Answered step by step

Verified Expert Solution

Question

1 Approved Answer

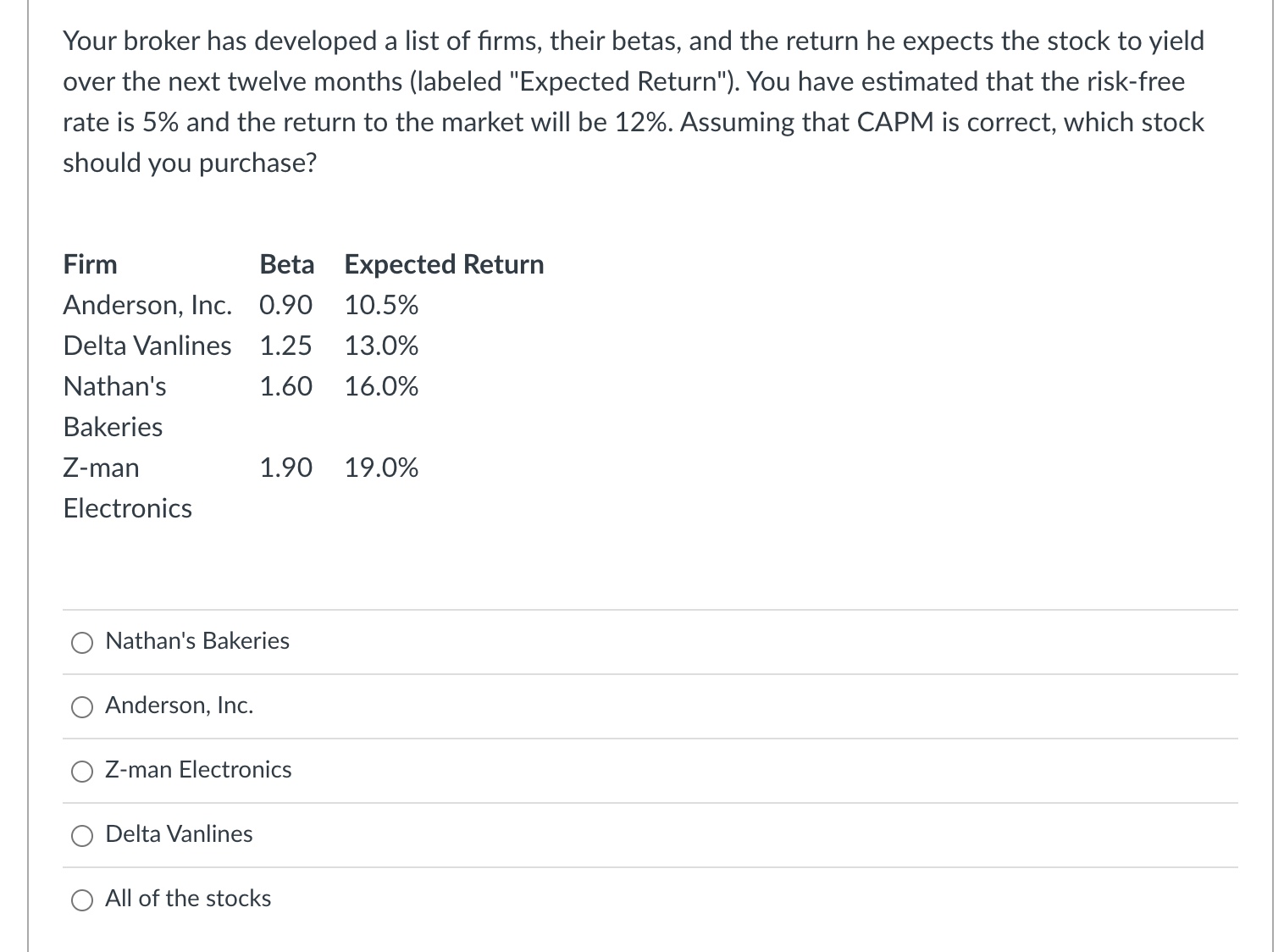

Your broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled

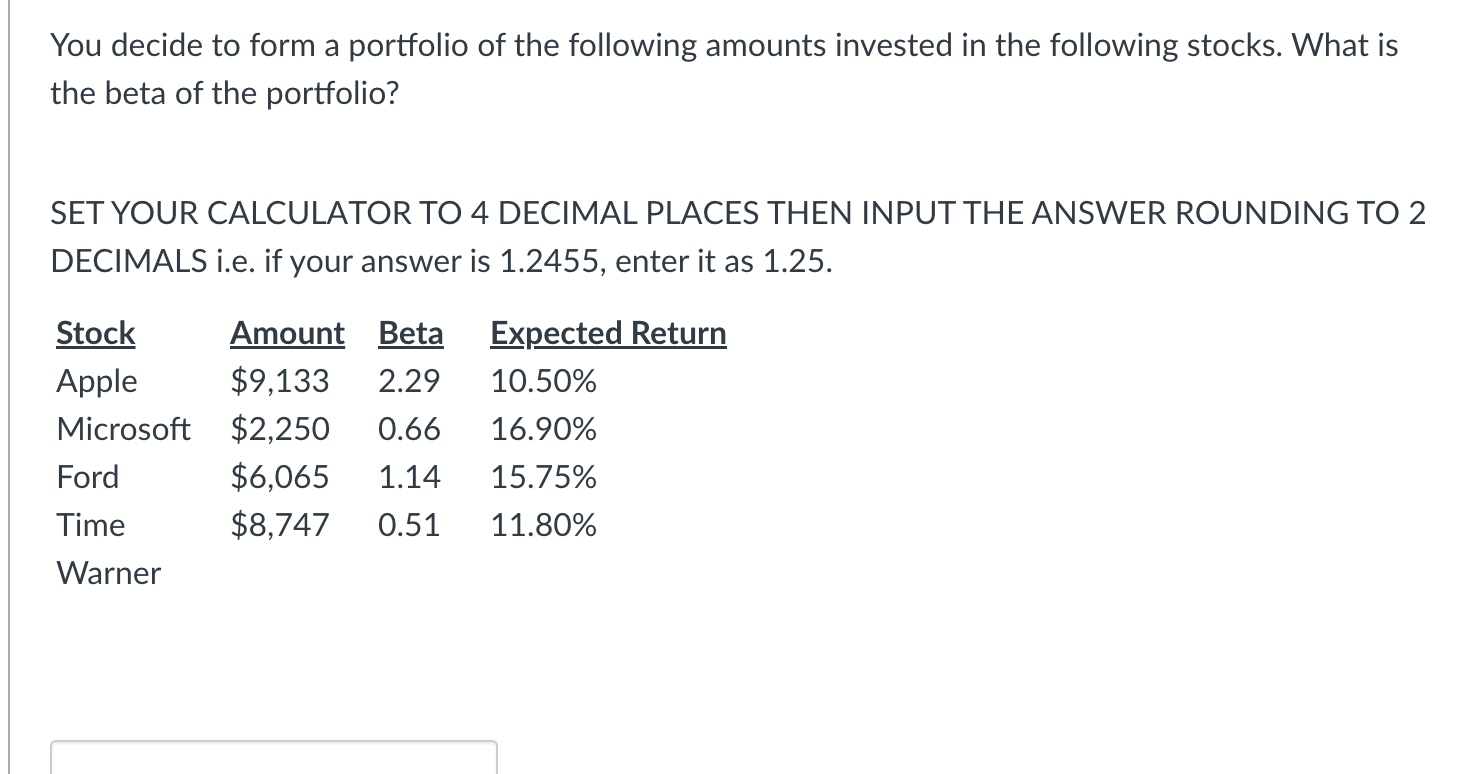

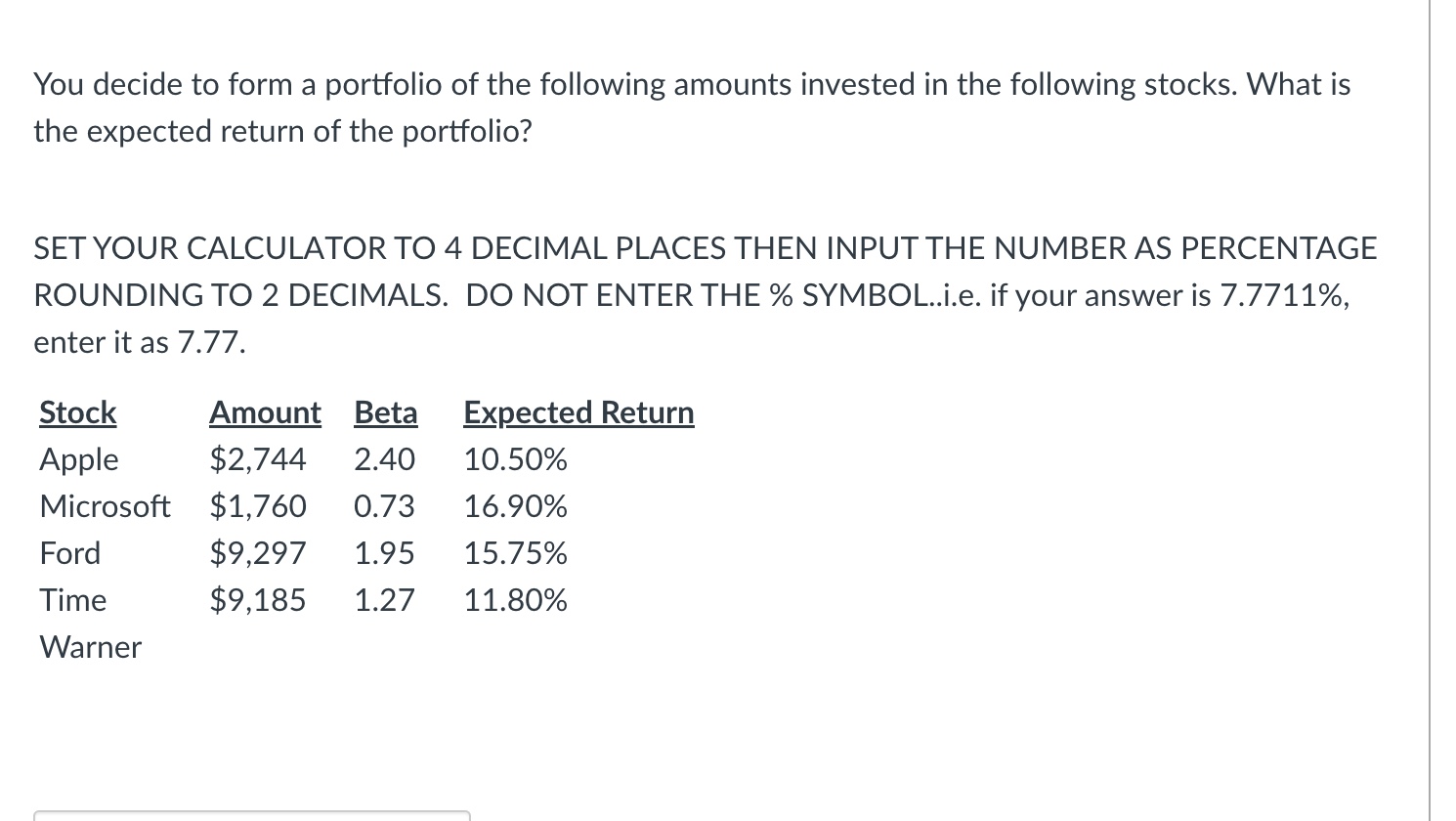

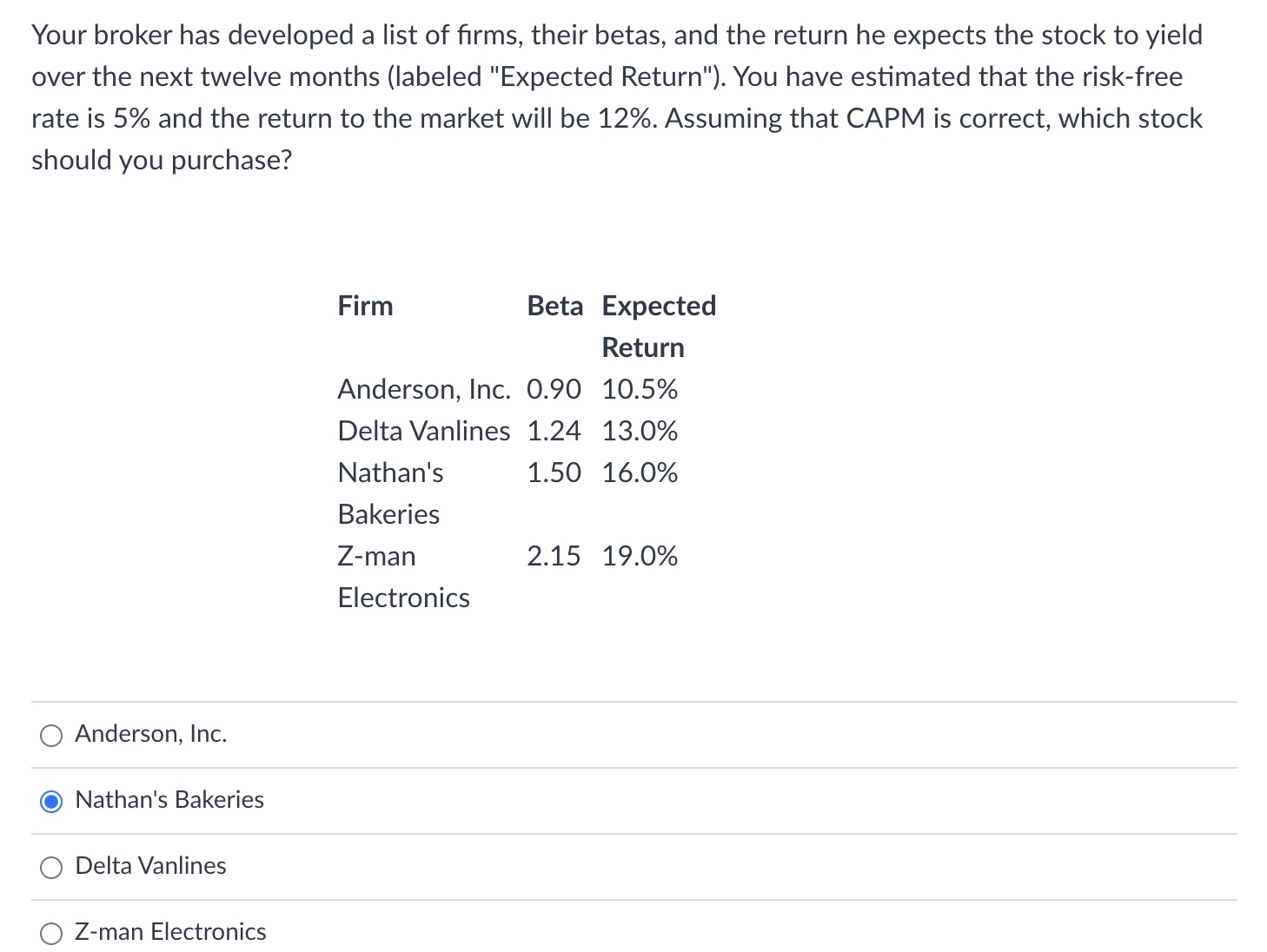

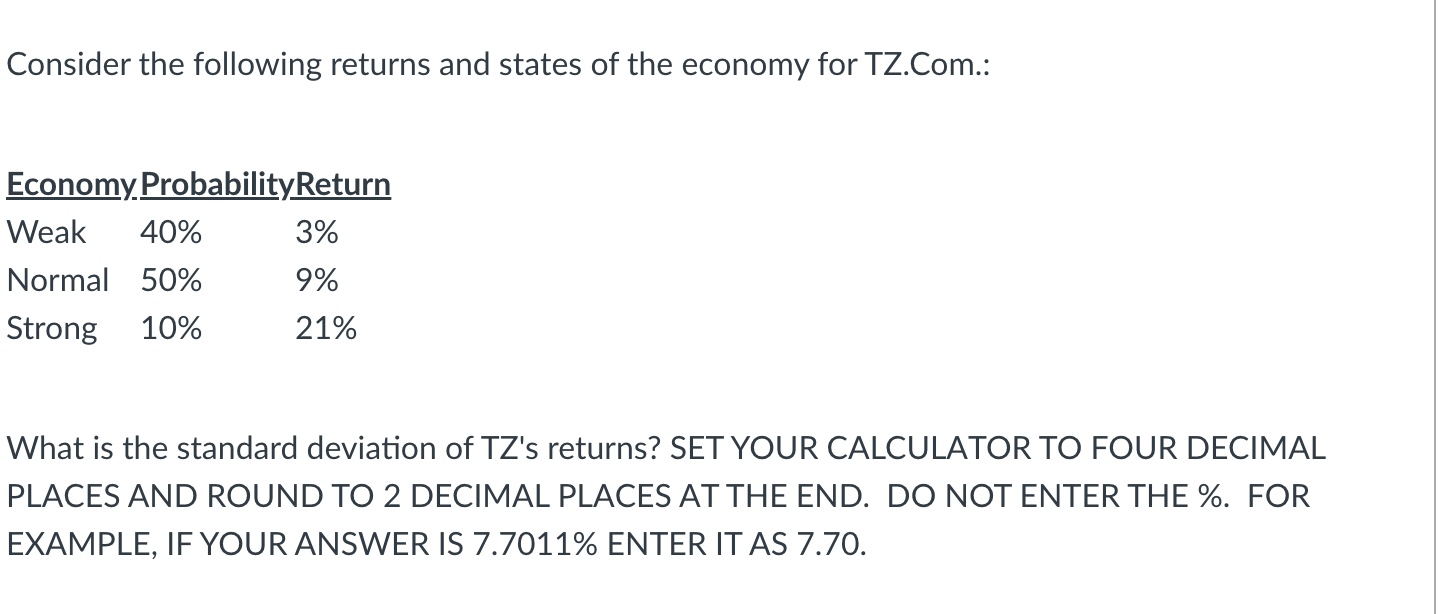

Your broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled "Expected Return"). You have estimated that the risk-free rate is 5% and the return to the market will be 12%. Assuming that CAPM is correct, which stock should you purchase? Anderson, Inc. Nathan's Bakeries Delta Vanlines Z-man Electronics You decide to form a