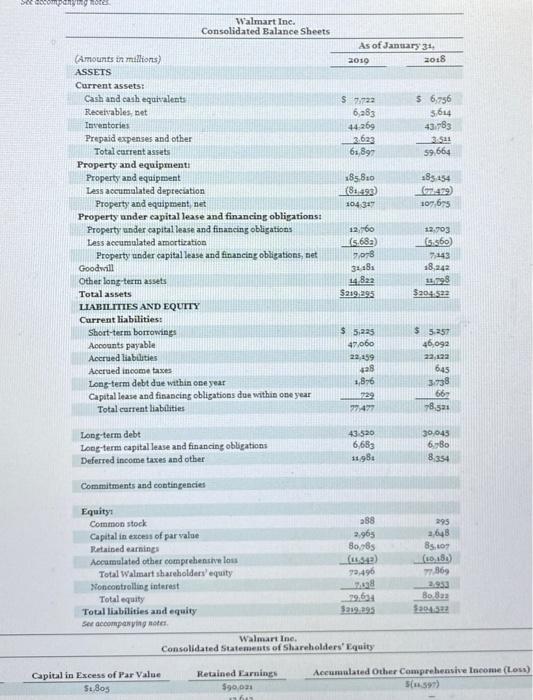

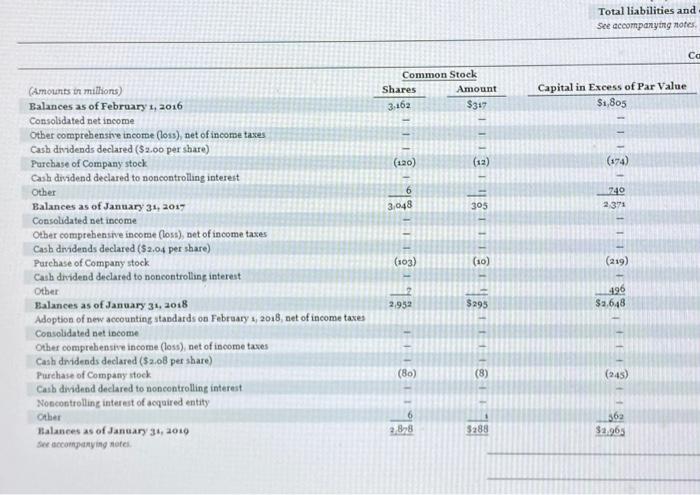

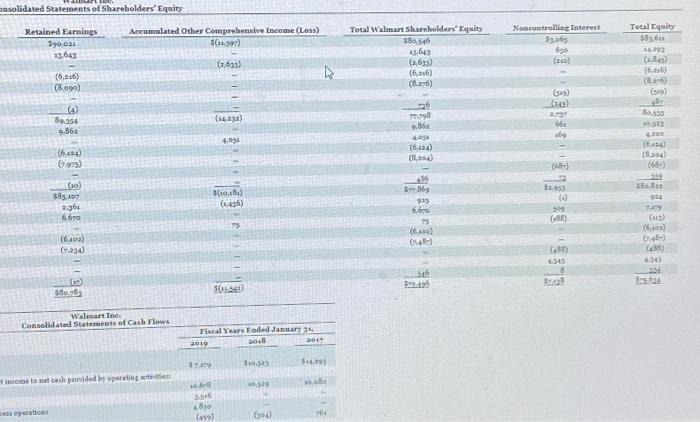

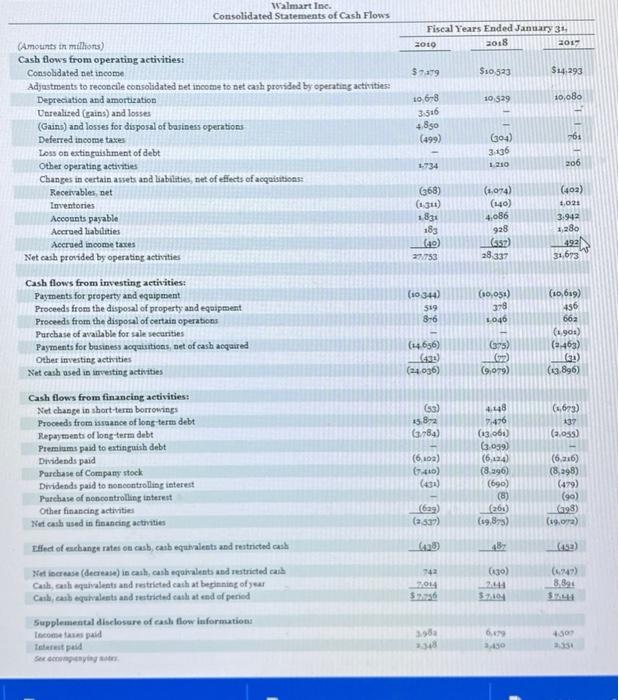

Your answer is incorrect. Amazon.com, Inc.'s financial statements are presented in Appendix D. Cilck here to view Appendix 0 Financial statements of Walmart, Inc. are presented in AppendixE. Click here to view Appendix E. The complete annual reports of Amazon and Walmart, including the notes to the financial statements, are available at each company's respective website: (a) Based on the information contained in these financial statements, compute free cash flow for each company. (Enter answers in millions, Show amounts that decrease cash flow with either a-sign es, 15,000 or in parenthesis es. (15,000).) Amaron.com, Inc. Consolidated Statements of Cash Flows (in millions) CASH, CASH EQUTVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Niet income Adjustments to reconcile net income to net cash from operating activities: Depreciation of property and equipmeat and other amcrtization, inclading capitalized content costs Stock based compensation Other operating expense, net Other expense (income), net Deferred incoate taves: Changes in operating assets and liabilities: Inveatories Aceounts teceivable, net and other Accounts payable Accrued expenses and other Unearned revenue Fiet eash provided by (used in) operating activities INVESTING NCTIVIIIES Purchases of ptoperty asd equipnest Proceeds from property and equipment incentives Acquisitions, net of cash acquired, and other Sales and maturities of anarketalle iecuritien Pirchases of parkotable securities Net cash provided by (used in) investiog activities HINANCEG ACTTVTIES: Proceeds from long term debt and other Repayments of long-term debt and ofher Principal repayents of capial lease obligabons Principal repayments of frasace iesie obligations Net cash provided by (ered in) financiog activities Foreign currency efiect on cash, cash eqeivalenti, and reatritted eash Net iocteane (decrease) in cast, cath equivalents, and retricted cab CASH, CASH EQUVNLENTS, AND RESTRICTED CASH, RND OF PERIOD SUPPLEAt2TAL CASH FLOW INTORMATION: Cath paid for interent oa loog term deke Cash paid for iaterest on copital and finance lease coligation Cash paid fot inceme taves, aet of refund Property and equipernt acquired snder capital leases Property and equipmest acyaired undet bald to suit lemes Year Ended December 31 , Amazon.com, Inc. Baste Diluted See accuapanying notes to consolidated tinabcial statements. Amazon,com, Ine. Consolidated Statements of Comprehensive Income (in millions) Net income Other comprehensive imcome (boss) Eareign currency tramslation adjustment, aet of tax of 5(49),5, and $6 Net change in untealized gains (hisses) on ayallable-for sale debt securties: Varealiard yains (losies), net of tax of $(12),3, and so Reclassification adjustment for losses (gxins) included in "Orker income (expense), net, "net of tax of so, so, and so Net unrealized gains (lesses) on avalable for sale debt securities Total other comprehensive income (less) Comprehensive income See Mrompabsing noter to consolidated flnancial statements Year Ended December 31 $23712016$9,0332017$10,0732018 (588) Amazon.com, ine. Consolidated Balanee Sheets (in millions, except per share data) December 31 , ASSETS Current assets Cast and eash equinaleats Merkerable securites (279) 593 Incentories Aceount reemable, net and other Tetal curent aisets Praperty and equipmeat, net Goodwill Crther asseta Total seset 2017 2028 HABIITIES AND STOCKHOLDEMS VQUTY Curmet lishilities. Mreounts payable Acerved espenses and other 5.3636 id, 170 