Your client, Bob Millers long-term financial goal is to retire comfortably in 23 years at age 65. You have conducted a robust risk profile analysis on him and have determined that he is an aggressive investor. Miller insisted on allocating a sizable portion of his portfolio to oil and gas stocks, given his 30 years of work experience in the industry. Recent volatility in oil and gas stocks is exerting a profound emotional toll on Miller, who has complained of watching business news channels on television and being consumed with fear as a result of the steady stream of pessimistic forecasts by commentators. Miller told you in a recent phone conversation that he feared financial Armageddon would be inevitable. This contradicts his statement in his client profile questionnaire that he would not change strategy simply due to short-term losses. You hope that Miller will respond favourably to calm reassurance and rational analytical discussions but fear he will pull his money out of equities entirely.

How should you advise Bob Miller, considering Millers emotional state of mind? Should you move him away from volatile investments? If so, what is a suitable strategy? Or should you advise him to stay the course. If so, how would you convince him to do so?

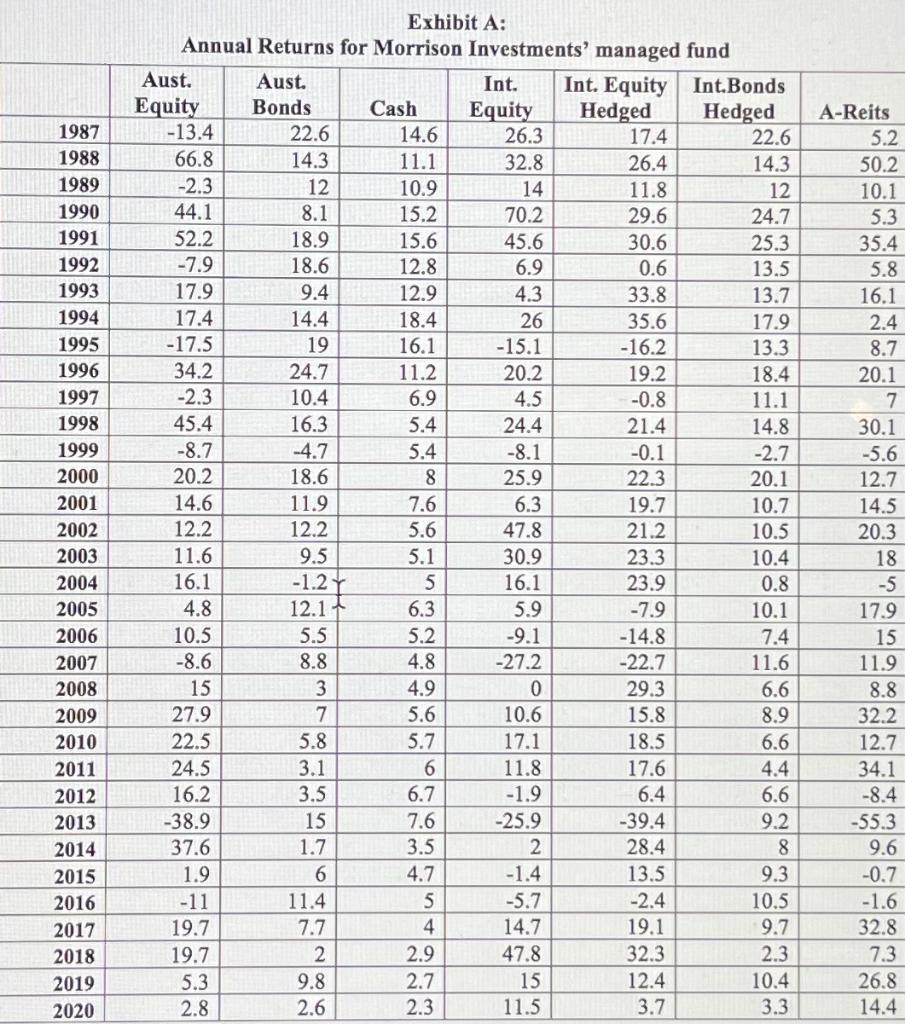

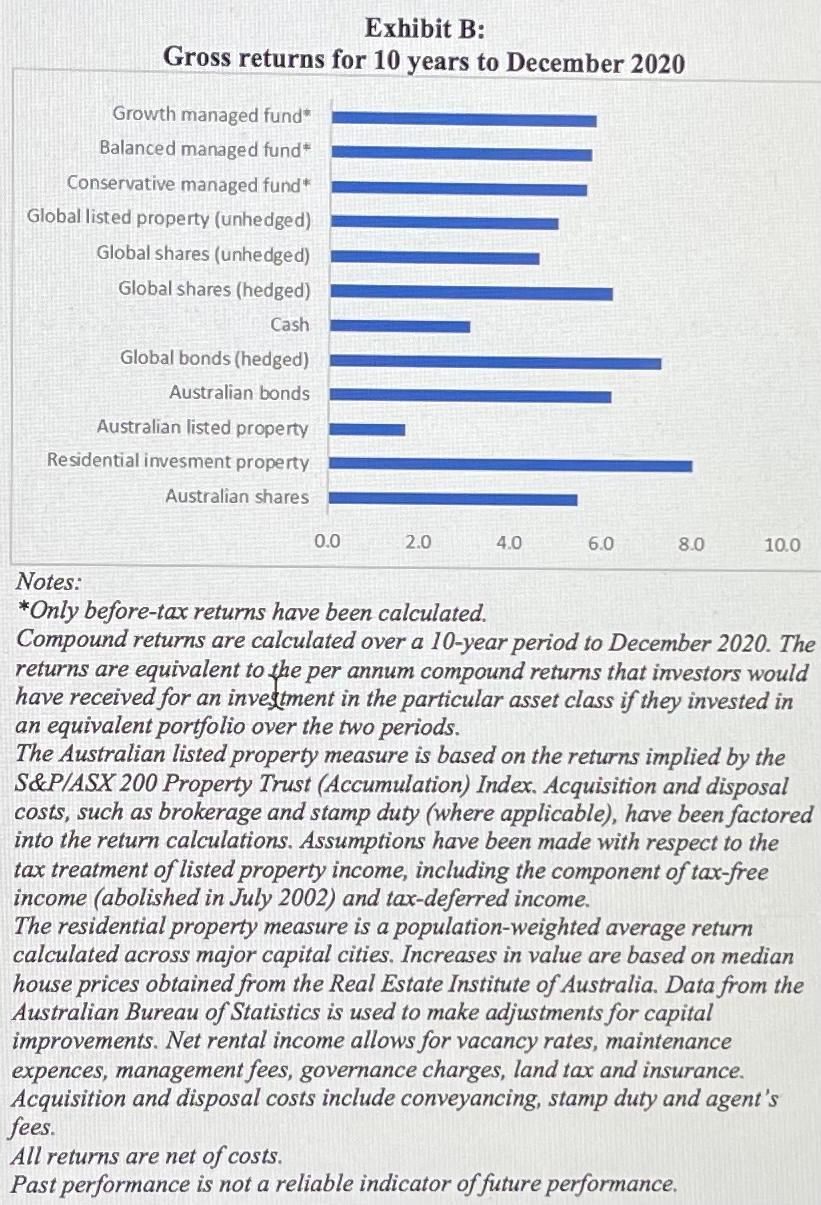

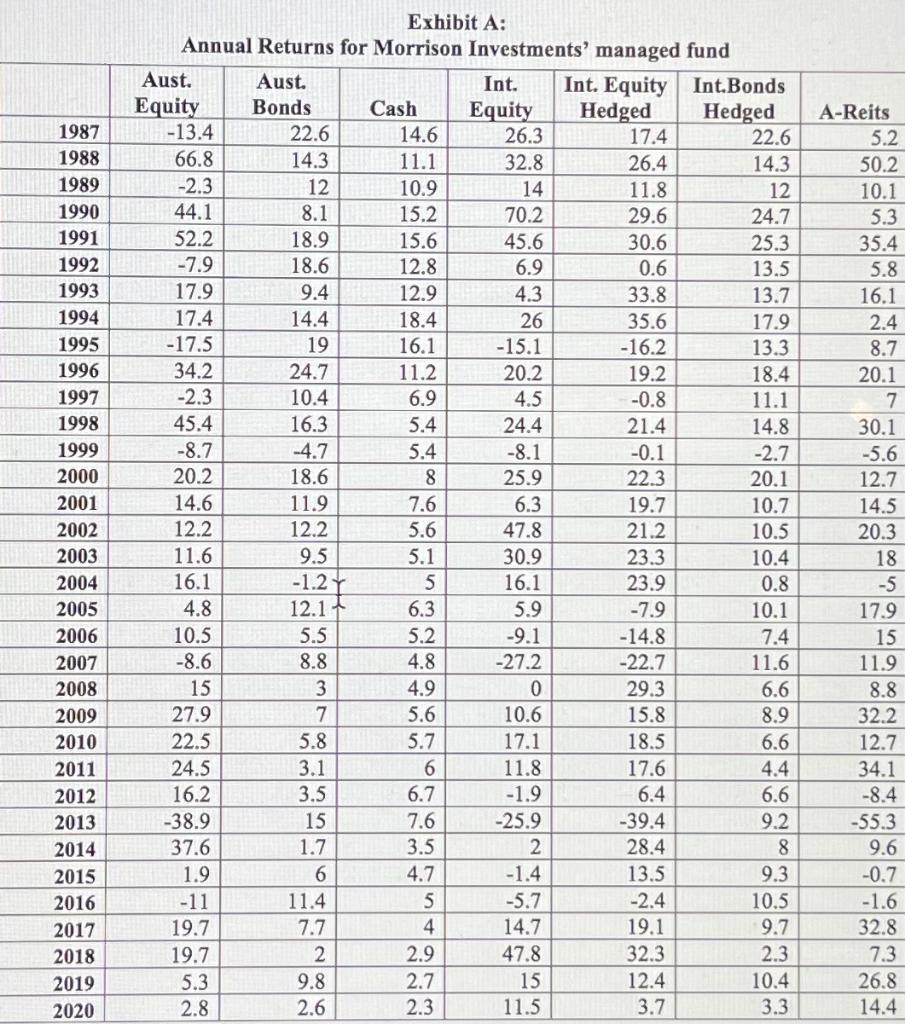

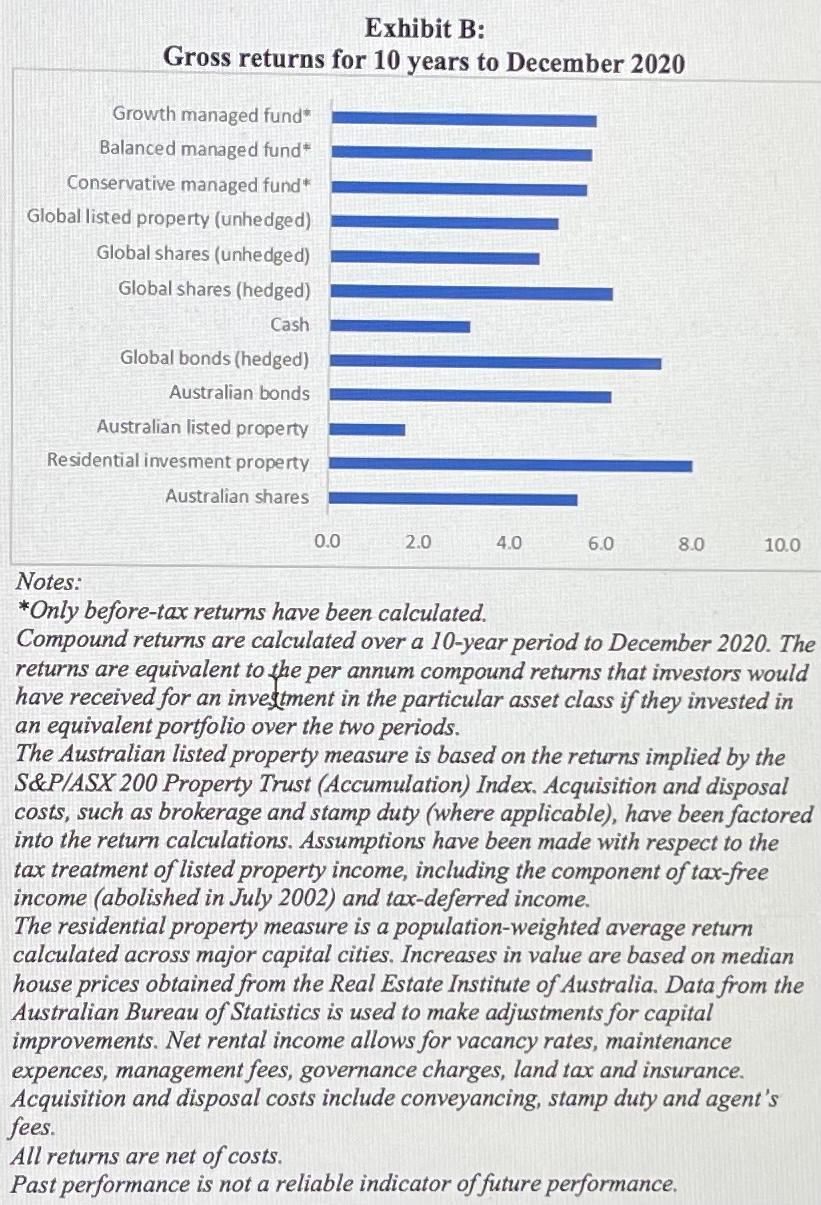

A-Reits 5.2 50.2 10.1 11.1 5.3 5.4 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Exhibit A: Annual Returns for Morrison Investments' managed fund Aust. Aust. Int. Int. Equity Int.Bonds Equity Bonds Cash Equity Hedged Hedged -13.4 22.6 14.6 26.3 17.4 22.6 66.814.3 32.8 26.4 14.3 -2.3 12 10.9 14 11.8 12 44.1 8.1 15.2 70.2 29.6 24.7 52.2 18.9 15.6 45.6 30.6 25.3 -7.9 18.6 12.8 6.9 0.6 13.5 17.9 9.4 12.9 4.3 33.8 13.7 17.4 14.4 18.4 26 35.6 17.9 -17.5 19 16.1 -15.1 -16.2 13.3 34.2 24.7 11.2 20.2 19.2 18.4 -2.3 10.4 6.9 4.5 -0.8 11.1 45.4 16.3 24.4 21.4 14.8 -8.7 -4.7 5.4 -8.1 -0.1 -2.7 20.2 18.6 8 25.9 22.3 20.1 14.6 11.9 7.6 6.3 19.7 10.7 12.2 12.2 5.6 47.8 21.2 10.5 11.6 9.5 5.1 30.9 23.3 10.4 16.1 -1.2 5 16.1 23.9 0.8 4.8 12.1 6.3 5.9 -7.9 10.1 10.5 5.5 5.2 -9.1 -14.8 7.4 -8.6 8.8 