Question

Your brother runs a lawn service and he needs to purchase a new riding lawn mower. He will purchase one of two mowers. Mower A

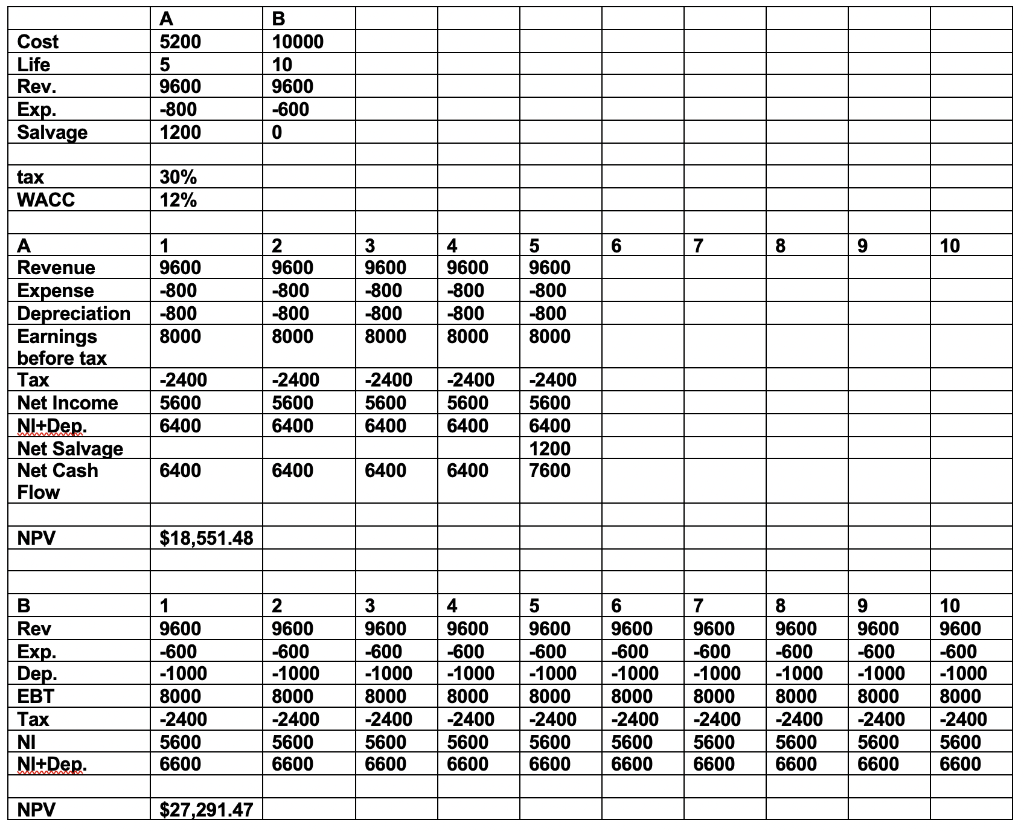

Your brother runs a lawn service and he needs to purchase a new riding lawn mower. He will purchase one of two mowers. Mower A costs $5,200, has a five-year life, a salvage value of $1200, and expenses of $800 per year. Mower B costs $10,000, has a ten-year life, a salvage value of $0, and expenses of $600 per year. Whichever mower is used, revenues are expected to be $9,600 per year, and the mowers will be replaced at the end of their lives. You have correctly put together the numbers below using straight-line depreciation (to the salvage value), a tax rate of 30%, and a cost of capital of 12%.

Determine which machine your brother should buy using an appropriate evaluation technique. Please explain your decision and describe the issue that has guided your decision.

Cost Life Rev. Exp. Salvage A 5200 5 9600 -800 1200 B 10000 10 9600 -600 0 tax WACC 30% 12% 6 7 8 9 10 1 9600 -800 -800 8000 2 9600 -800 -800 8000 3 9600 -800 4 9600 -800 -800 8000 5 9600 -800 -800 -800 8000 8000 A Revenue Expense Depreciation Earnings before tax Tax Net Income NI+Dep. Net Salvage Net Cash Flow -2400 5600 6400 -2400 5600 6400 -2400 5600 6400 -2400 5600 6400 -2400 5600 6400 1200 7600 6400 6400 6400 6400 NPV $18,551.48 B Rev Exp. Dep. EBT Tax NI NI+Dep. 1 9600 -600 -1000 8000 -2400 5600 6600 2 9600 -600 -1000 8000 -2400 5600 6600 3 9600 -600 -1000 8000 -2400 5600 6600 4 9600 -600 -1000 8000 -2400 5600 6600 5 9600 -600 -1000 8000 -2400 5600 6600 6 9600 -600 -1000 8000 -2400 5600 6600 7 9600 -600 -1000 8000 -2400 5600 6600 8 9600 -600 -1000 8000 -2400 5600 6600 9 9600 -600 -1000 8000 -2400 5600 6600 10 9600 -600 -1000 8000 -2400 5600 6600 NPV $27,291.47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started