Amazon.com, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31 , 2017 ASSETS Current assets: Cash and cash equivalents Marketable securities \begin{tabular}{rr} $20,522 & $31,750 \\ 10,464 & 9,500 \\ 16,047 & 17,174 \\ 13,164 & 16,677 \\ \hline 60,197 & 75,101 \\ 48,866 & 61,797 \\ 13,350 & 14,548 \\ 8,897 & 11,202 \\ \hline$131,310 & $162,648 \\ \hline \end{tabular} Inventories Accounts receivable, net and other Total current assets Property and equipment, net Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUTTY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long term debt Other long-term liabilities \begin{tabular}{rr} $34,616 & $38,192 \\ 18,170 & 23,663 \\ 5,097 & 6,536 \\ \hline 57,883 & 68,391 \\ 24,743 & 23,495 \\ 20,975 & 27,213 \end{tabular} Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, \$o.o1 par value: Authorized shares -500 Issued and outstanding shares-none Common stock, So.o1 par value: Authorized shares 5,000 Issued shares -507 and 54 Outstanding shares -484 and 491 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total stockholders' equity See accompanying notes to consolidated financial statements. Balance as of January 1, 2016 Net income Other comprehensive income (loss) Exercite of common stock options Excess tax benefits from stock-based compensation Stock-bayed compensation and issuance of employce benefit plan stock Balance as of December 31, 2016 Camulative effect of a change in accounting priaciple related to stock-based cornpensation Net income Other comprehensive income (loss) Erercise af common stock options Stock based compenzation and issuance of employee benefit plan stock Balance as of December 31,2017 Cumulative effect of changes in accountiag principles rolated to revegue recognition, income taxes, and financial instnumeats Net income Other comprehensive income (loss) Exetcise of common toek options Stock-based compensation and isruance of employee benefit plan stock Balance as of December 31,2018 ny's 2019 annual report. The complete annual report, including notes to the financial statements, is available at the company's website. Walmart Inc. Consolidated Statements of Income Walmart Inc. Dividends declared per common share See accompanying notes. Total liabilities and see accompanying notes. onsolidated Statements of Sharebolders' Equty Walnart Tne. Walmart Ine. Consolidated Statements of Cash Flows (Amounts in milhors) Cash flows from operating activities: Consolidated net income Adjastrents to recoecile consolidated net income to net calh prorided by operating activities: Depreciation and amortization Wrealited (gains) and losses (Gains) and losses for disposal of bariness eperations Deferred incorme taxes Loss on extinpuishment of debt Qther operating activities Changes in certain asiets and liabilities, net of effects of acquisitions: Receivablen, net Imventories Acconnts payable Accrued liablities Acerued income taxes Net eash provided by operating actunties Cash flows from investing activities: Payments for property aEd equipment Proceeds from the disposal of property and eqaipment Proceeds from the dispocal of certain operabom Purcbase of available for sale recurities Payments for basiness acquiutions, net of cash aequired Other imvesting acthities Net cash ased in imvesting acthities Cash flows from financing activities: Net change in short-term borrowings Proceeds frem issuance of long term debt Repaymentr of long-term debt Premiums paid to estin ruish debt Devidends paid Parchase of Company steck Dwidends paid to noncontrolling interest Parchase of poncontrolling intereit Other finaneing artivities Wht eash used in finanring activaties Supplemental diselosere of eash flow