Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your client sells his duplex for $ 420,000. He occupies the ground floor and receives a rent of $ 900 on the 1st of each

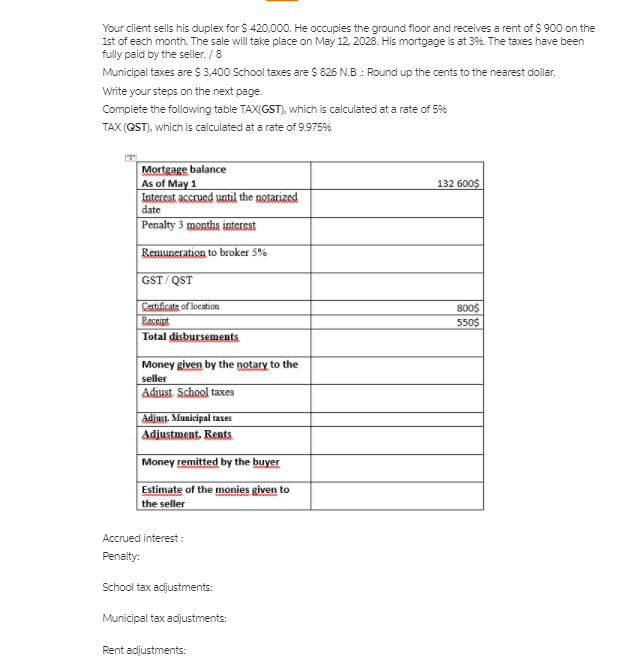

Your client sells his duplex for $ 420,000. He occupies the ground floor and receives a rent of $ 900 on the 1st of each month. The sale will take place on May 12, 2028. His mortgage is at 396. The taxes have been fully paid by the seller. / 8 Municipal taxes are $ 3,400 School taxes are $ 826 N.B.: Round up the cents to the nearest dollar. Write your steps on the next page. Complete the following table TAX(GST), which is calculated at a rate of 5% TAX (QST), which is calculated at a rate of 9.97596 132 600$ Mortgage balance As of May 1 Interest accrued until the notarized date Penalty 3 months interest Remuneration to broker 5% GST/QST 800$ 550$ Certificate of location Receipt Total disbursements Money given by the notary to the seller Adiust School taxes Adjust. Municipal taxes Adiustment. Rents Money remitted by the buyer Estimate of the monies given to the seller Accrued interest: Penalty: School tax adjustments: Municipal tax adjustments: Rent adjustments: Your client sells his duplex for $ 420,000. He occupies the ground floor and receives a rent of $ 900 on the 1st of each month. The sale will take place on May 12, 2028. His mortgage is at 396. The taxes have been fully paid by the seller. / 8 Municipal taxes are $ 3,400 School taxes are $ 826 N.B.: Round up the cents to the nearest dollar. Write your steps on the next page. Complete the following table TAX(GST), which is calculated at a rate of 5% TAX (QST), which is calculated at a rate of 9.97596 132 600$ Mortgage balance As of May 1 Interest accrued until the notarized date Penalty 3 months interest Remuneration to broker 5% GST/QST 800$ 550$ Certificate of location Receipt Total disbursements Money given by the notary to the seller Adiust School taxes Adjust. Municipal taxes Adiustment. Rents Money remitted by the buyer Estimate of the monies given to the seller Accrued interest: Penalty: School tax adjustments: Municipal tax adjustments: Rent adjustments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started