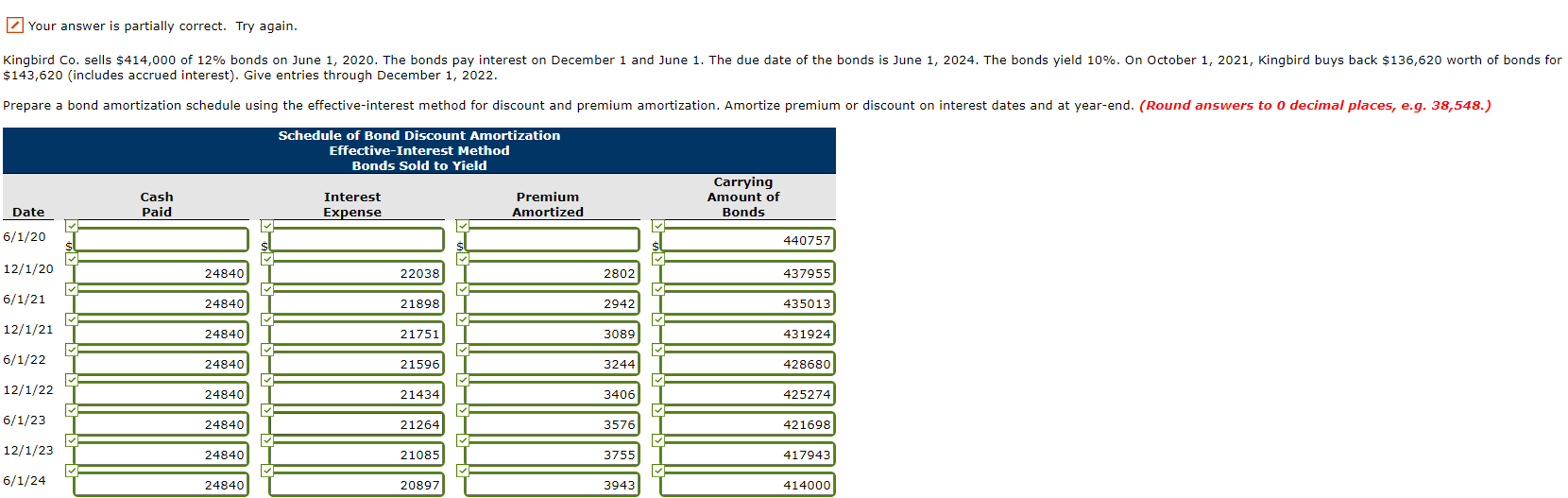

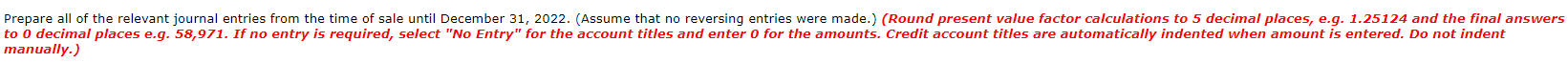

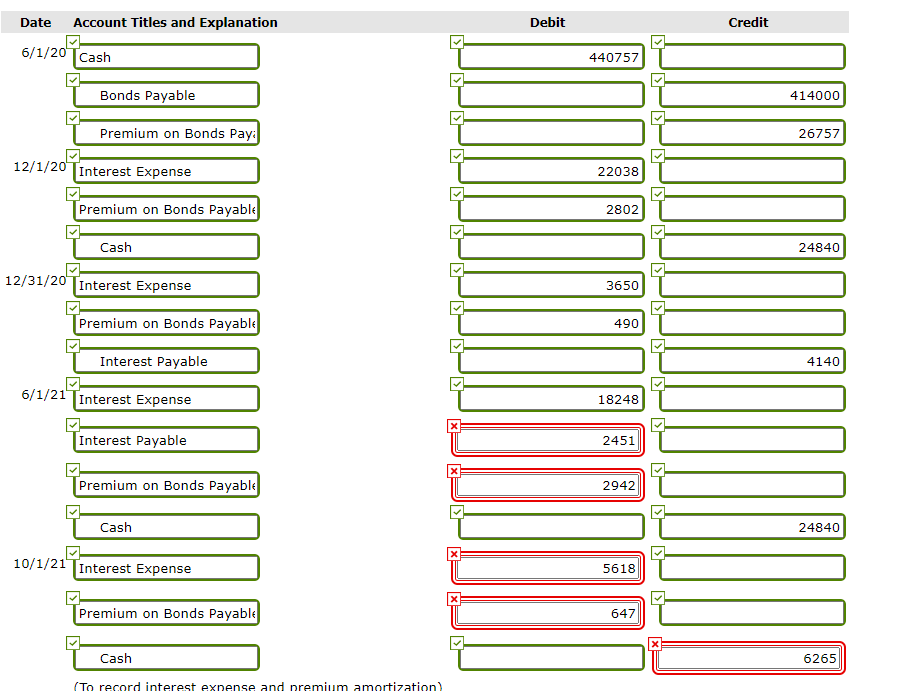

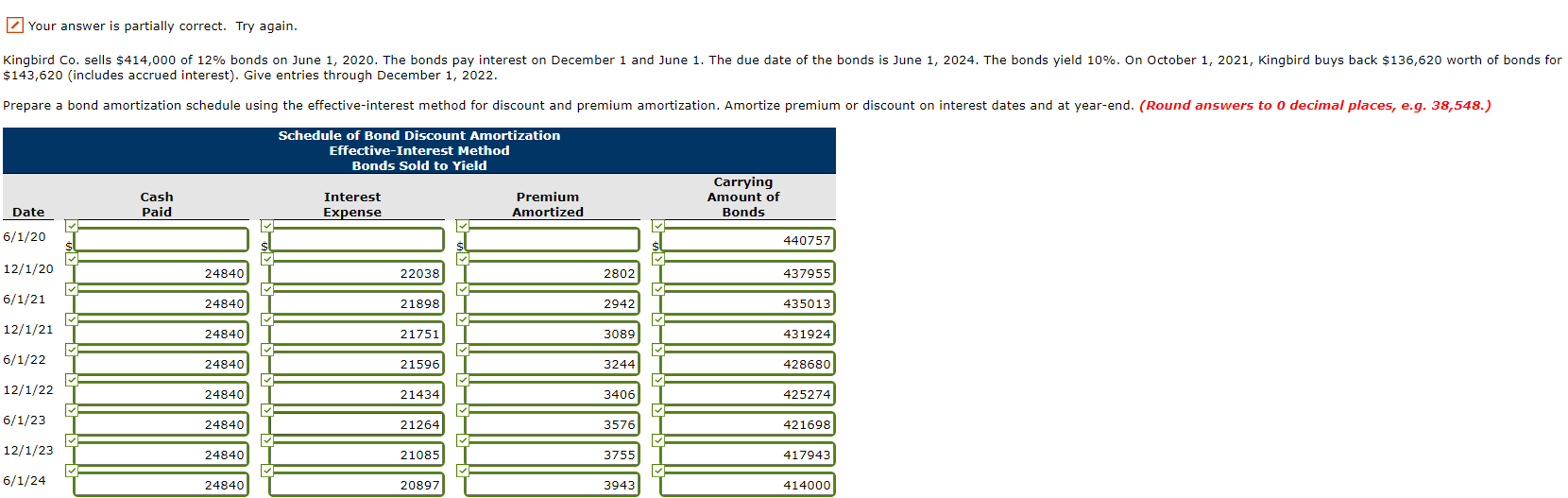

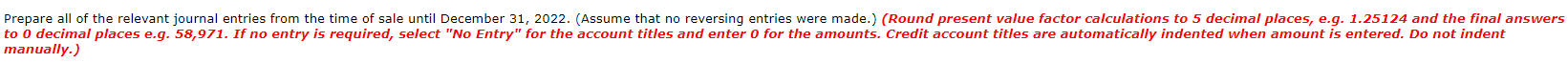

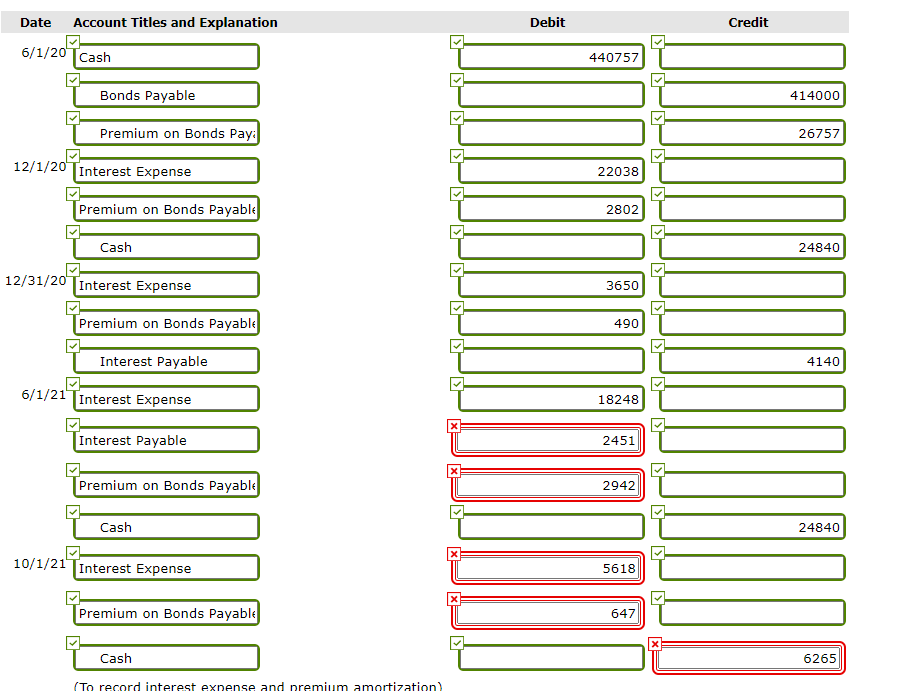

Your answer is partially correct. Try again. Kingbird Co. sells $414,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2024. The bonds yield 10%. On October 1, 2021, Kingbird buys back $136,620 worth of bonds for $143,620 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to o decimal places, e.g. 38,548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yield Cash Paid Interest Expense