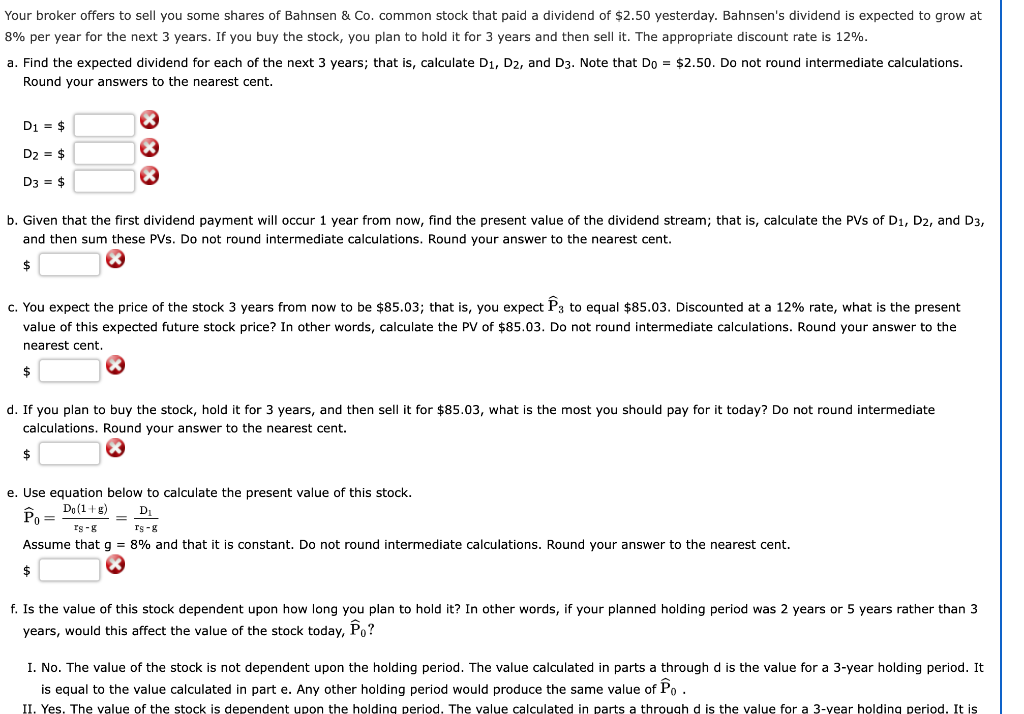

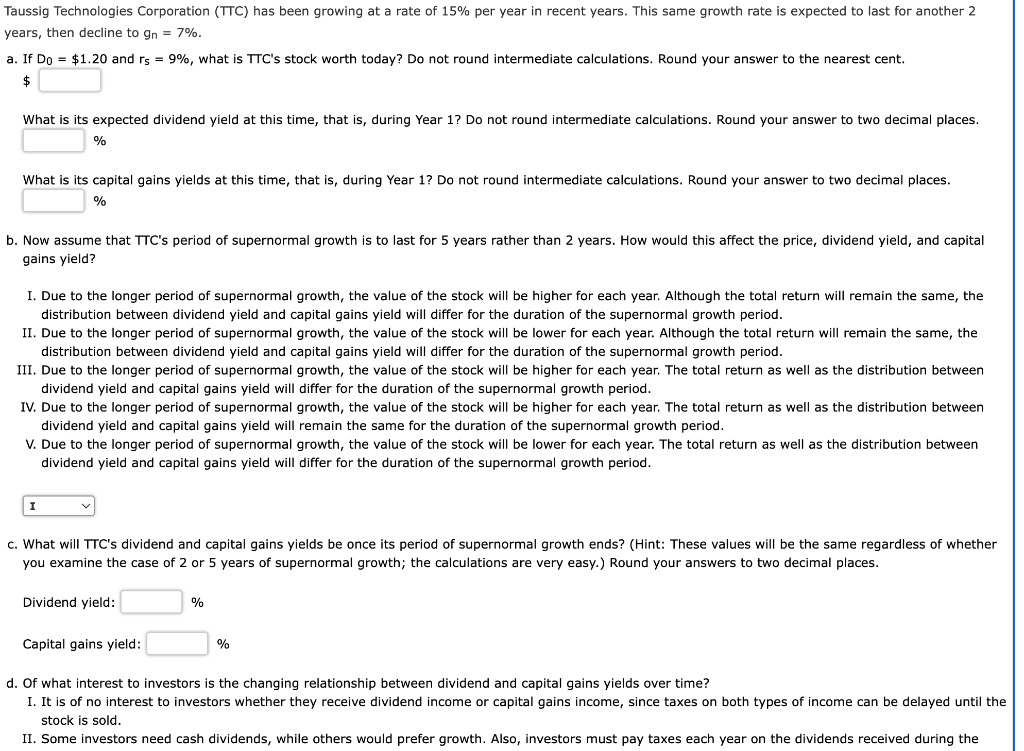

Your broker offers to sell you some shares of Bahnsen & Co. common stock that paid a dividend of $2.50 yesterday. Bahnsen's dividend is expected to grow at 8% per year for the next 3 years. If you buy the stock, you plan to hold it for 3 years and then sell it. The appropriate discount rate is 12%. a. Find the expected dividend for each of the next 3 years; that is, calculate D1, D2, and D3. Note that Do = $2.50. Do not round intermediate calculations. Round your answers to the nearest cent. D1 = $ D2 = $ X D3 = $ X b. Given that the first dividend payment will occur 1 year from now, find the present value of the dividend stream; that is, calculate the PVs of D1, D2, and D3, and then sum these PVs. Do not round intermediate calculations. Round your answer to the nearest cent. $ C. You expect the price of the stock 3 years from now to be $85.03; that is, you expect ; to equal $85.03. Discounted at a 12% rate, what is the present value of this expected future stock price? In other words, calculate the PV of $85.03. Do not round intermediate calculations. Round your answer to the nearest cent. $ d. If you plan to buy the stock, hold it for 3 years, and then sell it for $85.03, what is the most you should pay for it today? Do not round intermediate calculations. Round your answer to the nearest cent. $ e. Use equation below to calculate the present value of this stock. Po= D. (1+5) D Is- Tg-g Assume that g = 8% and that it is constant. Do not round intermediate calculations. Round your answer to the nearest cent. $ f. Is the value of this stock dependent upon how long you plan to hold it? In other words, if your planned holding period was 2 years or 5 years rather than 3 years, would this affect the value of the stock today, P.? I. No. The value of the stock is not dependent upon the holding period. The value calculated in parts a through d is the value for a 3-year holding period. It is equal to the value calculated in part e. Any other holding period would produce the same value of fo. II. Yes. The value of the stock is dependent upon the holding period. The value calculated in parts a through d is the value for a 3-year holding period. It is Taussig Technologies Corporation (TTC) has been growing at a rate of 15% per year in recent years. This same growth rate is expected to last for another 2 years, then decline to On = 7%. a. If Do = $1.20 and rs = 9%, what is TTC's stock worth today? