Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your boss, Sally Maloney, treasurer of Fred Clark Enterprises (FCE), asked you to help her estimate the intrinsic value of the company's stock. FCE

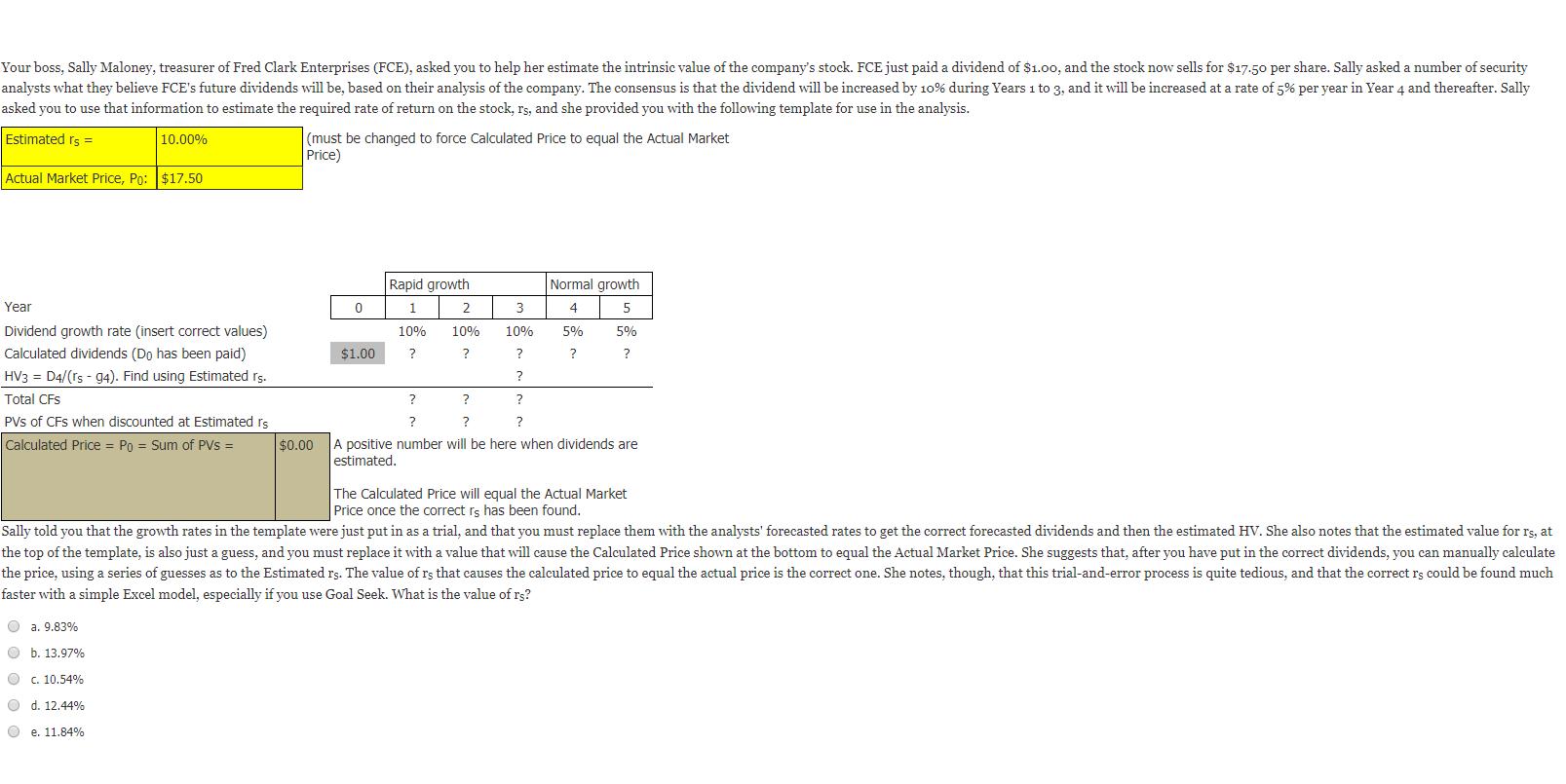

Your boss, Sally Maloney, treasurer of Fred Clark Enterprises (FCE), asked you to help her estimate the intrinsic value of the company's stock. FCE just paid a dividend of $1.00, and the stock now sells for $17.50 per share. Sally asked a number of security analysts what they believe FCE's future dividends will be, based on their analysis of the company. The consensus is that the dividend will be increased by 10% during Years 1 to 3, and it will be increased at a rate of 5% per year in Year 4 and thereafter. Sally asked you to use that information to estimate the required rate of return on the stock, rs, and she provided you with the following template for use in the analysis. Estimated rs = 10.00% Actual Market Price, Po: $17.50 Year Dividend growth rate (insert correct values) Calculated dividends (Do has been paid) HV3 = D4/(rs - 94). Find using Estimated rs. Total CFs PVS of CFs when discounted at Estimated rs Calculated Price = Po = Sum of PVs = a. 9.83% b. 13.97% c. 10.54% Od. 12.44% e. 11.84% (must be changed to force Calculated Price to equal the Actual Market Price) $0.00 0 $1.00 Rapid growth 1 10% ? 2 10% ? 3 10% ? ? ? ? ? Normal growth 4 5 5% ? 5% ? ? ? ? A positive number will be here when dividends are estimated. The Calculated Price will equal the Actual Market Price once the correct rs has been found. Sally told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated HV. She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price. She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs. The value of rs that causes the calculated price to equal the actual price is the correct one. She notes, though, that this trial-and-error process is quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek. What is the value of rs?

Step by Step Solution

★★★★★

3.55 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started