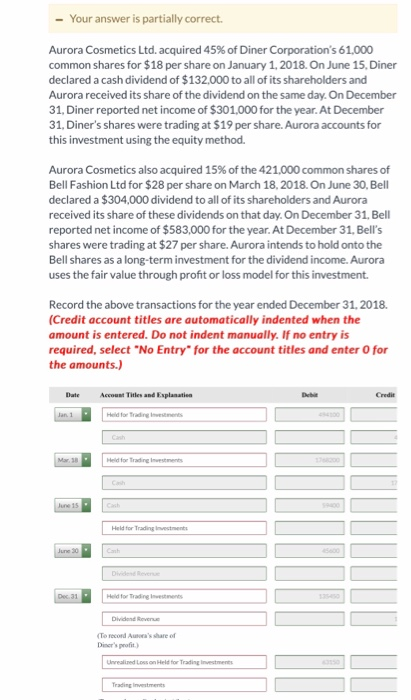

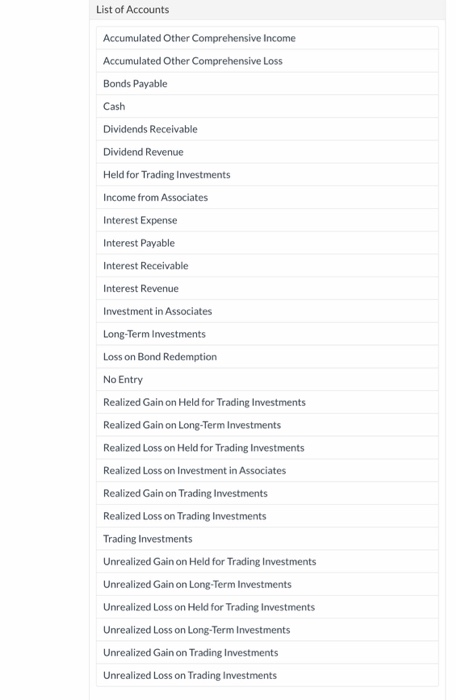

Your answer is partially correct Aurora Cosmetics Ltd. acquired 45% of Diner Corporation's 61,000 common shares for $18 per share on January 1, 2018. On June 15, Diner declared a cash dividend of $132,000 to all of its shareholders and Aurora received its share of the dividend on the same day. On December 31, Diner reported net income of $301,000 for the year. At December 31, Diner's shares were trading at $19 per share. Aurora accounts for this investment using the equity method. Aurora Cosmetics also acquired 15% of the 421,000 common shares of Bell Fashion Ltd for $28 per share on March 18, 2018. On June 30, Bell declared a $304,000 dividend to all of its shareholders and Aurora received its share of these dividends on that day. On December 31. Bell reported net income of $583,000 for the year. At December 31, Bell's shares were trading at $27 per share. Aurora intends to hold onto the Bell shares as a long-term investment for the dividend income. Aurora uses the fair value through profit or loss model for this investment Record the above transactions for the year ended December 31, 2018. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Accout Titles and Explanation Debit Credit Jan 1 Held for Trading Ivestments 00 Cash Held for Trading Investments Mar 38 Cash June 15 Cash 400 Held for Trading Investments June 30 Canh Dividend Reve Dec 31 Held for Trading Investments 5450 Dividend Reverue (To record Ausora's share of Diner's profit) Unrealied Los on Held for Trading investments Trading Investments List of Accounts Accumulated Other Comprehensive Income Accumulated Other Comprehensive Loss Bonds Payable Cash Dividends Receivable Dividend Revenue Held for Trading Investments Income from Associates Interest Expense Interest Payable Interest Receivable Interest Revenue Investment in Associates Long-Term Investments Loss on Bond Redemption No Entry Realized Gain on Held for Trading Investments Realized Gain on Long-Term Investments Realized Loss on Held for Trading Investments Realized Loss on Investment in Associates Realized Gain on Trading Investments Realized Loss on Trading Investments Trading Investments Unrealized Gain on Held for Trading Investments Unrealized Gain on Long-Term Investments Unrealized Loss on Held for Trading Investments Unrealized Loss on Long-Term Investments Unrealized Gain on Trading Investments Unrealized Loss on Trading Investments