informations Iesome laus paid Ieterest paid 295a 6.67 4sot ser denonopaying adery. Your answer is incorrect. Amazon.com, Inc.'s financial statements are presented in Appendix D. Cilck here to view Appendix 0 Financial statements of Walmart, Inc. are presented in AppendixE. Click here to view Appendix E. The complete annual reports of Amazon and Walmart, including the notes to the financial statements, are available at each company's respective website: (a) Based on the information contained in these financial statements, compute free cash flow for each company. (Enter answers in millions, Show amounts that decrease cash flow with either a-sign es, 15,000 or in parenthesis es. (15,000).) Amaron.com, Inc. Consolidated Statements of Cash Flows (in millions) CASH, CASH EQUTVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Niet income Adjustments to reconcile net income to net cash from operating activities: Depreciation of property and equipmeat and other amcrtization, inclading capitalized content costs Stock based compensation Other operating expense, net Other expense (income), net Deferred incoate taves: Changes in operating assets and liabilities: Inveatories Aceounts teceivable, net and other Accounts payable Accrued expenses and other Unearned revenue Fiet eash provided by (used in) operating activities INVESTING NCTIVIIIES Purchases of ptoperty asd equipnest Proceeds from property and equipment incentives Acquisitions, net of cash acquired, and other Sales and maturities of anarketalle iecuritien Pirchases of parkotable securities Net cash provided by (used in) investiog activities HINANCEG ACTTVTIES: Proceeds from long term debt and other Repayments of long-term debt and ofher Principal repayents of capial lease obligabons Principal repayments of frasace iesie obligations Net cash provided by (ered in) financiog activities Foreign currency efiect on cash, cash eqeivalenti, and reatritted eash Net iocteane (decrease) in cast, cath equivalents, and retricted cab CASH, CASH EQUVNLENTS, AND RESTRICTED CASH, RND OF PERIOD SUPPLEAt2TAL CASH FLOW INTORMATION: Cath paid for interent oa loog term deke Cash paid for iaterest on copital and finance lease coligation Cash paid fot inceme taves, aet of refund Property and equipernt acquired snder capital leases Property and equipmest acyaired undet bald to suit lemes Year Ended December 31 , Amazon.com, Inc. Baste Diluted See accuapanying notes to consolidated tinabcial statements. Amazon,com, Ine. Consolidated Statements of Comprehensive Income (in millions) Net income Other comprehensive imcome (boss) Eareign currency tramslation adjustment, aet of tax of 5(49),5, and $6 Net change in untealized gains (hisses) on ayallable-for sale debt securties: Varealiard yains (losies), net of tax of $(12),3, and so Reclassification adjustment for losses (gxins) included in "Orker income (expense), net, "net of tax of so, so, and so Net unrealized gains (lesses) on avalable for sale debt securities Total other comprehensive income (less) Comprehensive income See Mrompabsing noter to consolidated flnancial statements Year Ended December 31 $23712016$9,0332017$10,0732018 (588) Amazon.com, ine. Consolidated Balanee Sheets (in millions, except per share data) December 31 , ASSETS Current assets Cast and eash equinaleats Merkerable securites (279) 593 Incentories Aceount reemable, net and other Tetal curent aisets Praperty and equipmeat, net Goodwill Crther asseta Total seset 2017 2028 HABIITIES AND STOCKHOLDEMS VQUTY Curmet lishilities. Mreounts payable Acerved espenses and other 5.3636 id, 170 Amazon.com, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31 , 2017 ASSETS Current assets: