Answered step by step

Verified Expert Solution

Question

1 Approved Answer

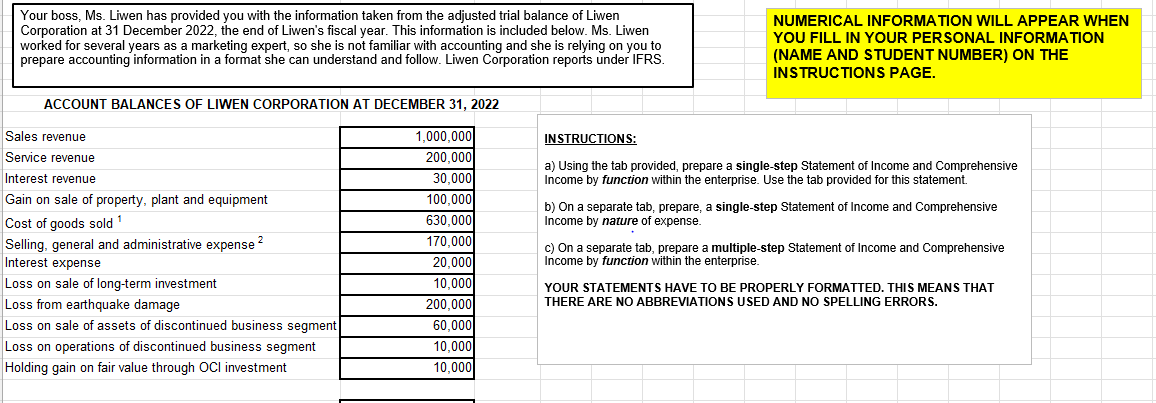

Your boss, Ms. Liwen has provided you with the information taken from the adjusted trial balance of Liwen Corporation at 31 December 2022, the end

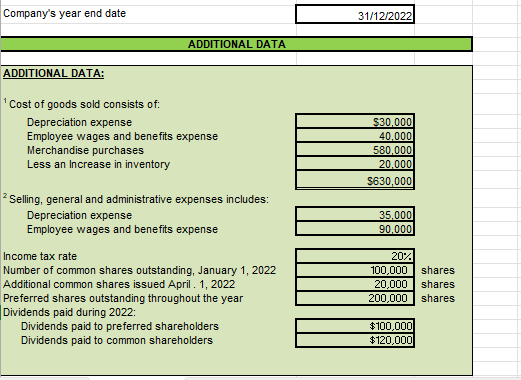

Your boss, Ms. Liwen has provided you with the information taken from the adjusted trial balance of Liwen Corporation at 31 December 2022, the end of Liwen's fiscal year. This information is included below. Ms. Liwen worked for several years as a marketing expert, so she is not familiar with accounting and she is relying on you to prepare accounting information in a format she can understand and follow. Liwen Corporation reports under IFRS. NUMERICAL INFORMATION WILL APPEAR WHEN YOU FILL IN YOUR PERSONAL INFORMATION (NAME AND STUDENT NUMBER) ON THE INSTRUCTIONS PAGE. AC.COIINT RAI ANC.FS OF I IWFN C.ORPORATION AT DFC.FMRFR 31.2022 INSTRUCTIONS: a) Using the tab provided, prepare a single-step Statement of Income and Comprehensive Income by function within the enterprise. Use the tab provided for this statement. b) On a separate tab, prepare, a single-step Statement of Income and Comprehensive Income by nature of expense. c) On a separate tab, prepare a multiple-step Statement of Income and Comprehensive Income by function within the enterprise. YOUR STATEMENTS HAVE TO BE PROPERLY FORMATTED. THIS MEANS THAT THERE ARE NO ABBREVIATIONS USED AND NO SPELLING ERRORS. \begin{tabular}{|c|c|c|} \hline Company's year end date & 31/12/2022 & \\ \hline \multicolumn{3}{|l|}{ ADDITIONAL DATA } \\ \hline \multicolumn{3}{|l|}{ ADDITIONAL DATA: } \\ \hline \multicolumn{3}{|l|}{1 Cost of goods sold consists of: } \\ \hline \multirow{5}{*}{DepreciationexpenseEmployeewagesandbenefitsexpenseMerchandisepurchasesLessanIncreaseininventory} & $30,000 & \\ \hline & 40,000 & \\ \hline & 580,000 & \\ \hline & 20,000 & \\ \hline & $630,000 & \\ \hline \multicolumn{3}{|l|}{2 Selling, general and administrative expenses includes: } \\ \hline \multirow{2}{*}{DepreciationexpenseEmployeewagesandbenefitsexpense} & 35,000 & \multirow{9}{*}{sharessharesshares} \\ \hline & 90,000 & \\ \hline \multirow{5}{*}{IncometaxrateNumberofcommonsharesoutstanding,January1,2022AdditionalcommonsharesissuedApril.1,2022PreferredsharesoutstandingthroughouttheyearDividendspaidduring2022:} & 20% & \\ \hline & 100,000 & \\ \hline & 20,000 & \\ \hline & 200,000 & \\ \hline & & \\ \hline Dividends paid to preferred shareholders & $100,000 & \\ \hline Dividends paid to common shareholders & $120,000 & \\ \hline \end{tabular}

