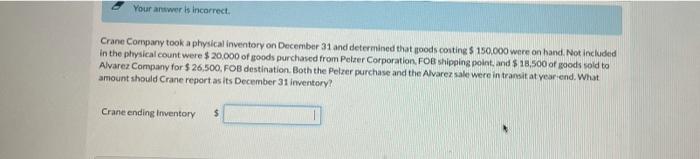

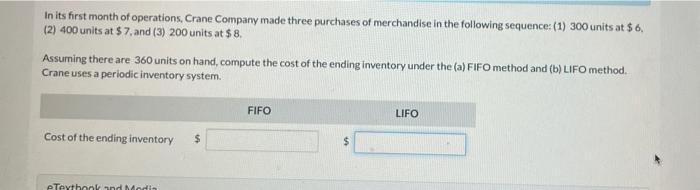

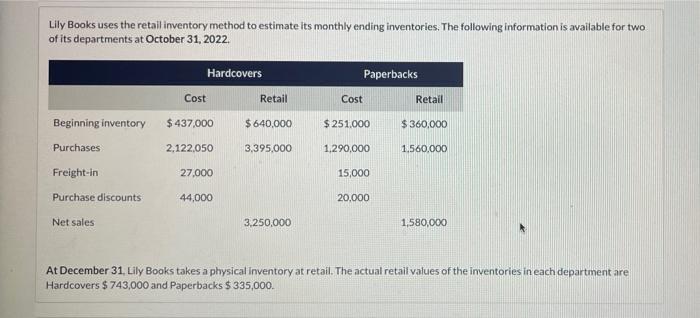

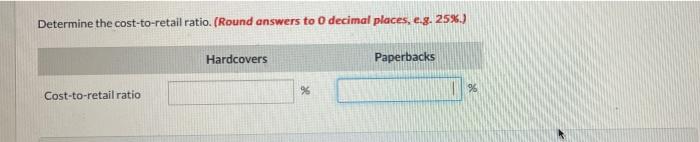

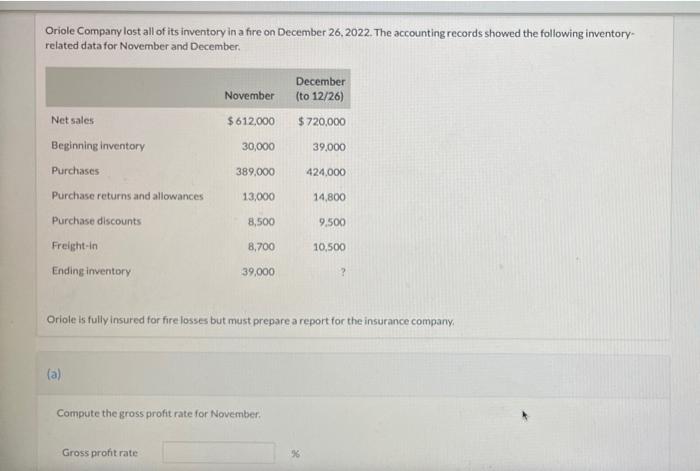

Your answer is incorrect Crane Company took a physical inventory on December 31 and determined that foods costing $ 150,000 were on hand. Not included In the physical count were $ 20,000 of poods purchased from Pelzer Corporation, FOB shipping point, and $ 18.500 of goods sold to Alvarez Company for $26.500, FOB destination. Both the Petrer purchase and the Alvarez sale were in transit at year end. What amount should Crane report as its December 31 inventory? Crane ending Inventory $ In its first month of operations, Crane Company made three purchases of merchandise in the following sequence: (1) 300 units at $ 6, (2) 400 units at $7, and (3) 200 units at $8. Assuring there are 360 units on hand, compute the cost of the ending Inventory under the (a) FIFO method and (b) LIFO method. Crane uses a periodic inventory system. FIFO LIFO Cost of the ending inventory $ $ Teythank and Modin Lily Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available for two of its departments at October 31, 2022. Hardcovers Paperbacks Cost Retail Cost Retail Beginning inventory $ 437,000 $ 640,000 $251.000 $360,000 1,560,000 Purchases 2.122,050 3,395,000 1,290,000 Freight-in 27,000 15,000 Purchase discounts 44,000 20.000 Net sales 3,250,000 1,580,000 At December 31, Lily Books takes a physical Inventory at retail. The actual retail values of the inventories in each department are Hardcovers $ 743,000 and Paperbacks $335,000. Determine the cost-to-retail ratio. (Round answers to 0 decimal places, e.g. 25%.) Hardcovers Paperbacks 96 96 Cost-to-retail ratio Oriole Company lost all of its inventory in a fire on December 26, 2022. The accounting records showed the following inventory related data for November and December December November (to 12/26) $612,000 $ 720,000 Net sales 30,000 39,000 389,000 424,000 13,000 14,800 Beginning inventory Purchases Purchase returns and allowances Purchase discounts Freight-in Ending inventory 8,500 9.500 8,700 10,500 39.000 2 Oriole is fully insured for fire losses but must prepare a report for the insurance company, (a) Compute the gross profit rate for November Gross proftrate