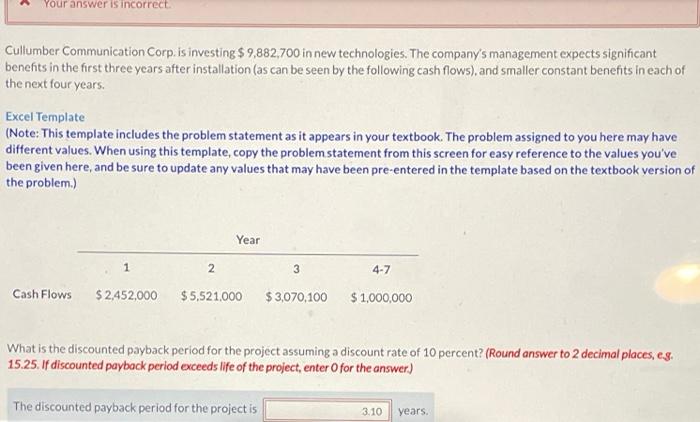

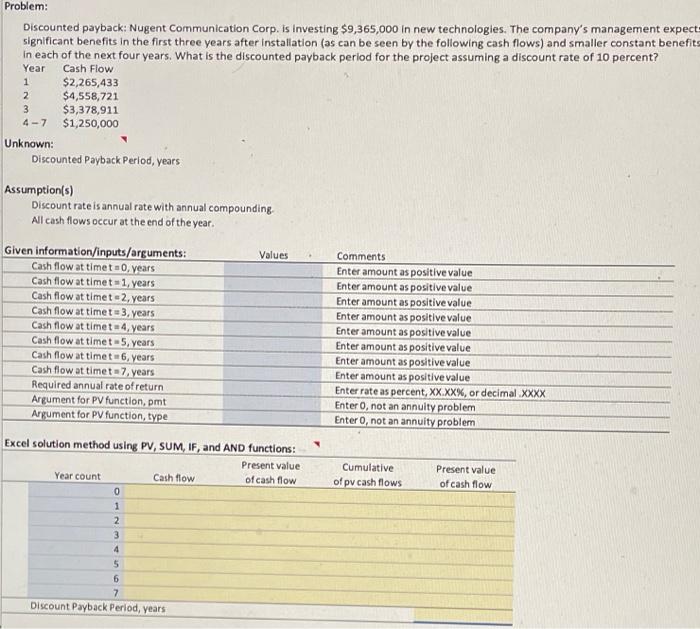

Your answer is incorrect Cullumber Communication Corp. is investing $ 9,882,700 in new technologies. The company's management expects significant benefits in the first three years after installation (as can be seen by the following cash flows), and smaller constant benefits in each of the next four years. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Year 1 2 3 4-7 Cash Flows $ 2,452,000 $ 5,521,000 $ 3,070,100 $ 1,000,000 What is the discounted payback period for the project assuming a discount rate of 10 percent? (Round answer to 2 decimal places, es. 15.25. If discounted payback period exceeds life of the project, enter for the answer) The discounted payback period for the project is 3.10 years. Problem: Discounted payback: Nugent Communication Corp. is Investing $9,365,000 in new technologies. The company's management expect significant benefits in the first three years after installation (as can be seen by the following cash flows) and smaller constant benefits in each of the next four years. What is the discounted payback period for the project assuming a discount rate of 10 percent? Year Cash Flow $2,265,433 $4,558,721 $3,378,911 4-7 $1,250,000 Unknown: Discounted Payback Perlod, years 1 2 3 Assumption(s) Discount rate is annual rate with annual compounding All cash flows occur at the end of the year. Values Given information/inputs/arguments: Cash flow at timet, years Cash flow at timet 1, years Cash flow at timet - 2 years Cash flow at timeta 3 years Cash flow at timet = 4, years Cash flow at timet -5, years Cash flow at timet6. years Cash flow at timet 7 years Required annual rate of return Argument for PV function, pmt Argument for PV function, type Comments Enter amount as positive value Enter amount as positive value Enter amount as positive value Enter amount as positive value Enter amount as positive value Enter amount as positive value Enter amount as positive value Enter amount as positive value Enter rate as percent, XX.XX%, or decimal XXXX Enter O, not an annuity problem Entero, not an annuity problem Cumulative of pv cash flows Present value of cash flow Excel solution method using PV, SUM, IF, and AND functions: Present value Year count Cash flow of cash flow 0 1 2 3 4 5 6 7 Discount Payback period, years