Question

Your client is considering two alternate investments - one a perpetuity and the other an annuity. The perpetuity pays $1000 in perpetuity from the

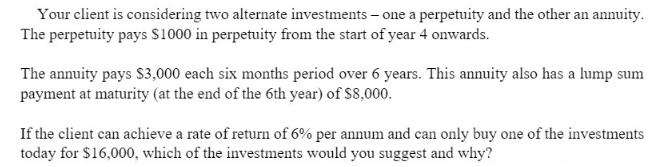

Your client is considering two alternate investments - one a perpetuity and the other an annuity. The perpetuity pays $1000 in perpetuity from the start of year 4 onwards. The annuity pays $3,000 each six months period over 6 years. This annuity also has a lump sum payment at maturity (at the end of the 6th year) of $8,000. If the client can achieve a rate of return of 6% per annum and can only buy one of the investments today for $16,000, which of the investments would you suggest and why?

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the present value of each investment using the given rate of return of 6 per annum Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Mathematics In Canada

Authors: Ernest Jerome

7th edition

978-0071091411, 71091416, 978-0070009899

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App