Your boss, Ms. Liwen has provided you with the information taken from the adjusted trial balance of Liwen Corporation at 31 December 2022, the end of Liwen's fiscal year. This information is included below. Ms. Liwen worked for several years as a marketing expert, so she is not familiar with accounting and she is relying on you to prepare accounting information in a format she can understand and follow. Liwen Corporation reports under IFRS. NUMERICAL INFORMATION WILL APPEAR WHEN YOU FILL IN YOUR PERSONAL INFORMATION (NAME AND STUDENT NUMBER) ON THE INSTRUCTIONS PAGE. AC.COIINT RAI ANC.FS OF I IWFN C.ORPORATION AT DFC.FMRFR 31.2022 INSTRUCTIONS: a) Using the tab provided, prepare a single-step Statement of Income and Comprehensive Income by function within the enterprise. Use the tab provided for this statement. b) On a separate tab, prepare, a single-step Statement of Income and Comprehensive Income by nature of expense. c) On a separate tab, prepare a multiple-step Statement of Income and Comprehensive Income by function within the enterprise. YOUR STATEMENTS HAVE TO BE PROPERLY FORMATTED. THIS MEANS THAT THERE ARE NO ABBREVIATIONS USED AND NO SPELLING ERRORS. \begin{tabular}{|c|c|c|} \hline Company's year end date & 31/12/2022 & \\ \hline \multicolumn{3}{|l|}{ ADDITIONAL DATA } \\ \hline \multicolumn{3}{|l|}{ ADDITIONAL DATA: } \\ \hline \multicolumn{3}{|l|}{1 Cost of goods sold consists of: } \\ \hline \multirow{5}{*}{DepreciationexpenseEmployeewagesandbenefitsexpenseMerchandisepurchasesLessanIncreaseininventory} & $30,000 & \\ \hline & 40,000 & \\ \hline & 580,000 & \\ \hline & 20,000 & \\ \hline & $630,000 & \\ \hline \multicolumn{3}{|l|}{2 Selling, general and administrative expenses includes: } \\ \hline \multirow{2}{*}{DepreciationexpenseEmployeewagesandbenefitsexpense} & 35,000 & \multirow{9}{*}{sharessharesshares} \\ \hline & 90,000 & \\ \hline \multirow{5}{*}{IncometaxrateNumberofcommonsharesoutstanding,January1,2022AdditionalcommonsharesissuedApril.1,2022PreferredsharesoutstandingthroughouttheyearDividendspaidduring2022:} & 20% & \\ \hline & 100,000 & \\ \hline & 20,000 & \\ \hline & 200,000 & \\ \hline & & \\ \hline Dividends paid to preferred shareholders & $100,000 & \\ \hline Dividends paid to common shareholders & $120,000 & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started