Question

Your Aunt Nelly has come to you with investment questions; respond to her questions below. 1) Aunt Nelly is confused about asset allocation and what

Your Aunt Nelly has come to you with investment questions; respond to her questions below.

1) Aunt Nelly is confused about asset allocation and what she should do as she gets closer to her retirement. She is unsure if the following statement is true or false: One of the reasons for changing your asset allocation is a change in your time horizon in your stage in life. In other words, as you get closer to your investment goal, you'll likely need to change your asset allocation. Most people investing for retirement hold less stock and more bonds and cash equivalents as they get closer to retirement age.

a)True

b)False

2) Aunt Nelly is unsure which statement is false about mutual fund Fund Facts?

a) Fund Facts is a short, easy-to-read document designed to provide investors with key information about a mutual fund.

b) Fund Facts explain the basics of what the mutual fund invests in, the risks involved, how the fund has performed, and the costs of ownership.

c) Fund Facts describe the returns that you can expect in the future should you decide to invest in the mutual fund.

d) Fund Facts provide an overview of a fund including the fund's investment objective, risk level, costs, past performance, and holdings details.

3) Which of Aunt Nellys friends has a diversified portfolio?

a) Vasu works in IT and only invests in technology stocks such as Amazon, Microsoft, Apple.

b) Nabil has his money in a savings account at the bank and just opened a Tax-Free Savings Account (TFSA) with the money invested in a Money Market mutual fund.

c) Laura graduated with a degree in Fashion Design and is a buyer for Zara. She only invests in retail (specifically clothing) as this is her field of work and a comfortable sector for her.

d) Ava invests in energy stocks, and has now added technology stocks, biotech, utility companies, real estate holdings, and other sectors to her portfolio.

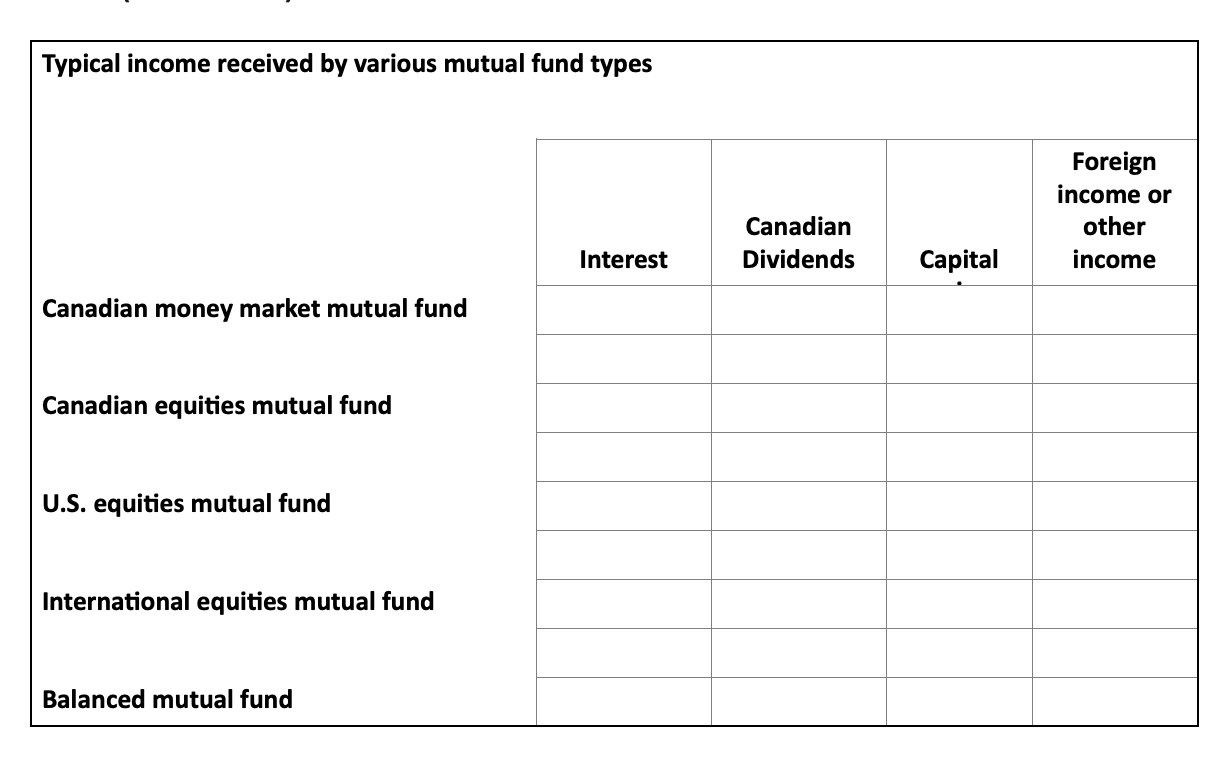

4) Help Aunt Nelly understand the typical investment income received by various mutual fund types. Insert an X in the table where investment income applies. (Table attached)

5) Provide Aunt Nelly with five (5) advantages of investing in mutual funds.

5) Provide Aunt Nelly with five (5) advantages of investing in mutual funds.

6) Provide Aunt Nelly with five (5) disadvantages of investing in mutual funds.

7) Aunt Nelly has heard of Ethical funds but does not know what this is. Explain Ethical funds to Aunt Nelly.

8) Explain to Aunt Nelly what Exchange-Traded Funds (ETFs) are.

9) Provide Aunt Nelly with three (3) benefits that ETFs have that are similar to mutual funds?

10) Provide Aunt Nelly with three (3) differences between ETFs and mutual funds?

11) Explain to Aunt Nelly what Segregated Funds are.

12) Provide Aunt Nelly with two (2) benefits of Segregated Funds.

Typical income received by various mutua Canadian money market mutual fund Canadian equities mutual fund U.S. equities mutual fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started