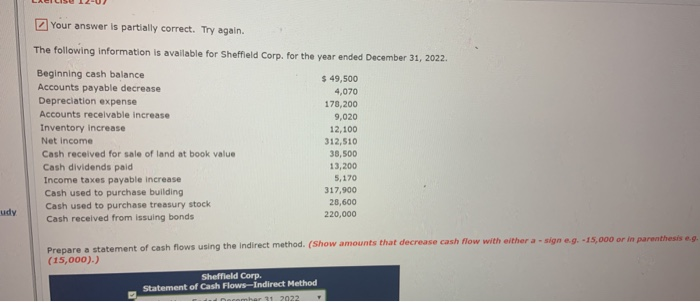

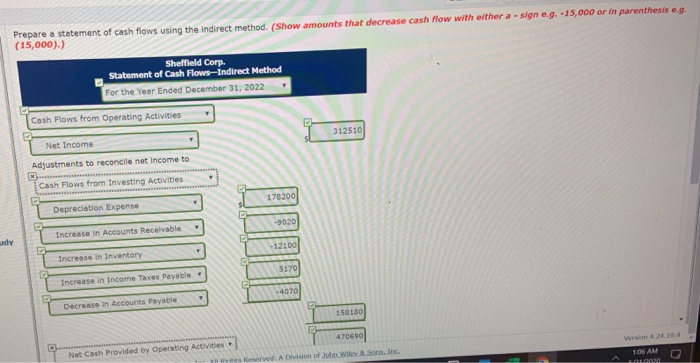

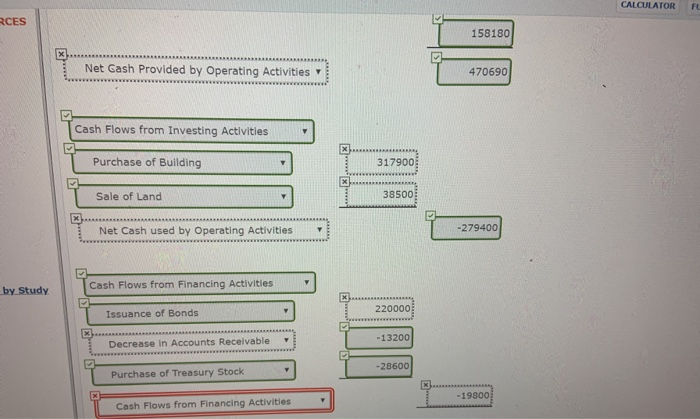

Your answer is partially correct. Try again. The following information is available for Sheffield Corp. for the year ended December 31, 2022. Beginning cash balance $ 49,500 Accounts payable decrease 4,070 Depreciation expense 178,200 Accounts receivable increase 9,020 Inventory Increase 12,100 Net Income 312,510 Cash received for sale of land at book value 38,500 Cash dividends pald 13,200 Income taxes payable increase 5,170 Cash used to purchase building 317,900 Cash used to purchase treasury stock 28,600 Cash received from issuing bonds 220,000 udy Prepare a statement of cash flows using the Indirect method. (Show amounts that decrease cash flow with either a signe.g. -15,000 or in parenthesis e.g. (15,000).) Sheffield Corp. Statement of Cash Flows-Indirect Method 2022 Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a sign e.g. -15,000 or in parenthesis a.. (15,000).) Sheffield Corp. Statement of Cash Flows-Indirect Method For the Year Ended December 31, 2022 Cash Flows from Operating Activities 312510 Net Income Adjustments to reconcile net income to Cash Flows from Investing Activities 178200 Depreciation Expense -9020 Increase in Accounts Receivable wdy -12100 Increase in Inventory 5170 Increase in Income Taxes Payable -4070 Decrease in Accounts Payable 158100 470690 Wersion 2194 Net Cash Provided by Operating Activities served. A Division of John Wiley & Sons, Inc. 106 AM GALA CALCULATOR FL RCES 158180 x Net Cash Provided by Operating Activities 470690 Cash Flows from Investing Activities > Purchase of Building 317900 Sale of Land 38500 Net Cash used by Operating Activities -279400 by Study Cash Flows from Financing Activities 220000 Issuance of Bonds -13200 Decrease in Accounts Receivable -28600 Purchase of Treasury Stock X -19300 Cash Flows from Financing Activities Your answer is partially correct. Try again. The following information is available for Sheffield Corp. for the year ended December 31, 2022. Beginning cash balance $ 49,500 Accounts payable decrease 4,070 Depreciation expense 178,200 Accounts receivable increase 9,020 Inventory Increase 12,100 Net Income 312,510 Cash received for sale of land at book value 38,500 Cash dividends pald 13,200 Income taxes payable increase 5,170 Cash used to purchase building 317,900 Cash used to purchase treasury stock 28,600 Cash received from issuing bonds 220,000 udy Prepare a statement of cash flows using the Indirect method. (Show amounts that decrease cash flow with either a signe.g. -15,000 or in parenthesis e.g. (15,000).) Sheffield Corp. Statement of Cash Flows-Indirect Method 2022 Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a sign e.g. -15,000 or in parenthesis a.. (15,000).) Sheffield Corp. Statement of Cash Flows-Indirect Method For the Year Ended December 31, 2022 Cash Flows from Operating Activities 312510 Net Income Adjustments to reconcile net income to Cash Flows from Investing Activities 178200 Depreciation Expense -9020 Increase in Accounts Receivable wdy -12100 Increase in Inventory 5170 Increase in Income Taxes Payable -4070 Decrease in Accounts Payable 158100 470690 Wersion 2194 Net Cash Provided by Operating Activities served. A Division of John Wiley & Sons, Inc. 106 AM GALA CALCULATOR FL RCES 158180 x Net Cash Provided by Operating Activities 470690 Cash Flows from Investing Activities > Purchase of Building 317900 Sale of Land 38500 Net Cash used by Operating Activities -279400 by Study Cash Flows from Financing Activities 220000 Issuance of Bonds -13200 Decrease in Accounts Receivable -28600 Purchase of Treasury Stock X -19300 Cash Flows from Financing Activities