Question

Your company applies a discount rate of 7.5% to all projects. Assuming you are the financial investor of the company, fulfil the following duties: a.

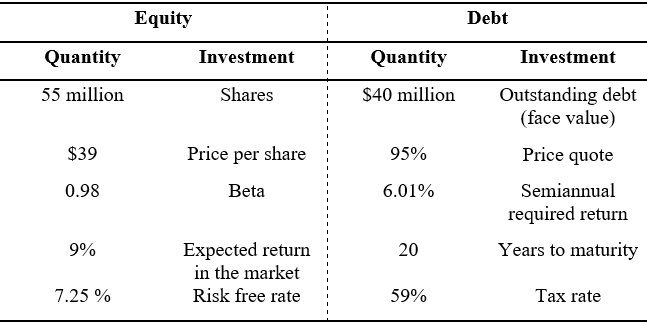

Your company applies a discount rate of 7.5% to all projects. Assuming you are the financial investor of the company, fulfil the following duties: a. Find new lines of investment. Two investments are proposed: Project C with an initial outlay of $50,000 and future inlays of $20,000 for the next five years; and Project D with an initial outlay of $300,000 and inlays of $130,000 for the next three years. Both are mutually exclusive. Present your investment decision to the board of directors of your company justifying why your decision wouldnt be the same if both projects would be non-mutually exclusive. b. Establish an evaluation criterion for future business opportunities considering the capital structure of your company (summarised in the table below).  c. Determine the convenience of the following projects given the previous determined criterion: a mineral company estimated to have an IRR of 11%; a famous hot pot soup producer with an estimated IRR of 10%; a crypto-investment company with an IRR of 7%. Present your results based on the information of the projects provided.

c. Determine the convenience of the following projects given the previous determined criterion: a mineral company estimated to have an IRR of 11%; a famous hot pot soup producer with an estimated IRR of 10%; a crypto-investment company with an IRR of 7%. Present your results based on the information of the projects provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started