Question

Your broker would like to sell you a security (S) that will pay you $485 each year for the next 7 years (payments at

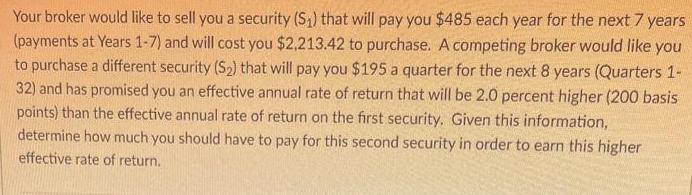

Your broker would like to sell you a security (S) that will pay you $485 each year for the next 7 years (payments at Years 1-7) and will cost you $2,213.42 to purchase. A competing broker would like you to purchase a different security (S) that will pay you $195 a quarter for the next 8 years (Quarters 1- 32) and has promised you an effective annual rate of return that will be 2.0 percent higher (200 basis points) than the effective annual rate of return on the first security. Given this information, determine how much you should have to pay for this second security in order to earn this higher effective rate of return.

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Answer S1 Present value 221342 Annual payments 485 Period 7 years E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

3rd edition

9780077506902, 78025540, 77506901, 978-0078025549

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App