Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your biotech company has the opportunity to invest in a new drug project. The project costs $10 million upfront to invest in. It is

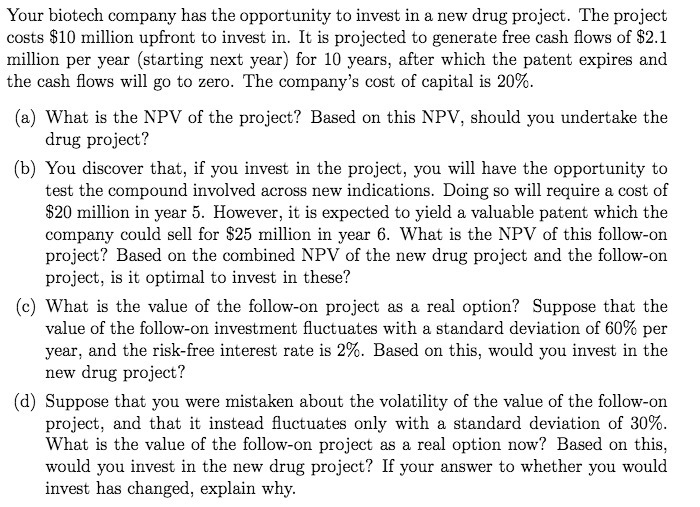

Your biotech company has the opportunity to invest in a new drug project. The project costs $10 million upfront to invest in. It is projected to generate free cash flows of $2.1 million per year (starting next year) for 10 years, after which the patent expires and the cash flows will go to zero. The company's cost of capital is 20%. (a) What is the NPV of the project? Based on this NPV, should you undertake the drug project? (b) You discover that, if you invest in the project, you will have the opportunity to test the compound involved across new indications. Doing so will require a cost of $20 million in year 5. However, it is expected to yield a valuable patent which the company could sell for $25 million in year 6. What is the NPV of this follow-on project? Based on the combined NPV of the new drug project and the follow-on project, is it optimal to invest in these? (c) What is the value of the follow-on project as a real option? Suppose that the value of the follow-on investment fluctuates with a standard deviation of 60% per year, and the risk-free interest rate is 2%. Based on this, would you invest in the new drug project? (d) Suppose that you were mistaken about the volatility of the value of the follow-on project, and that it instead fluctuates only with a standard deviation of 30%. What is the value of the follow-on project as a real option now? Based on this, would you invest in the new drug project? If your answer to whether you would invest has changed, explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the Net Present Value NPV of the project we need to discount the projected cash flows to their present value using the companys cost of capital NPV Sum of Cash Flow 1 Cost of Capitaln I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started