Question

Your brother-in-law, Bil, fancies himself quite an investor, and he knows your sister, Hermana, also has a bit of an interest in the markets. So,

Your brother-in-law, Bil, fancies himself quite an investor, and he knows your sister, Hermana, also has "a bit of an interest in the markets." So, he wants you to settle a dispute between them as to who is the better "market player."

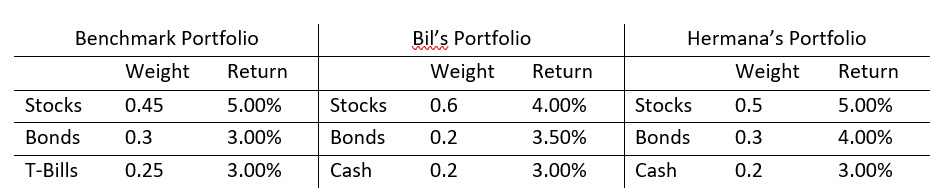

Your research into their online brokerage trades has turned up the following performance information:

The risk-free rate is 3% and the standard deviation for the Benchmark portfolio is 4.00%, Bil's portfolio is 5.00%, and Hermana's portfolio is 6.00%.

1. Compare Bil and Hermana's performance relative to the benchmark in terms of portfolio returns.

2. If they are beating the market, determine the sources of their success in terms of security selection and asset allocation.

a. Who is superior in security selection?

b. Who is superior in asset allocation?

3. Using the Sharpe Index, determine which relative is performing better than the market on a risk adjusted basis.

Benchmark Portfolio Bil's Portfolio Hermana's Portfolio Weight Return Weight Return Weight Return Stocks 0.45 5.00% Stocks 0.6 4.00% Stocks 0.5 5.00% Bonds 0.3 3.00% Bonds 0.2 3.50% Bonds 0.3 4.00% T-Bills 0.25 3.00% Cash 0.2 3.00% Cash 0.2 3.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compare Bil and Hermanas performance relative to the benchmark lets analyze their portfolio returns Benchmark Portfolio Return 300 Bils Portfolio Return 500 Hermanas Portfolio Return 600 Comparing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started