Premium Amortized Carrying Amount of Bonds Date 6/1/20 440757 S 12/1/20 24840 22038 2802 437955 6/1/21 24840 21898 2942 435013 12/1/21 24840 21751 3089 431924 6/1/22 24840 21596 3244 428680 12/1/22 24840 21434 3406 425274 6/1/23 24840 21264 3576 421698 12/1/23 24840 210851 3755 417943 6/1/24 24840 20897 3943 414000 Prepare all of the relevant journal entries from the time of sale until December 31, 2022. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to o decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 6/1/20 Cash 440757 Bonds Payable 414000 Premium on Bonds Pay: 26757 12/1/20 Interest Expense 22038 Premium on Bonds Payable 2802 Cash 24840 12/31/20 Interest Expense 3650 Premium on Bonds Payable 490 Interest Payable 4140 6/1/21 Interest Expense 18248 Interest Payable 2451 Premium on Bonds Payable 2942 Cash 24840 10/1/21 Interest Expense 5618 Premium on Bonds Payable 647 Cash 6265 (To record interest expense and premium amortization) 1/21 Bonds Payable Premium on Bonds Payable Gain on Redemption of Boi Cash (To record buy back of bonds) 1/21 Interest Expense 14573 Premium on Bonds Payable 2070 Cash 16643 1/21 Interest Expense 2412 Premium on Bonds Payable 362 Interest Payable 2774 1/22 Interest Expense 12058 Interest Payable 2774 Premium on Bonds Payable 1811 Cash 16643