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is its expected dividend yield at this time, that is, during Year 1? Do not round intermediate calculations. Round your answer to two decimal places. % What is its capital gains yields at this time, that is, during Year 1? Do not round intermediate calculations. Round your answer to two decimal places. % b. Now assume that TTC's period of supernormal growth is to last for 5 years rather than 2 years. How would this affect the price, dividend yield, and capital gains yield? I. Due to the longer period of supernormal growth, the value of the stock will be higher for each year. Although the total return will remain the same, the distribution between dividend yield and capital gains yield will differ for the duration of the supernormal growth period. II. Due to the longer period of supernormal growth, the value of the stock will be lower for each year. Although the total return will remain the same, the distribution between dividend yield and capital gains yield will differ for the duration of the supernormal growth period. III. Due to the longer period of supernormal growth, the value of the stock will be higher for each year. The total return as well as the distribution between dividend yield and capital gains yield will differ for the duration of the supernormal growth period. IV. Due to the longer period of supernormal growth, the value of the stock will be higher for each year. The total return as well as the distribution between dividend yield and capital gains yield will remain the same for the duration of the supernormal growth period. V. Due to the longer period of supernormal growth, the value of the stock will be lower for each year. The total return as well as the distribution between dividend yield capital gains yield differ for the duration the supernormal growth period. I c. What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.) Round your answers to two decimal places. Dividend yield: % Capital gains yield: % d. Of what interest to investors is the changing relationship between dividend and capital gains yields over time? I. It is of no interest to investors whether they receive dividend income or capital gains income, since taxes on both types of income can be delayed until the stock is sold. II. Some investors need cash dividends, while others would prefer growth. Also, investors must pay taxes each year on the dividends received during the