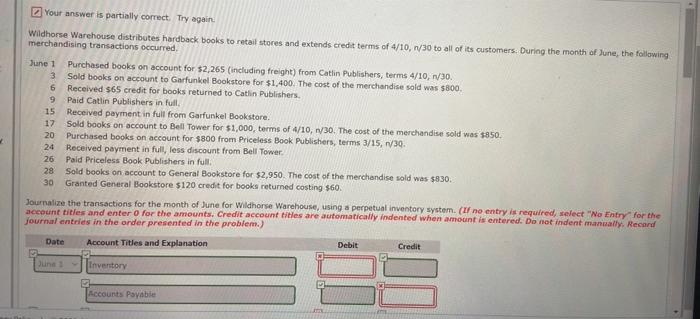

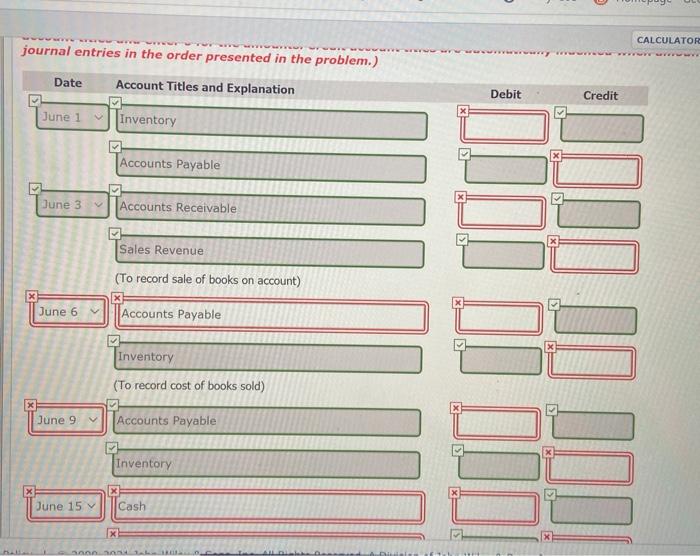

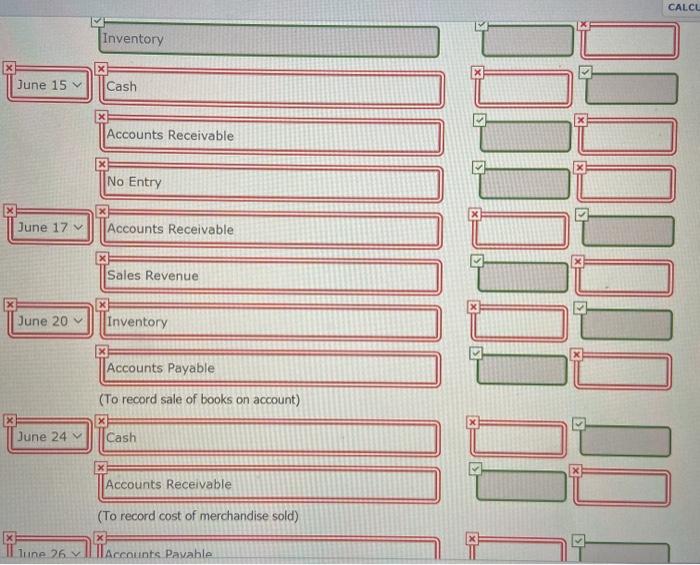

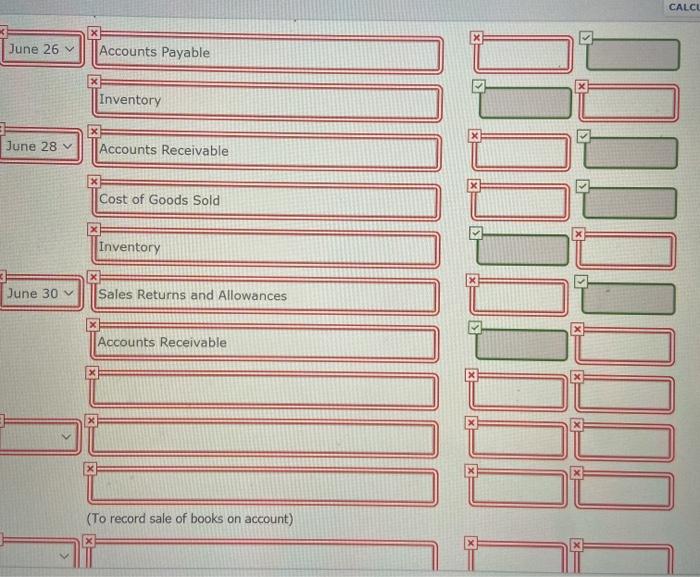

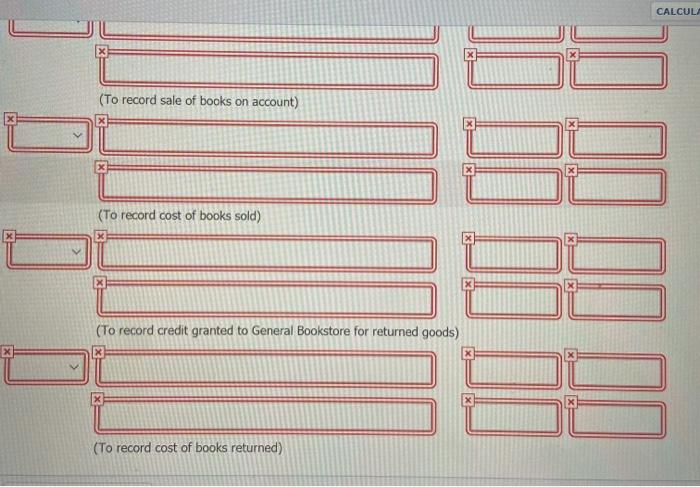

Your answer is partially correct. Try again Wildhorse Warehouse distributes hardback books to retail stores and extends credit terms of 4/10, 1/30 to all of its customers. During the month of June, the following merchandising transactions occurred June 1 Purchased books on account for $2,265 (including freight) from Catlin Publishers, terms 4/10, 1/30 3 Sold books on account to Garfunkel Bookstore for $1,400. The cost of the merchandise sold was $800. 6 Received $65 credit for books returned to Catlin Publishers. 9 Paid Catlin Publishers in full 15 Received payment in full from Garfunkel Bookstore. 17 Sold books on account to Bell Tower for $1,000, terms of 4/10, 1/30. The cost of the merchandise sold was $850. 20 Purchased books on account for $800 from Priceless Book Publishers, terms 3/15, 1/30 24 Received payment in full, less discount from Bell Tower 26 Pald Priceless Book Publishers in full 28 Sold books on account to General Bookstore for $2,950. The cost of the merchandise sold was $830. 30 Granted General Bookstore $120 credit for books returned costing $60. Journalize the transactions for the month of June for Wildhorse Warehouse, using a perpetual inventory system. (If no entry is required, select "No Entry for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record Journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Inventory Accounts Payable CALCULATOR journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit June 1 Inventory Accounts Payable June 3 Accounts Receivable Sales Revenue (To record sale of books on account) June 6 Accounts Payable CD dood igro do cidad Inventory (To record cost of books sold) June 9 Accounts Payable Inventory June 15 Cash x CALCU Inventory June 15 x Cash X Accounts Receivable No Entry June 17 X Accounts Receivable Sales Revenue di dididid T DO Dddddddd x June 20 Inventory X Accounts Payable (To record sale of books on account) June 24 X Cash Accounts Receivable (To record cost of merchandise sold) TI Lune 26 v Il accounts Payable CALCI June 26 Accounts Payable x Inventory June 28 Accounts Receivable X X Cost of Goods Sold X Inventory June 30 Sales Returns and Allowances bodOJDI 10000000 Accounts Receivable x (To record sale of books on account) CALCULA (To record sale of books on account) (To record cost of books sold) JO DO DI DI (To record credit granted to General Bookstore for returned goods) X X (To record cost of books returned)