- Your client is shocked at how much risk Blandy stock has and would like to reduce the level of risk. You suggest that the client sell 25% of the Blandy stock and create a portfolio with 75% Blandy stock and 25% in the high risk Gourmange stock. How do you suppose the client will react to replacing some of the Blandy stock with high risk stock? Show the client what the proposed portfolio return would have been in each of year of the sample. Then calculate the average return and standard deviation using the portfolio's annual returns. How does the risk of this two-stock portfolio compare with the risk of the individual stocks if they were held in isolation?

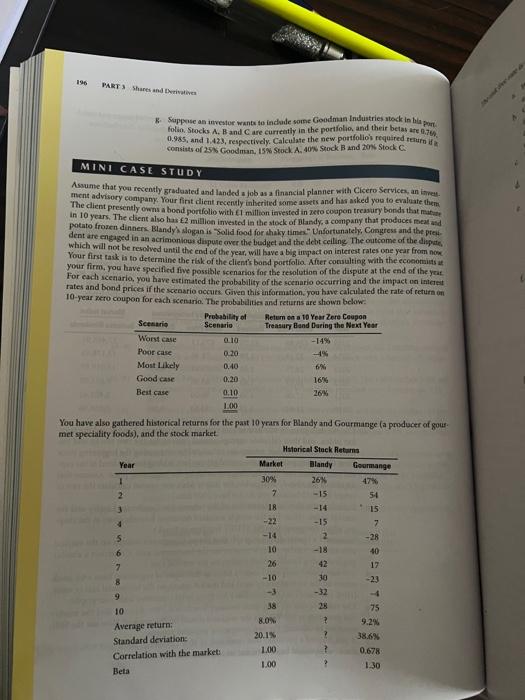

folio. Stocks A. B and C are curreatiy in the portiolio, and their betas ate n.7Ge. 0.985, and 1.423, respectively. Calculate the new portiolio's required terufn if as consists of 25 b Coodman. 15\% Seock A. 40N stock B and 20ns Stock C. MINI CASE STU DY Assume that you reciently gradaated and landed a job as a financial planner with Clcero Services, an ianea. ment advisory company, Your firit dient recervly inherited some assets and has asked you to evaluate them. The client presently omns a boad portfolio with f milion izvested in zeto cocapon treasury bonds that nacte4 in 10 years. The dient also has E2 million imveated in the stock of Blandy, a company that produces reat asd potato fropen dinners. Blandy's slogan is "solid food for thaky times. " Unfortunately, Coasgress and the preifdent are engaged in an acrianonious dispule over the budyet and the debt celling. The ontcome of the dispite, which will not be resolved until the end of the year, will have a big incyact on interest rates one year fram nox. Your first fask is to determine the riak of the client's basd potfolio After consulting with the ecoeotsuiss at your firm, you have specified five possible scenarios for the resolution of the dispure at the end of theyeat. For cach scenario, you have estimated the probabulity of the scenario occurring and the intepact ve interet rates and bond prices if the scenario occues. Given this tnformation. you have calculated the rate of return on 10-year nero coupon for each scentrio. The probabulites and returns are shown below: You have also gathered historical returns for the past 10 yrass for Blandy and Gourmange (a poyducer of gous. met spectalify foods), and the stock market. folio. Stocks A. B and C are curreatiy in the portiolio, and their betas ate n.7Ge. 0.985, and 1.423, respectively. Calculate the new portiolio's required terufn if as consists of 25 b Coodman. 15\% Seock A. 40N stock B and 20ns Stock C. MINI CASE STU DY Assume that you reciently gradaated and landed a job as a financial planner with Clcero Services, an ianea. ment advisory company, Your firit dient recervly inherited some assets and has asked you to evaluate them. The client presently omns a boad portfolio with f milion izvested in zeto cocapon treasury bonds that nacte4 in 10 years. The dient also has E2 million imveated in the stock of Blandy, a company that produces reat asd potato fropen dinners. Blandy's slogan is "solid food for thaky times. " Unfortunately, Coasgress and the preifdent are engaged in an acrianonious dispule over the budyet and the debt celling. The ontcome of the dispite, which will not be resolved until the end of the year, will have a big incyact on interest rates one year fram nox. Your first fask is to determine the riak of the client's basd potfolio After consulting with the ecoeotsuiss at your firm, you have specified five possible scenarios for the resolution of the dispure at the end of theyeat. For cach scenario, you have estimated the probabulity of the scenario occurring and the intepact ve interet rates and bond prices if the scenario occues. Given this tnformation. you have calculated the rate of return on 10-year nero coupon for each scentrio. The probabulites and returns are shown below: You have also gathered historical returns for the past 10 yrass for Blandy and Gourmange (a poyducer of gous. met spectalify foods), and the stock market