Answered step by step

Verified Expert Solution

Question

1 Approved Answer

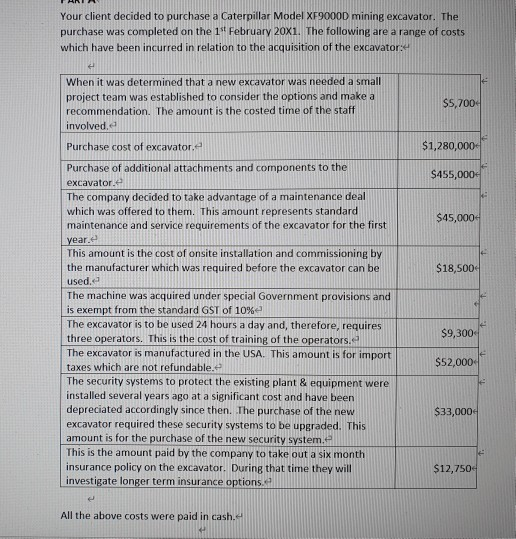

Your client decided to purchase a Caterpillar Model XF9000D mining excavator. The purchase was completed on the 1 February 20x1. The following are a range

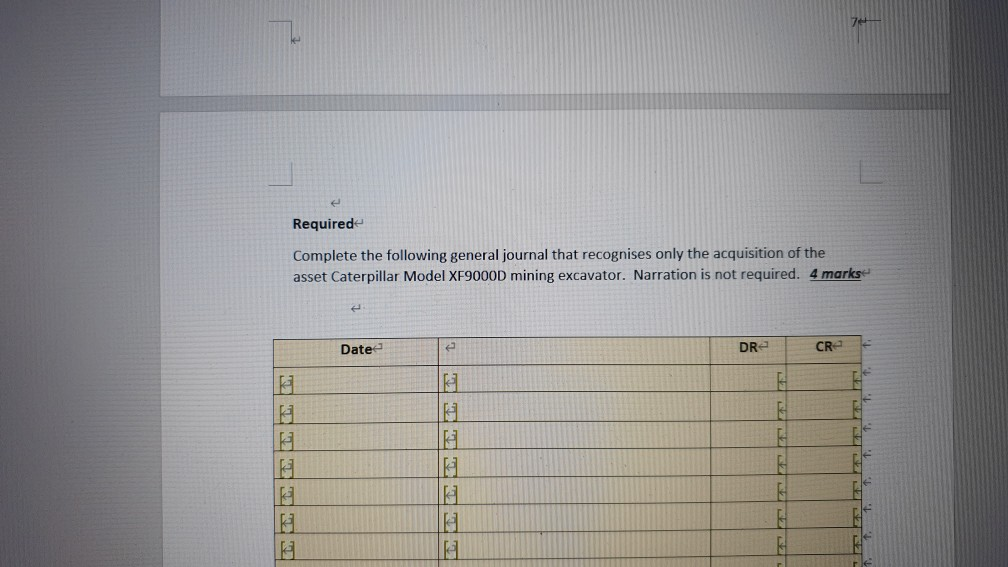

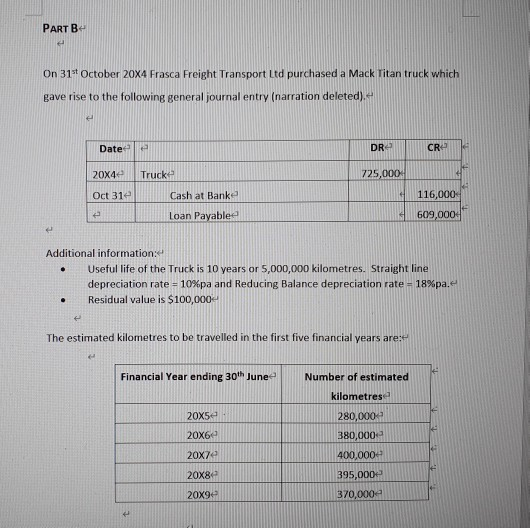

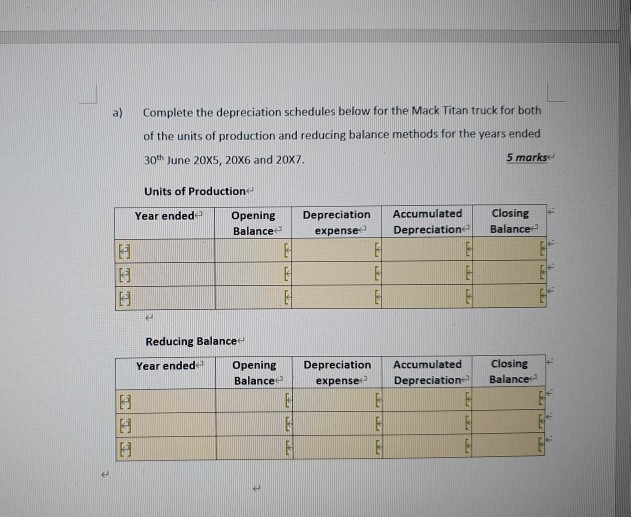

Your client decided to purchase a Caterpillar Model XF9000D mining excavator. The purchase was completed on the 1" February 20x1. The following are a range of costs which have been incurred in relation to the acquisition of the excavatore When it was determined that a new excavator was needed a small project team was established to consider the options and make a recommendation. The amount is the costed time of the staff involved. $5,7004 Purchase cost of excavator $1,280,000 $455,000 $45,000 $18,500 Purchase of additional attachments and components to the excavator. The company decided to take advantage of a maintenance deal which was offered to them. This amount represents standard maintenance and service requirements of the excavator for the first year. This amount is the cost of onsite installation and commissioning by the manufacturer which was required before the excavator can be used, The machine was acquired under special Government provisions and is exempt from the standard GST of 10%- The excavator is to be used 24 hours a day and, therefore, requires three operators. This is the cost of training of the operators. The excavator is manufactured in the USA. This amount is for import taxes which are not refundable. The security systems to protect the existing plant & equipment were installed several years ago at a significant cost and have been depreciated accordingly since then. The purchase of the new excavator required these security systems to be upgraded. This