Answered step by step

Verified Expert Solution

Question

1 Approved Answer

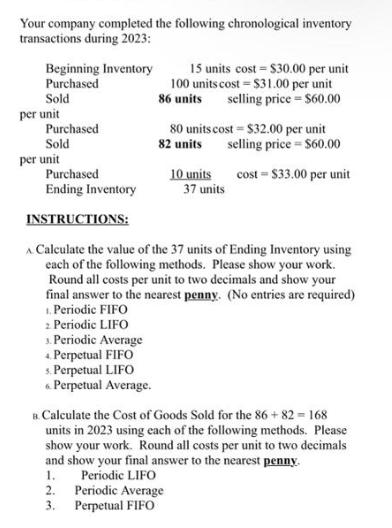

Your company completed the following chronological inventory transactions during 2023: Beginning Inventory Purchased Sold per unit Purchased Sold per unit Purchased Ending Inventory INSTRUCTIONS:

Your company completed the following chronological inventory transactions during 2023: Beginning Inventory Purchased Sold per unit Purchased Sold per unit Purchased Ending Inventory INSTRUCTIONS: 3. Periodic Average + Perpetual FIFO s. Perpetual LIFO Perpetual Average. 15 units cost = $30.00 per unit 100 units cost = $31.00 per unit units selling price = $60.00 86 80 units cost = $32.00 per unit 82 units selling price = $60.00 cost-$33.00 per unit 2. 3. A Calculate the value of the 37 units of Ending Inventory using each of the following methods. Please show your work. Round all costs per unit to two decimals and show your final answer to the nearest penny. (No entries are required) 1. Periodic FIFO 2. Periodic LIFO 10 units 37 units B. Calculate the Cost of Goods Sold for the 86 +82-168 units in 2023 using each of the following methods. Please show your work. Round all costs per unit to two decimals and show your final answer to the nearest penny. 1. Periodic LIFO Periodic Average Perpetual FIFO

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the 37 units of Ending Inventory using each method well need to track the inventory transactions and apply the respective costing methods Lets go through each method 1 Period...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started