Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your client, a limited company, has made profits before tax of 95,000 for the year ended 31 December 2021. In calculating those profits there have

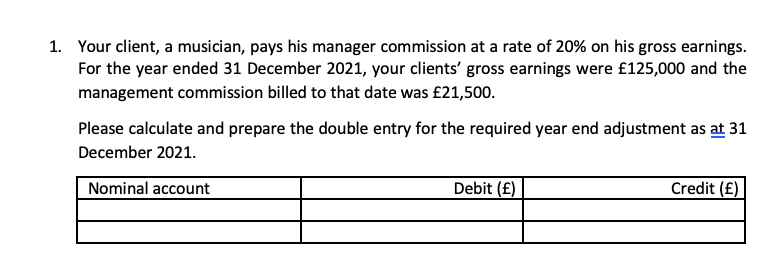

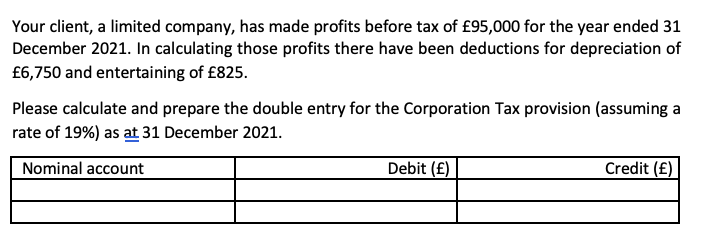

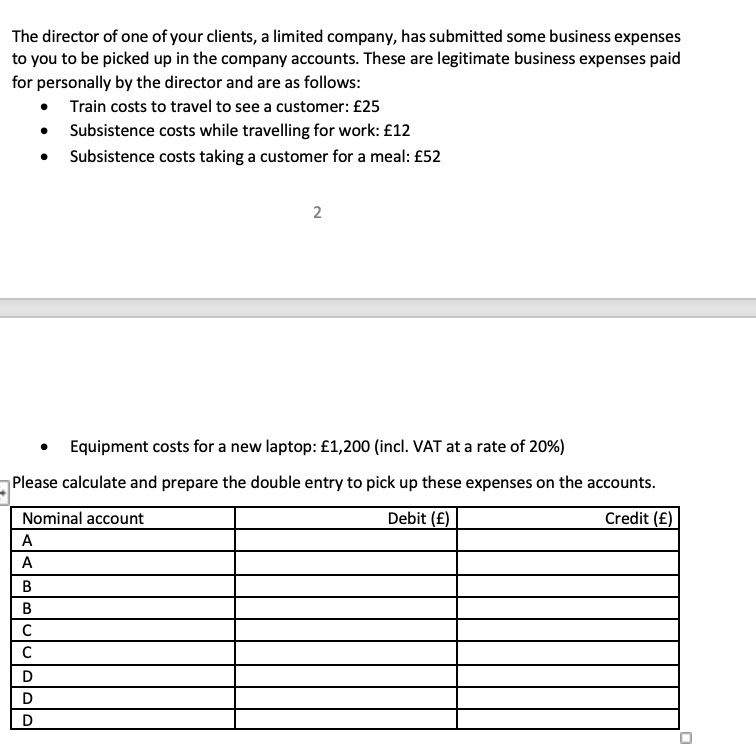

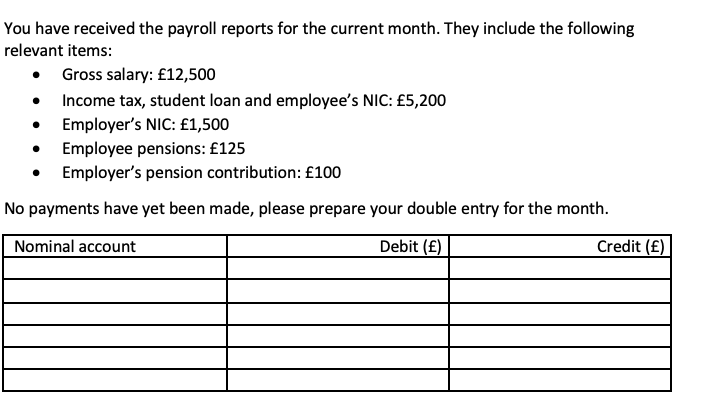

Your client, a limited company, has made profits before tax of 95,000 for the year ended 31 December 2021. In calculating those profits there have been deductions for depreciation of 6,750 and entertaining of 825. Please calculate and prepare the double entry for the Corporation Tax provision (assuming a rate of 19\%) as at 31 December 2021. Your client, a musician, pays his manager commission at a rate of 20% on his gross earnings. For the year ended 31 December 2021, your clients' gross earnings were 125,000 and the management commission billed to that date was 21,500. Please calculate and prepare the double entry for the required year end adjustment as at 31 December 2021. The director of one of your clients, a limited company, has submitted some business expenses to you to be picked up in the company accounts. These are legitimate business expenses paid for personally by the director and are as follows: - Train costs to travel to see a customer: 25 - Subsistence costs while travelling for work: 12 - Subsistence costs taking a customer for a meal: 52 2 - Equipment costs for a new laptop: f1,200 (incl. VAT at a rate of 20% ) Please calculate and prepare the double entry to pick up these expenses on the accounts. You have received the payroll reports for the current month. They include the following relevant items: - Gross salary: 12,500 - Income tax, student loan and employee's NIC: 5,200 - Employer's NIC: 1,500 - Employee pensions: 125 - Employer's pension contribution: f100

Your client, a limited company, has made profits before tax of 95,000 for the year ended 31 December 2021. In calculating those profits there have been deductions for depreciation of 6,750 and entertaining of 825. Please calculate and prepare the double entry for the Corporation Tax provision (assuming a rate of 19\%) as at 31 December 2021. Your client, a musician, pays his manager commission at a rate of 20% on his gross earnings. For the year ended 31 December 2021, your clients' gross earnings were 125,000 and the management commission billed to that date was 21,500. Please calculate and prepare the double entry for the required year end adjustment as at 31 December 2021. The director of one of your clients, a limited company, has submitted some business expenses to you to be picked up in the company accounts. These are legitimate business expenses paid for personally by the director and are as follows: - Train costs to travel to see a customer: 25 - Subsistence costs while travelling for work: 12 - Subsistence costs taking a customer for a meal: 52 2 - Equipment costs for a new laptop: f1,200 (incl. VAT at a rate of 20% ) Please calculate and prepare the double entry to pick up these expenses on the accounts. You have received the payroll reports for the current month. They include the following relevant items: - Gross salary: 12,500 - Income tax, student loan and employee's NIC: 5,200 - Employer's NIC: 1,500 - Employee pensions: 125 - Employer's pension contribution: f100 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started