Question

Your boss asks you to perform a financial analysis on Tree Lights R Us and recommend a trade that uses $10mm of capital. Please recommend

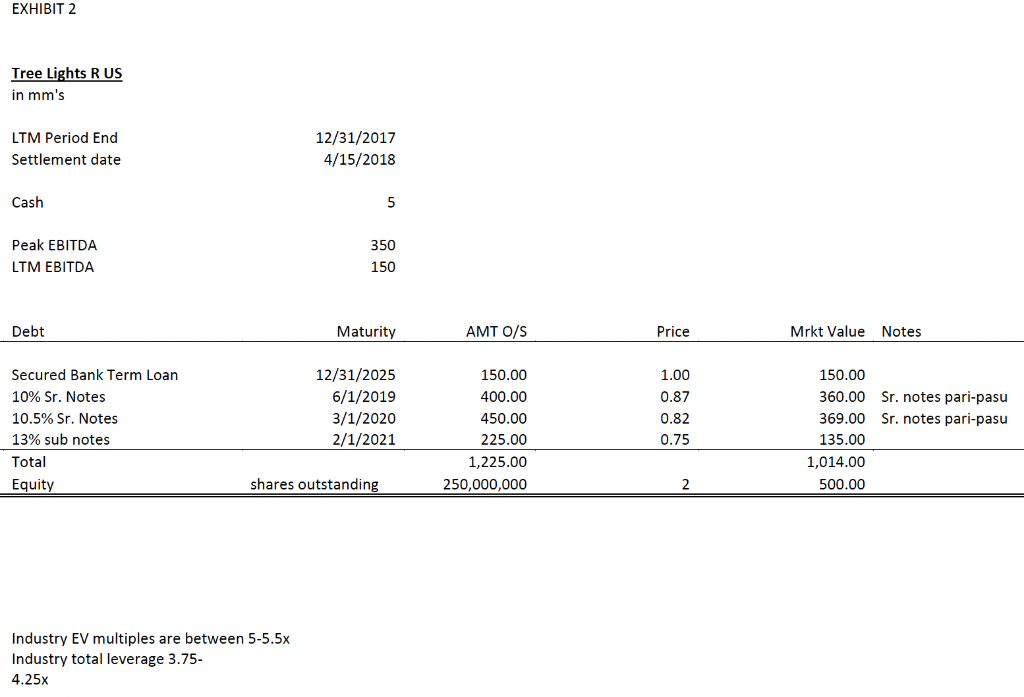

Your boss asks you to perform a financial analysis on Tree Lights R Us and recommend a trade that uses $10mm of capital. Please recommend a trade and explain your rationale for your recommendation. Use the capital structure on Exhibit 2 to determine what your trade recommendation will be. Based on your financial due diligence you have come up with the following assumptions:

Your boss asks you to perform a financial analysis on Tree Lights R Us and recommend a trade that uses $10mm of capital. Please recommend a trade and explain your rationale for your recommendation. Use the capital structure on Exhibit 2 to determine what your trade recommendation will be. Based on your financial due diligence you have come up with the following assumptions:

90% chance of bankruptcy

10% chance of refinancing

In a bankruptcy 2019 Sr. Notes will trade to .65

In a bankruptcy 2020 Sr. Notes will trade to .65

In a bankruptcy Sub Notes will trade to .40

In a refi 2019 Sr. Notes will trade to 1.00

In a refi 2020 Sr. Notes will trade to .95 In a refi Sub Notes will trade to .90

Industry EV multiples are between 5-5.5x

EXHIBIT 2 Tree Lights RUS in mm's LTM Period End Settlement date 12/31/2017 4/15/2018 Cash 5 Peak EBITDA LTM EBITDA 350 150 Debt Maturity AMT O/S Price Mrkt Value Notes Secured Bank Term Loan 10% Sr. Notes 10.5% Sr. Notes 13% sub notes Total Equity 12/31/2025 6/1/2019 3/1/2020 2/1/2021 150.00 400.00 450.00 225.00 1,225.00 250,000,000 1.00 0.87 0.82 0.75 150.00 360.00 Sr. notes pari-pasu 369.00 Sr. notes pari-pasu 135.00 1,014.00 500.00 shares outstanding 2 Industry EV multiples are between 5-5.5x Industry total leverage 3.75- 4.25x EXHIBIT 2 Tree Lights RUS in mm's LTM Period End Settlement date 12/31/2017 4/15/2018 Cash 5 Peak EBITDA LTM EBITDA 350 150 Debt Maturity AMT O/S Price Mrkt Value Notes Secured Bank Term Loan 10% Sr. Notes 10.5% Sr. Notes 13% sub notes Total Equity 12/31/2025 6/1/2019 3/1/2020 2/1/2021 150.00 400.00 450.00 225.00 1,225.00 250,000,000 1.00 0.87 0.82 0.75 150.00 360.00 Sr. notes pari-pasu 369.00 Sr. notes pari-pasu 135.00 1,014.00 500.00 shares outstanding 2 Industry EV multiples are between 5-5.5x Industry total leverage 3.75- 4.25xStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started