Question

Your client Bob Smith has been in staffing placement business since 2009. He has operated as C Corporation 2009. The corporation owes payroll taxes including

Your client Bob Smith has been in staffing placement business since 2009. He has operated as C Corporation 2009. The corporation owes payroll taxes including penalties in the amount of $86,000. These payroll taxes belong to years 2010 to 2012. The. The collection division of IRS filed a lien on his bank account and also sent letters to his customers stating that all future payments are made to IRS. The IRS refused to take off levy from bank account and the corporation has payroll due this week ending March 6, 2015. IRS is also demanding tax return turn for 2013 and 2014.The CPA just completed 2013 and 2014 tax returns and corporation owes $125,000 taxes.

Answer the three questions below:

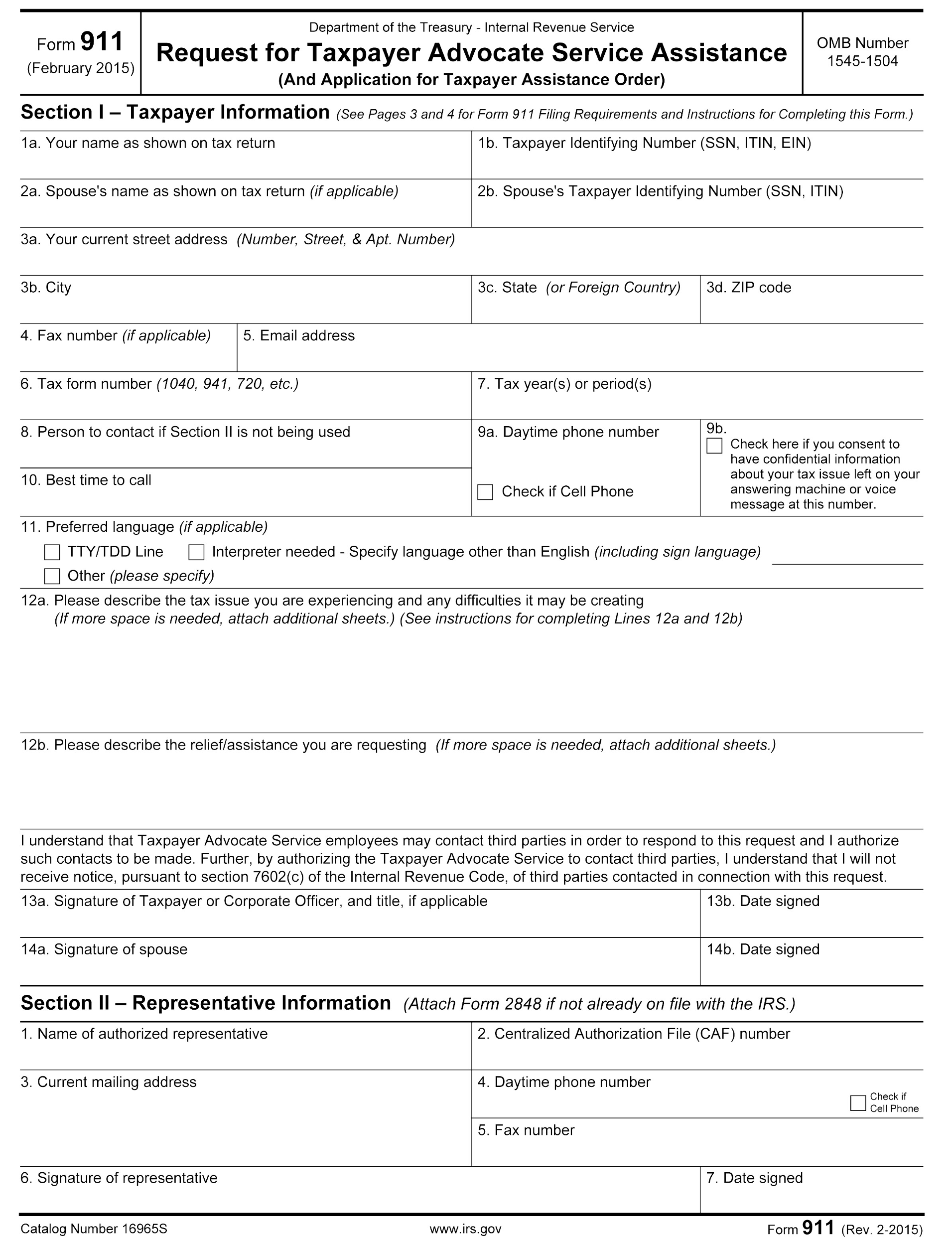

