Answered step by step

Verified Expert Solution

Question

1 Approved Answer

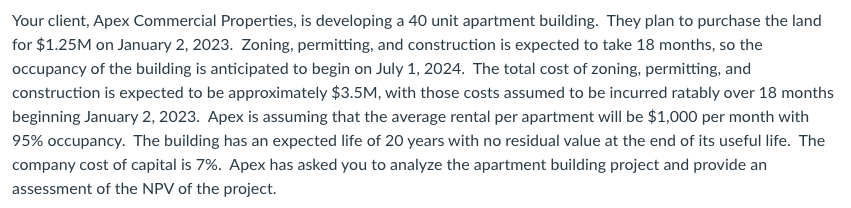

Your client, Apex Commercial Properties, is developing a 4 0 unit apartment building. They plan to purchase the land for $ 1 . 2 5

Your client, Apex Commercial Properties, is developing a unit apartment building. They plan to purchase the land

for $ on January Zoning, permitting, and construction is expected to take months, so the

occupancy of the building is anticipated to begin on July The total cost of zoning, permitting, and

construction is expected to be approximately $ with those costs assumed to be incurred ratably over months

beginning January Apex is assuming that the average rental per apartment will be $ per month with

occupancy. The building has an expected life of years with no residual value at the end of its useful life. The

company cost of capital is Apex has asked you to analyze the apartment building project and provide an

assessment of the NPV of the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started