Question

Your client is closely following a publicly listed Australian company, however your client does not have the requisite skills to evaluate the company and, as

Your client is closely following a publicly listed Australian company, however your client does not have the requisite skills to evaluate the company and, as such, has provided you with the following information. Your client indicates that the company is closely integrated with the Australian economy and that he is happy for you to use the rates of return for the Australian economy as a whole in the evaluation process. You have researched the following returns and other characteristics for this company:

Australian Treasury bills currently pay a return of 3% p.a.

Australian stock market return over the same period has averaged 8% p.a.

Australian stock market standard deviation of returns is 13% p.a.

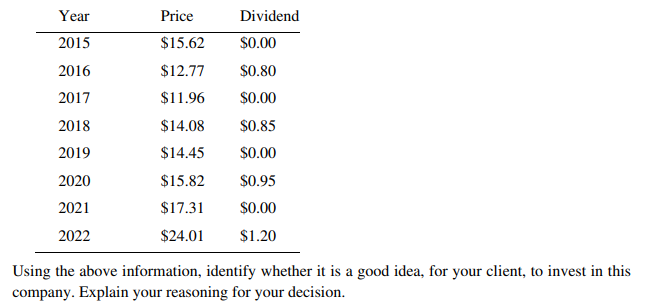

This company's beta is estimated at 1.10. ? Historical returns and dividends (below).

Year Price Dividend 2015 $15.62 $0.00 2016 $12.77 $0.80 2017 $11.96 $0.00 2018 $14.08 $0.85 2019 $14.45 $0.00 2020 $15.82 $0.95 2021 $17.31 $0.00 2022 $24.01 $1.20 Using the above information, identify whether it is a good idea, for your client, to invest in this company. Explain your reasoning for your decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started