amount is for the purchase of the new security system. This is the amount paid by the company to take out a six month insurance policy on the excavator. During that time they will investigate longer term insurance options. $9,300 $52,000 $33,000 $12,7504 All the above costs were paid in cash. Requirede Complete the following general journal that recognises only the acquisition of the asset Caterpillar Model XF9000D mining excavator. Narration is not required. 4 marks Date DR CR T il PART B On 31st October 20X4 Frasca Freight Transport Ltd purchased a Mack Titan truck which gave rise to the following general journal entry (narration deleted).- Date DR CR 20X4 Truck 725,000 Oct 31 Cash at Banka 116,000 609,000 Loan Payabled Additional information: Useful life of the Truck is 10 years or 5,000,000 kilometres. Straight line depreciation rate = 10%pa and Reducing Balance depreciation rate = 18%pa. Residual value is $100,000 . The estimated kilometres to be travelled in the first five financial years are:- Financial Year ending 30th June Number of estimated kilometres 20x52 280,000 20X6 380,000 20x7e 400,000 20x8 395,000 370,000 20x9 Complete the depreciation schedules below for the Mack Titan truck for both of the units of production and reducing balance methods for the years ended 30th June 20x5, 20x6 and 20x7. 5 marks Units of Production Year ended Opening Balance Depreciation expense Accumulated Depreciation Closing Balance k H BE Reducing Balance Year ended Opening Balance Depreciation expense Accumulated Depreciation Closing Balance GE H I) In addition to the units of production and the reducing balance methods of depreciation there is also the straight line method. Describe what the effects of each method are on depreciation expense and how the company decides on which of the three methods to adopt? 4 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started