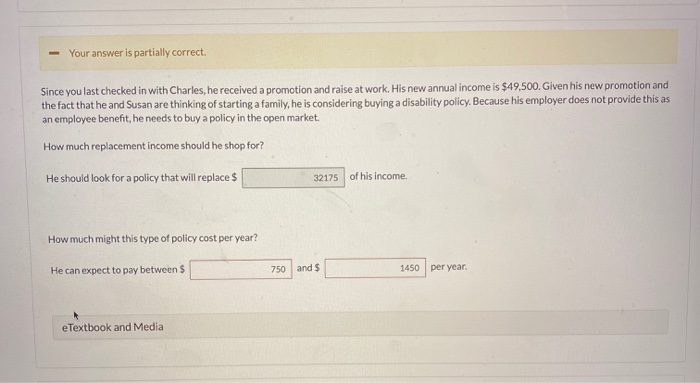

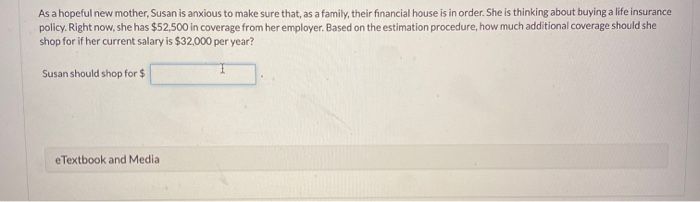

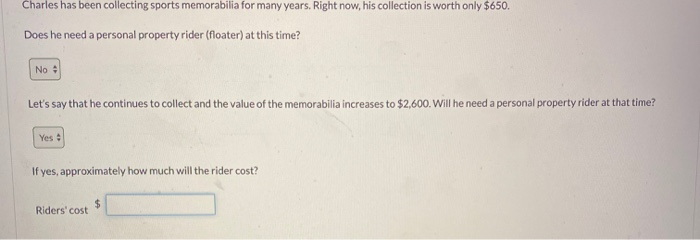

- Your answer is partially correct. Since you last checked in with Charles, he received a promotion and raise at work. His new annual income is $49,500. Given his new promotion and the fact that he and Susan are thinking of starting a family, he is considering buying a disability policy. Because his employer does not provide this as an employee benefit, he needs to buy a policy in the open market. How much replacement income should he shop for? He should look for a policy that will replace $ 32175 of his income How much might this type of policy cost per year? He can expect to pay between $ 750 and $ 1450 per year. eTextbook and Media As a hopeful new mother, Susan is anxious to make sure that, as a family, their financial house is in order. She is thinking about buying a life insurance policy. Right now, she has $52,500 in coverage from her employer. Based on the estimation procedure, how much additional coverage should she shop for if her current salary is $32,000 per year? Susan should shop for $ e Textbook and Media Charles has been collecting sports memorabilia for many years. Right now, his collection is worth only $650. Does he need a personal property rider (floater) at this time? No Let's say that he continues to collect and the value of the memorabilia increases to $2.600. Will he need a personal property rider at that time? Ves If yes, approximately how much will the rider cost? Riders' cost - Your answer is partially correct. Since you last checked in with Charles, he received a promotion and raise at work. His new annual income is $49,500. Given his new promotion and the fact that he and Susan are thinking of starting a family, he is considering buying a disability policy. Because his employer does not provide this as an employee benefit, he needs to buy a policy in the open market. How much replacement income should he shop for? He should look for a policy that will replace $ 32175 of his income How much might this type of policy cost per year? He can expect to pay between $ 750 and $ 1450 per year. eTextbook and Media As a hopeful new mother, Susan is anxious to make sure that, as a family, their financial house is in order. She is thinking about buying a life insurance policy. Right now, she has $52,500 in coverage from her employer. Based on the estimation procedure, how much additional coverage should she shop for if her current salary is $32,000 per year? Susan should shop for $ e Textbook and Media Charles has been collecting sports memorabilia for many years. Right now, his collection is worth only $650. Does he need a personal property rider (floater) at this time? No Let's say that he continues to collect and the value of the memorabilia increases to $2.600. Will he need a personal property rider at that time? Ves If yes, approximately how much will the rider cost? Riders' cost