Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your client is considering to invest $6,000 in your risky portfolio below, that includes 50% of stock X and 50% of stock Y. Stock

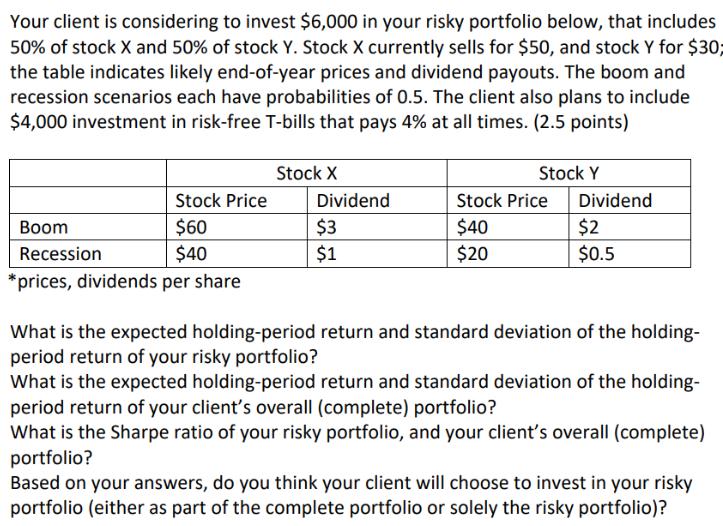

Your client is considering to invest $6,000 in your risky portfolio below, that includes 50% of stock X and 50% of stock Y. Stock X currently sells for $50, and stock Y for $30; the table indicates likely end-of-year prices and dividend payouts. The boom and recession scenarios each have probabilities of 0.5. The client also plans to include $4,000 investment in risk-free T-bills that pays 4% at all times. (2.5 points) Stock Price Boom $60 Recession $40 *prices, dividends per share Stock X Dividend $3 $1 Stock Y Stock Price $40 $20 Dividend $2 $0.5 What is the expected holding-period return and standard deviation of the holding- period return of your risky portfolio? What is the expected holding-period return and standard deviation of the holding- period return of your client's overall (complete) portfolio? What is the Sharpe ratio of your risky portfolio, and your client's overall (complete) portfolio? Based on your answers, do you think your client will choose to invest in your risky portfolio (either as part of the complete portfolio or solely the risky portfolio)?

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected holdingperiod return and standard deviation of the holdingperiod return for the risky portfolio we need to consider the probabilities of the boom and recession scenarios Risk...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started