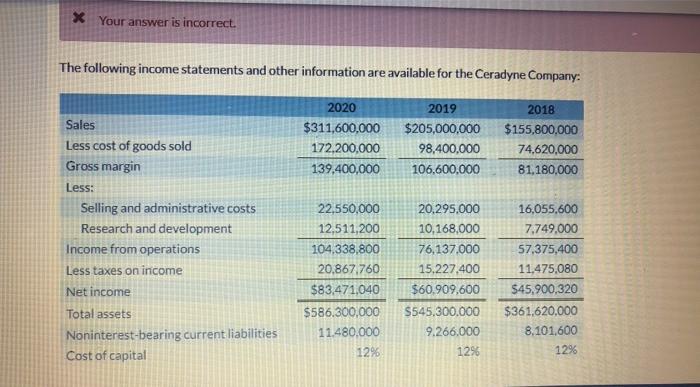

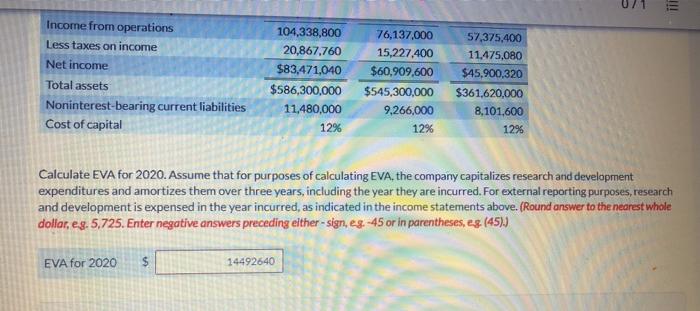

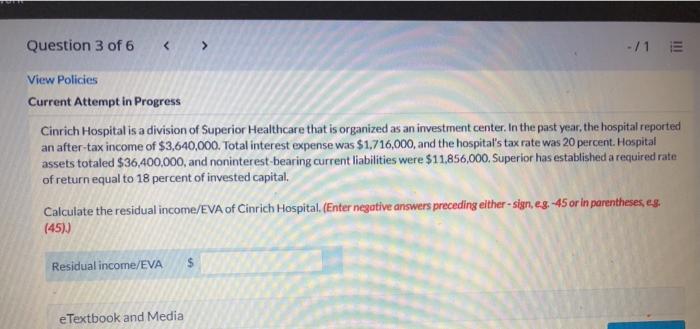

* Your answer is incorrect. The following income statements and other information are available for the Ceradyne Company: 2020 $311,600,000 172.200,000 139.400,000 2019 $205,000,000 98,400,000 106,600,000 2018 $155,800,000 74,620,000 81,180,000 Sales Less cost of goods sold Gross margin Less: Selling and administrative costs Research and development Income from operations Less taxes on income Net income Total assets Noninterest-bearing current liabilities Cost of capital 22,550,000 12,511,200 104.338,800 20.867,760 $83,471,040 $586,300,000 11.480,000 12 20.295,000 10,168,000 76,137.000 15.227.400 $60.909,600 S545,300.000 9.266,000 1296 16,055,600 7.749,000 57,375,400 11,475,080 $45,900,320 $361,620,000 8,101,600 12% Income from operations Less taxes on income Net income Total assets Noninterest-bearing current liabilities Cost of capital 104,338,800 20,867.760 $83,471,040 $586,300,000 11.480,000 12% 76,137,000 15,227,400 $60,909,600 $545,300,000 9,266,000 12% 57,375,400 11,475,080 $45,900.320 $361,620,000 8,101.600 1296 Calculate EVA for 2020. Assume that for purposes of calculating EVA, the company capitalizes research and development expenditures and amortizes them over three years, including the year they are incurred. For external reporting purposes, research and development is expensed in the year incurred, as indicated in the income statements above. (Round answer to the nearest whole dollar, eg. 5,725. Enter negative answers preceding either - sign, eg. -45 or in parentheses, es (45)) EVA for 2020 CA 14492640 Question 3 of 6 -/1 E View Policies Current Attempt in Progress Cinrich Hospital is a division of Superior Healthcare that is organized as an investment center. In the past year, the hospital reported an after-tax income of $3,640,000. Total interest expense was $1,716,000, and the hospital's tax rate was 20 percent. Hospital assets totaled $36,400,000, and noninterest-bearing current liabilities were $11,856,000, Superior has established a required rate of return equal to 18 percent of invested capital. Calculate the residual income/EVA of Cinrich Hospital, (Enter negative answers preceding either-sign, eg.-45 or in parentheses, es. (45)) Residual income/EVA $ e Textbook and Media