4.8 -27.2 -22.7 11.6 15 3 4.9 0 29.3 6.6 27.9 7 5.6 10.6 15.8 8.9 22.5 5.8 5.7 17.1 18.5 6.6 24.5 3.1 6 11.8 17.6 4.4 16.2 3.5 6.7 -1.9 6.4 6.6 -38.9 15 7.6 -25.9 -39.4 37.6 1.7 3.5 2 28.4 8 1.9 6 4.7 -1.4 13.5 9.3 -11 11.4 5 -5.7 -2.4 10.5 19.7 7.7 4 14.7 19.1 9.7 19.7 2 2.9 47.8 32.3 2.3 5.3 9.8 2.7 15 12.4 10.4 2.6 2.3 11.5 3.7 3.3 35.4 5.8 16.1 2.4 8.7 20.1 7 30.1 -5.6 12.7 14.5 20.3 18 -5 179 15 11.9 8.8 32.2 12.7 34.1 -8.4 -55.3 9.6 -0.7 -1.6 32.8 7.3 26.8 14.4 9.2 2.8 Exhibit B: Gross returns for 10 years to December 2020 Growth managed fund* Balanced managed fund Conservative managed fund" Global listed property (unhedged) Global shares (unhedged) Global shares (hedged) Cash Global bonds (hedged) Australian bonds Australian listed property Residential invesment property Australian shares 0.0 2.0 4.0 6.0 8.0 10.0 Notes: *Only before-tax returns have been calculated. Compound returns are calculated over a 10-year period to December 2020. The returns are equivalent to the per annum compound returns that investors would have received for an investment in the particular asset class if they invested in an equivalent portfolio over the two periods. The Australian listed property measure is based on the returns implied by the S&P/ASX 200 Property Trust (Accumulation) Index. Acquisition and disposal costs, such as brokerage and stamp duty (where applicable), have been factored into the return calculations. Assumptions have been made with respect to the tax treatment of listed property income, including the component of tax-free income (abolished in July 2002) and tax-deferred income. The residential property measure is a population-weighted average return calculated across major capital cities. Increases in value are based on median house prices obtained from the Real Estate Institute of Australia. Data from the Australian Bureau of Statistics is used to make adjustments for capital improvements. Net rental income allows for vacancy rates, maintenance expences, management fees, governance charges, land tax and insurance. Acquisition and disposal costs include conveyancing, stamp duty and agent's fees. All returns are net of costs. Past performance is not a reliable indicator of future performance