Answered step by step

Verified Expert Solution

Question

1 Approved Answer

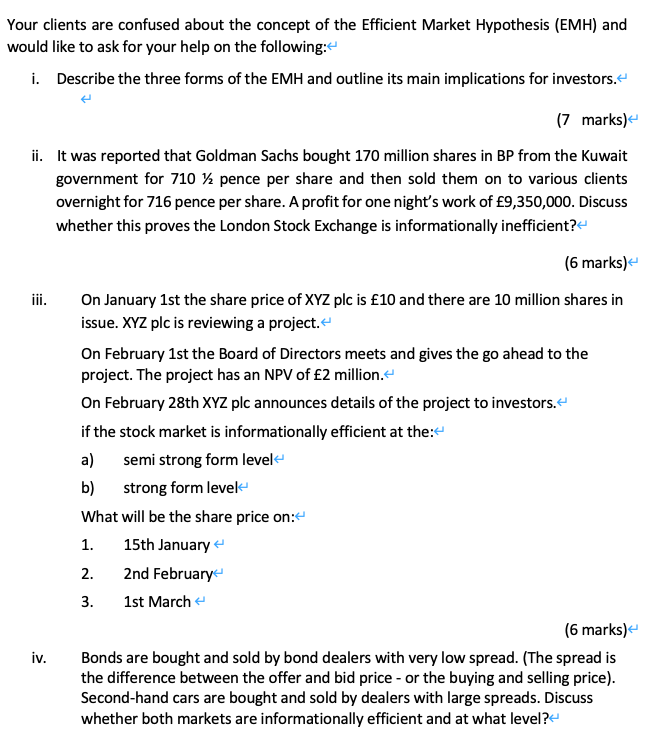

Your clients are confused about the concept of the Efficient Market Hypothesis (EMH) and would like to ask for your help on the following:

Your clients are confused about the concept of the Efficient Market Hypothesis (EMH) and would like to ask for your help on the following: i. Describe the three forms of the EMH and outline its main implications for investors. < (7 marks) < ii. It was reported that Goldman Sachs bought 170 million shares in BP from the Kuwait government for 710 % pence per share and then sold them on to various clients overnight for 716 pence per share. A profit for one night's work of 9,350,000. Discuss whether this proves the London Stock Exchange is informationally inefficient? < iii. iv. (6 marks) < On January 1st the share price of XYZ plc is 10 and there are 10 million shares in issue. XYZ plc is reviewing a project. < On February 1st the Board of Directors meets and gives the go ahead to the project. The project has an NPV of 2 million. < On February 28th XYZ plc announces details of the project to investors. < if the stock market is informationally efficient at the: < a) semi strong form level b) strong form level What will be the share price on: < 1. 15th January 2. 3. 2nd February 1st March (6 marks) < Bonds are bought and sold by bond dealers with very low spread. (The spread is the difference between the offer and bid price - or the buying and selling price). Second-hand cars are bought and sold by dealers with large spreads. Discuss whether both markets are informationally efficient and at what level? Your clients are confused about the concept of the Efficient Market Hypothesis (EMH) and would like to ask for your help on the following: i. Describe the three forms of the EMH and outline its main implications for investors. < (7 marks) < ii. It was reported that Goldman Sachs bought 170 million shares in BP from the Kuwait government for 710 pence per share and then sold them on to various clients overnight for 716 pence per share. A profit for one night's work of 9,350,000. Discuss whether this proves the London Stock Exchange is informationally inefficient? < iii. iv. (6 marks) < On January 1st the share price of XYZ plc is 10 and there are 10 million shares in issue. XYZ plc is reviewing a project. < On February 1st the Board of Directors meets and gives the go ahead to the project. The project has an NPV of 2 million. < On February 28th XYZ plc announces details of the project to investors. < if the stock market is informationally efficient at the: < a) semi strong form level b) strong form level What will be the share price on: < 1. 15th January 2. 3. 2nd February 1st March (6 marks) < Bonds are bought and sold by bond dealers with very low spread. (The spread is the difference between the offer and bid price - or the buying and selling price). Second-hand cars are bought and sold by dealers with large spreads. Discuss whether both markets are informationally efficient and at what level?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Efficient Market Hypothesis Explained for Your Clients i Three forms of the EMH and implications for investors a Weak form Prices reflect all historic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started