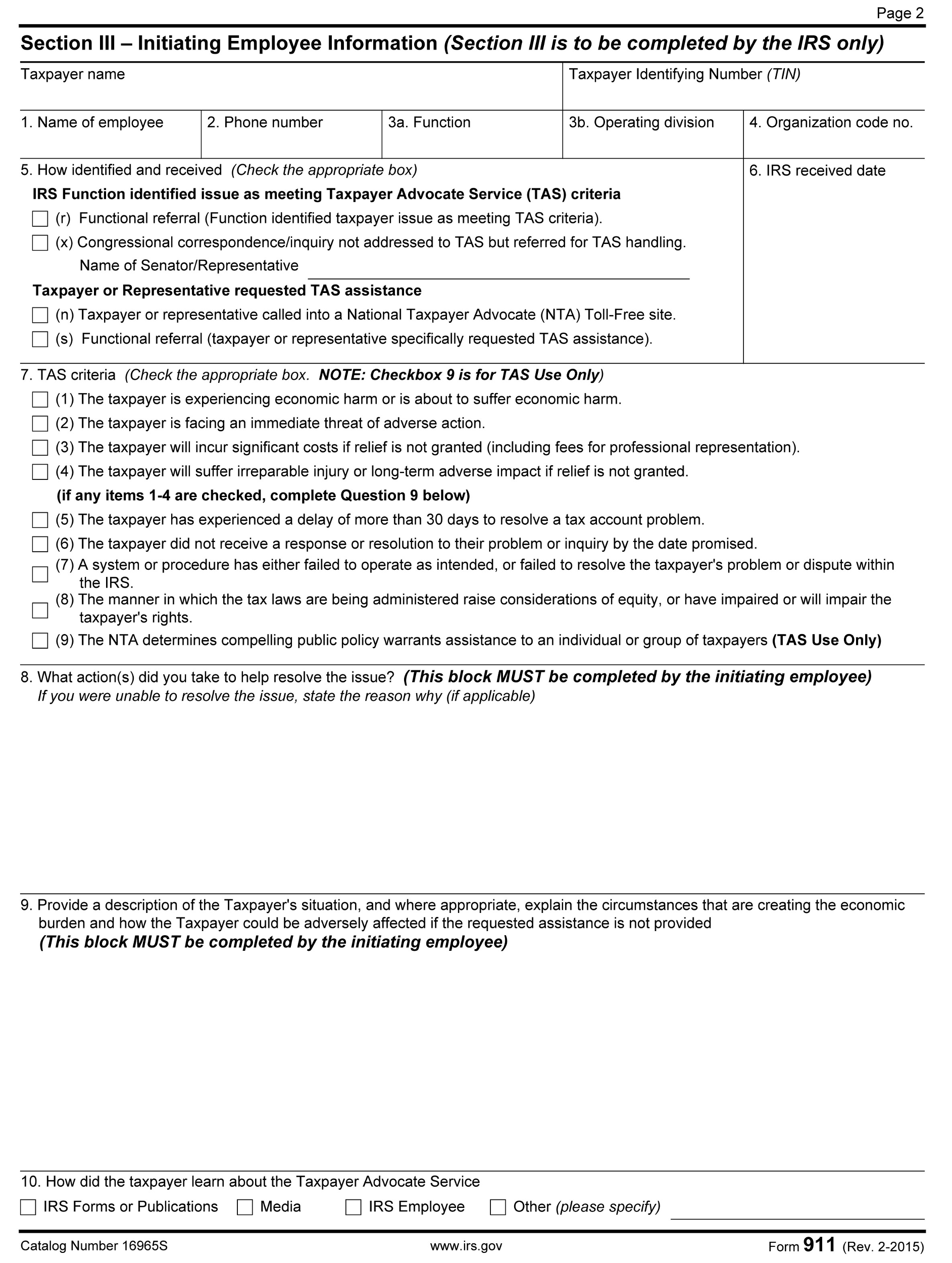

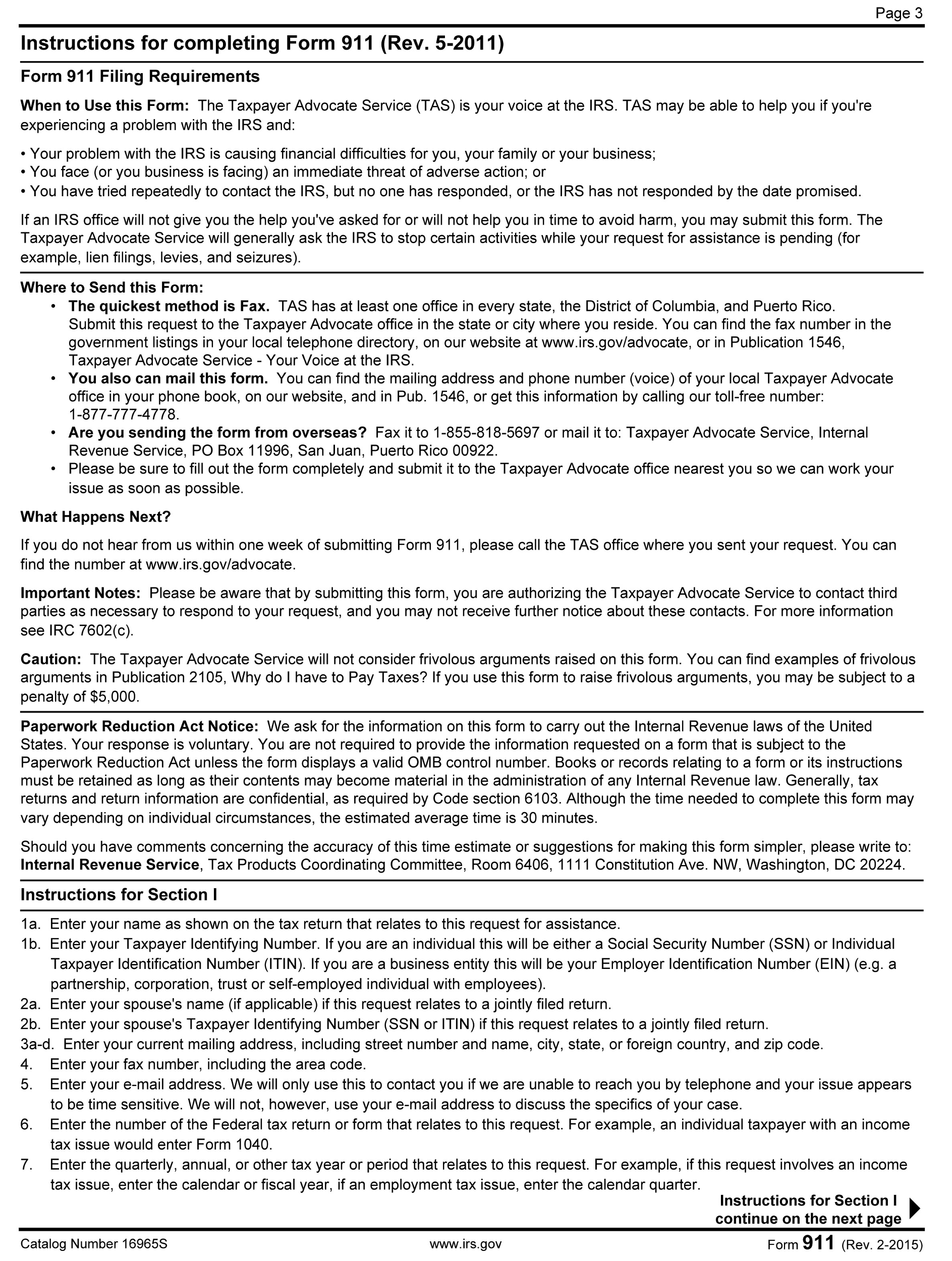

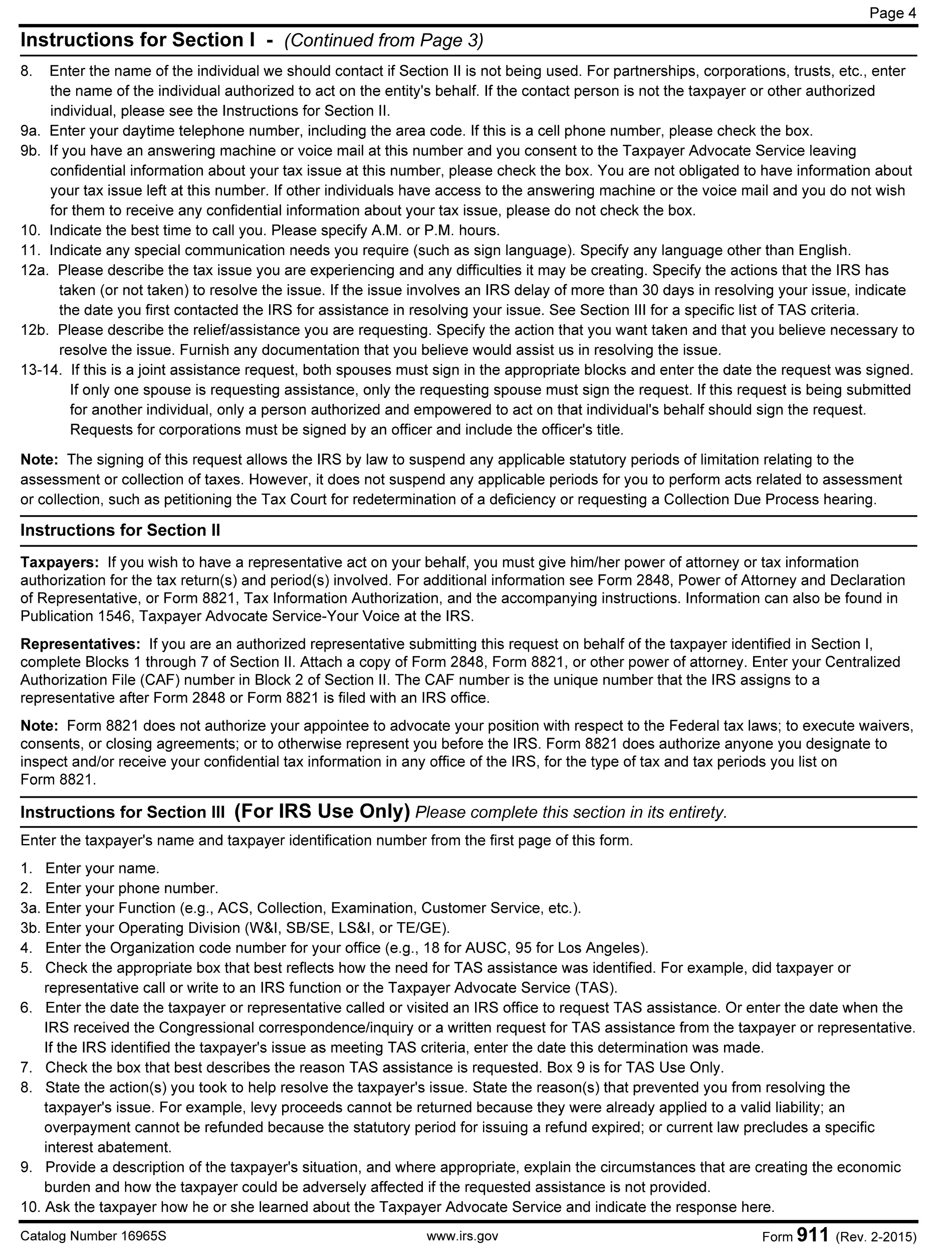

1. Fill up the Form 911 that will be submitted to Taxpayer Advocate Office. Answer the lien and levy problem and the form 911. (https://www.irs.gov/pub/irs-pdf/f911.pdf)

