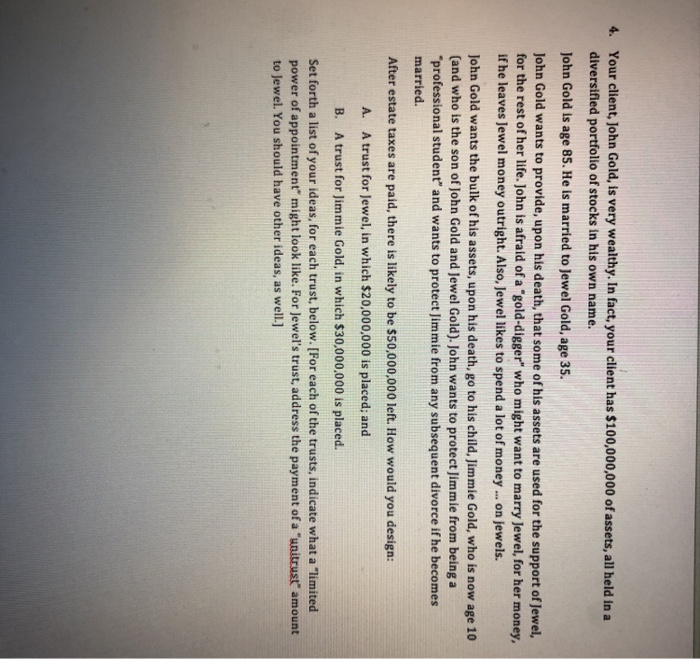

Your client, John Gold, is very wealthy. In fact, your client has $100,000,000 of assets, all held in a diversified portfolio of stocks in his own name. 4. John Gold is age 85. He is married to Jewel Gold, age 35. John Gold wants to provide, upon his death, that some of his assets are used for the support of Jewel, for the rest of her life. John is afraid of a "gold-digger" who might want to marry Jewel, for her money, if he leaves Jewel money outright. Also, Jewel likes to spend a lot of money... on jewels. John Gold wants the bulk of his assets, upon his death, go to his child, Jimmie Gold, who is now age 10 (and who is the son of John Gold and Jewel Gold). John wants to protect Jimmie from being a professional student" and wants to protect Jimmie from any subsequent divorce if he becomes married. After estate taxes are paid, there is likely to be $50,000,000 left. How would you design: A. A trust for Jewel, in which $20,000,000 is placed; and B. A trust for Jimmie Gold, in which $30,000,000 is placed. Set forth a list of your ideas, for each trust, below. [For each of the trusts, indicate what a "limited power of appointment" might look like. For Jewel's trust, address the payment of a "unitrust amount to Jewel. You should have other ideas, as well.] Your client, John Gold, is very wealthy. In fact, your client has $100,000,000 of assets, all held in a diversified portfolio of stocks in his own name. 4. John Gold is age 85. He is married to Jewel Gold, age 35. John Gold wants to provide, upon his death, that some of his assets are used for the support of Jewel, for the rest of her life. John is afraid of a "gold-digger" who might want to marry Jewel, for her money, if he leaves Jewel money outright. Also, Jewel likes to spend a lot of money... on jewels. John Gold wants the bulk of his assets, upon his death, go to his child, Jimmie Gold, who is now age 10 (and who is the son of John Gold and Jewel Gold). John wants to protect Jimmie from being a professional student" and wants to protect Jimmie from any subsequent divorce if he becomes married. After estate taxes are paid, there is likely to be $50,000,000 left. How would you design: A. A trust for Jewel, in which $20,000,000 is placed; and B. A trust for Jimmie Gold, in which $30,000,000 is placed. Set forth a list of your ideas, for each trust, below. [For each of the trusts, indicate what a "limited power of appointment" might look like. For Jewel's trust, address the payment of a "unitrust amount to Jewel. You should have other ideas, as well.]