portfolio of the following amounts invested in the following stocks. What is the expected return of the portfolio? SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN INPUT THE NUMBER AS PERCENTAGE ROUNDING TO 2 DECIMALS. DO NOT ENTER THE \% SYMBOL..i.e. if your answer is 7.7711%, enter it as 7.77. Your broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled "Expected Return"). You have estimated that the risk-free rate is 5% and the return to the market will be 12%. Assuming that CAPM is correct, which stock should you purchase? Nathan's Bakeries Anderson, Inc. Z-man Electronics Delta Vanlines All of the stocks You decide to form a portfolio of the following amounts invested in the following stocks. What is the beta of the portfolio? SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN INPUT THE ANSWER ROUNDING TO 2 DECIMALS i.e. if your answer is 1.2455 , enter it as 1.25 . Consider the following returns and states of the economy for TZ.Com.: What is the standard deviation of TZ's returns? SET YOUR CALCULATOR TO FOUR DECIMAL PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE \%. FOR EXAMPLE, IF YOUR ANSWER IS 7.7011\% ENTER IT AS 7.70

Your broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled "Expected Return"). You have estimated that the risk-free rate is 5% and the return to the market will be 12%. Assuming that CAPM is correct, which stock should you purchase? Anderson, Inc. Nathan's Bakeries Delta Vanlines Z-man Electronics You decide to form a portfolio of the following amounts invested in the following stocks. What is the expected return of the portfolio? SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN INPUT THE NUMBER AS PERCENTAGE ROUNDING TO 2 DECIMALS. DO NOT ENTER THE \% SYMBOL..i.e. if your answer is 7.7711%, enter it as 7.77. Your broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled "Expected Return"). You have estimated that the risk-free rate is 5% and the return to the market will be 12%. Assuming that CAPM is correct, which stock should you purchase? Nathan's Bakeries Anderson, Inc. Z-man Electronics Delta Vanlines All of the stocks You decide to form a portfolio of the following amounts invested in the following stocks. What is the beta of the portfolio? SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN INPUT THE ANSWER ROUNDING TO 2 DECIMALS i.e. if your answer is 1.2455 , enter it as 1.25 . Consider the following returns and states of the economy for TZ.Com.: What is the standard deviation of TZ's returns? SET YOUR CALCULATOR TO FOUR DECIMAL PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE \%. FOR EXAMPLE, IF YOUR ANSWER IS 7.7011\% ENTER IT AS 7.70 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started