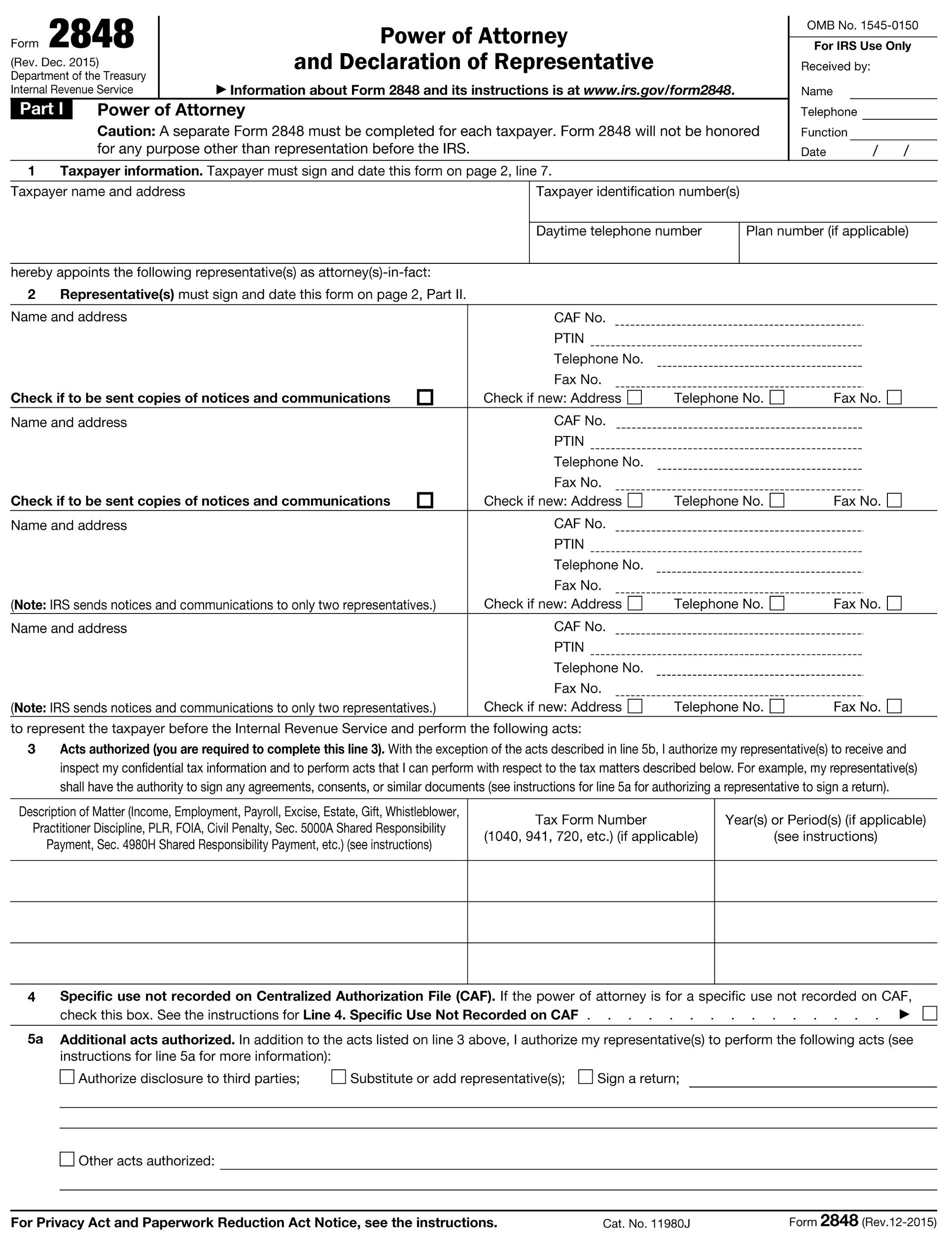

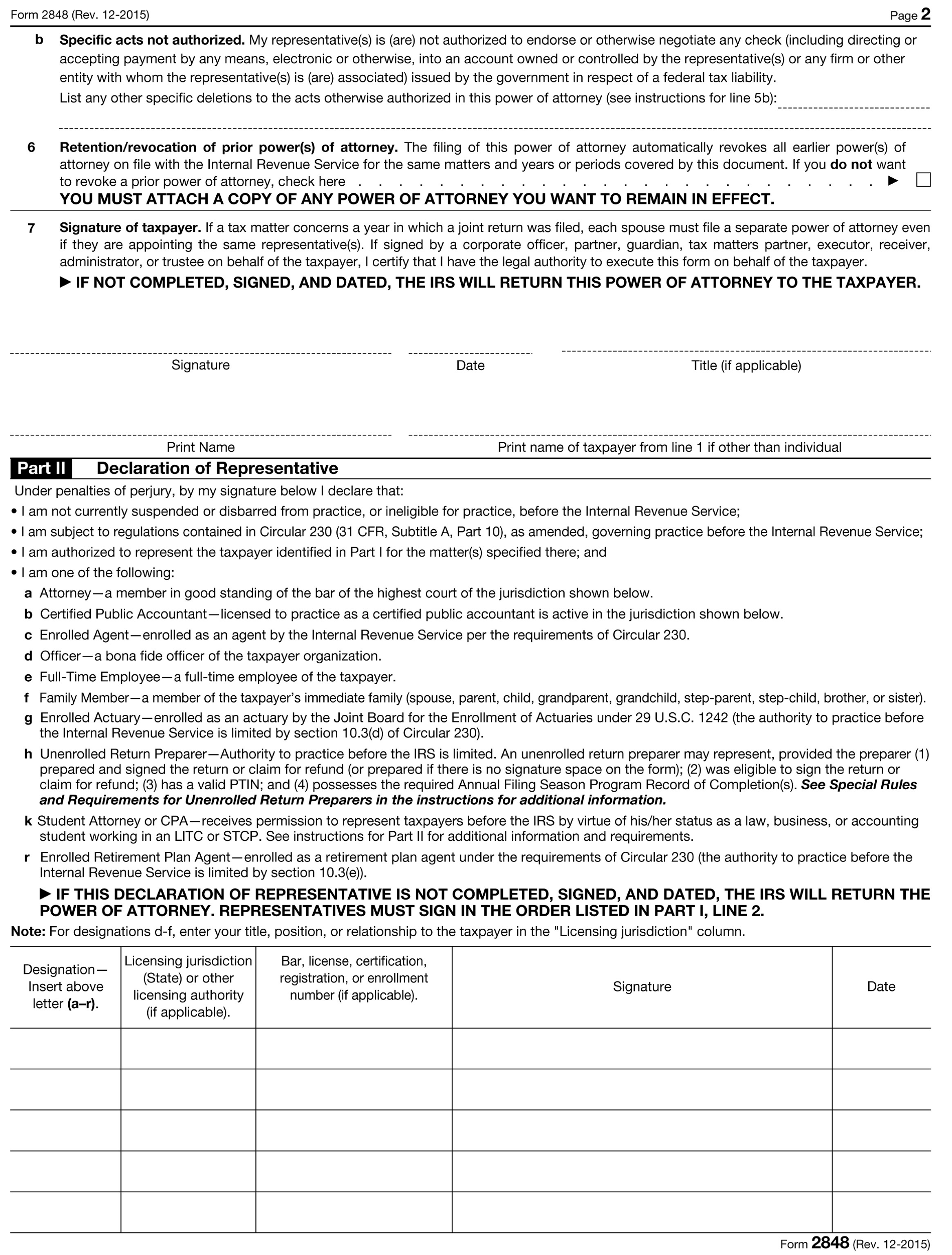

2. Fill up Form 2848 (Power of Attorney and Declaration of Representative). What are the requirements needed to file for bankruptcy? What taxes can you ebated on filing bankruptcy? (Bankruptcy Chapter 7 and Chapter 11) (https://www.irs.gov/pub/irs-pdf/f2848.pdf)

3. How will you handle the payroll tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started