Cash and cash equivalents Marketable securities \begin{tabular}{rr} $20,522 & $31,750 \\ 10,464 & 9,500 \\ 16,047 & 17,174 \\ 13,164 & 16,677 \\ \hline 60,197 & 75,101 \\ 48,866 & 61,797 \\ 13,350 & 14,548 \\ 8,897 & 11,202 \\ \hline$131,310 & $162,648 \\ \hline \end{tabular} Inventories Accounts receivable, net and other Total current assets Property and equipment, net Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUTTY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long term debt Other long-term liabilities \begin{tabular}{rr} $34,616 & $38,192 \\ 18,170 & 23,663 \\ 5,097 & 6,536 \\ \hline 57,883 & 68,391 \\ 24,743 & 23,495 \\ 20,975 & 27,213 \end{tabular} Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, \$o.o1 par value: Authorized shares -500 Issued and outstanding shares-none Common stock, So.o1 par value: Authorized shares 5,000 Issued shares -507 and 54 Outstanding shares -484 and 491 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total stockholders' equity See accompanying notes to consolidated financial statements. Balance as of January 1, 2016 Net income Other comprehensive income (loss) Exercite of common stock options Excess tax benefits from stock-based compensation Stock-bayed compensation and issuance of employce benefit plan stock Balance as of December 31, 2016 Camulative effect of a change in accounting priaciple related to stock-based cornpensation Net income Other comprehensive income (loss) Erercise af common stock options Stock based compenzation and issuance of employee benefit plan stock Balance as of December 31,2017 Cumulative effect of changes in accountiag principles rolated to revegue recognition, income taxes, and financial instnumeats Net income Other comprehensive income (loss) Exetcise of common toek options Stock-based compensation and isruance of employee benefit plan stock Balance as of December 31,2018 ny's 2019 annual report. The complete annual report, including notes to the financial statements, is available at the company's website. Walmart Inc. Consolidated Statements of Income Walmart Inc. Dividends declared per common share See accompanying notes. Total liabilities and see accompanying notes. onsolidated Statements of Sharebolders' Equty Walnart Tne. Walmart Ine. Consolidated Statements of Cash Flows (Amounts in milhors) Cash flows from operating activities: Consolidated net income Adjastrents to recoecile consolidated net income to net calh prorided by operating activities: Depreciation and amortization Wrealited (gains) and losses (Gains) and losses for disposal of bariness eperations Deferred incorme taxes Loss on extinpuishment of debt Qther operating activities Changes in certain asiets and liabilities, net of effects of acquisitions: Receivablen, net Imventories Acconnts payable Accrued liablities Acerued income taxes Net eash provided by operating actunties Cash flows from investing activities: Payments for property aEd equipment Proceeds from the disposal of property and eqaipment Proceeds from the dispocal of certain operabom Purcbase of available for sale recurities Payments for basiness acquiutions, net of cash aequired Other imvesting acthities Net cash ased in imvesting acthities Cash flows from financing activities: Net change in short-term borrowings Proceeds frem issuance of long term debt Repaymentr of long-term debt Premiums paid to estin ruish debt Devidends paid Parchase of Company steck Dwidends paid to noncontrolling interest Parchase of poncontrolling intereit Other finaneing artivities Wht eash used in finanring activaties Supplemental diselosere of eash flow informations Iesome laus paid Ieterest paid 295a 6.67 4sot ser denonopaying adery