Question

Your company, Deep Rock Mining LLC, is considering an expansion of operations into iron ore mining. Your engineers have just completed a 6-month survey designed

Your company, Deep Rock Mining LLC, is considering an expansion of operations into iron ore mining. Your engineers have just completed a 6-month survey designed to determine whether or not a viable mining operation can be mounted on a particular piece of land. This survey cost $500,000 to complete. The results of the survey, along with several other pieces of information, are detailed below:

Survey Results:

Your engineers estimate that there are 650,000-700,000 tons of recoverable iron ore underneath this land.

Investment in CapEx:

-If you choose to move forward with the project, you will need to invest in several new pieces of mining equipment. The cost of this new equipment is $10,000,000.

-This equipment will need to be manufactured to your specific needs. Design and construction of this equipment will take one year. Payment is due upon delivery of the new equipment to your site at the end of this year

-Once the equipment is built, it will need to be transported and installed onsite at an additional cost of $1,500,000.

-An additional $500,000 will need to be spent to prepare the site itself for the installation of the new equipment. This includes grading the land, running electrical and water lines, ensuring proper drainage, and making sure all environmental requirements are followed.

Operations:

-After the equipment has been installed onsite at the end of Year 1, mining operations will commence in Year 2. Your team estimates you can produce 125,000 tons of ore in the first year of mining operations.

-The amount of ore produced will remain constant for the first four years of operations at 125,000 tons per year

-Beginning with the 5th year of mining operations, as the easier-to-access ore becomes more scarce, your team estimates that the amount of ore produced will begin to decrease by 60% per year, relative to the year prior. This will continue for three years

-After the 7th year of mining operations, it is estimated that the mine will no longer be viable and will be shut down.

Accounting Assumptions:

-For the purposes of this analysis, the price of ore is assumed to remain constant for the life of the project. Iron ore currently sells for $125/ton.

-The operating costs to extract the ore are estimated to be $70 per ton for the life of the project.

-In addition to the variable operating costs just outlined, there will be additional fixed costs of $750,000 each year the active mining operations are taking place if you move forward with this project.

-The investment in equipment and any appropriate associated costs will be depreciated straight-line over 7 years, to an assumed salvage value of zero for accounting purposes.

-Despite the depreciation assumptions stated earlier, you expect that, at the end of the projects life, you will be able to sell the equipment involved in the project for $2,000,000

-During the first year of the project, while the mining equipment is being built, the project will require an additional investment in net working capital of $1,000,000. This level of working capital will remain constant for the life of the project. At the end of the projects life, the full amount of this working capital will be recovered (reduced to $0)

-The tax rate is assumed to be 30%. Your firms cost of capital is 14%

-All revenues and expenses will be accounted for and recognized at the end of the period in which they take place.

ANSWER THE FOLLOWING QUESTION

1. Forecast the incremental free cash flows that will result from an investment in this project.

2. Based upon the cash flows calculated in question 1, what is the NPV of this project?

3. A significant source of uncertainty in this project lies in the base case assumptions made surrounding the prevailing price of iron ore, assumed to be $125/ton, and the costs of production, assumed to be $70/ton. Perform the following sensitivity analysis to give your board a better sense of just how much margin for error there is in this project.

a. Holding all other assumptions constant, what is the NPV break-even price of iron ore for this project.? Put another way, what price of iron ore must be realized throughout the life of this project to result in an NPV of zero?

b. Holding all other assumptions constant, what is the NPV break-even level of production costs?

4. Your HSSE Director (Health, Safety, Security, & Environment) informs you that there will likely be ongoing costs associated with maintaining the decommissioned mine once operations cease. It is estimated that these costs will reduce your firms pretax income by $500,000 per year and will last forever. If these costs begin in the year immediately after the termination of operations, what is your adjusted NPV calculation for this project?

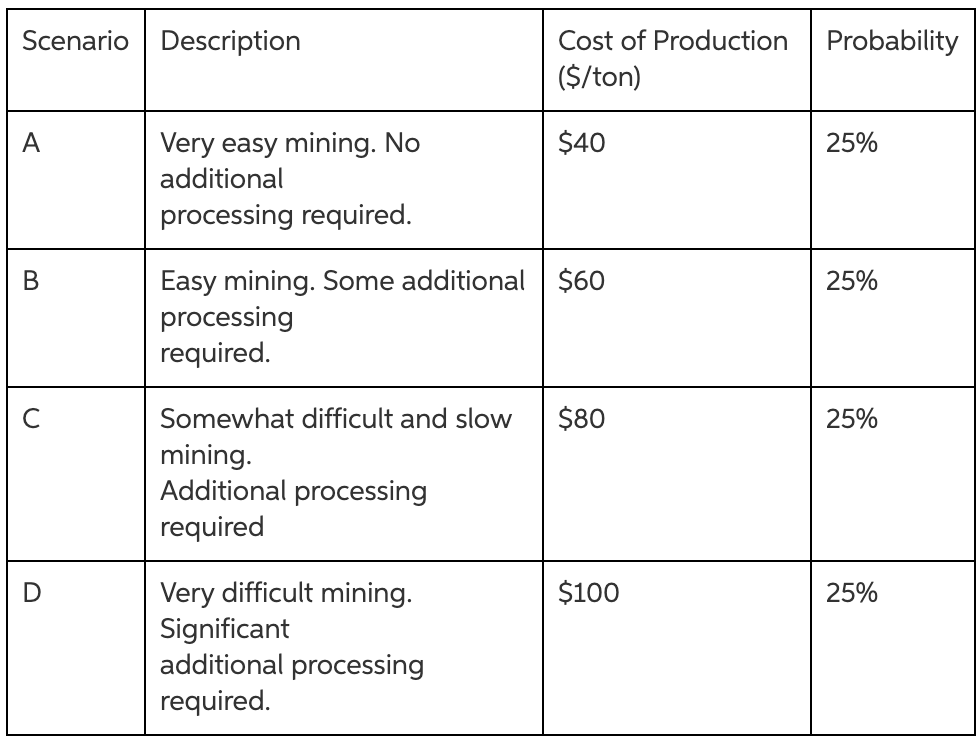

5. As previously stated, one of the more significant sources of uncertainty in this project lies in the variable cost of production. Though you have a sense of how difficult and expensive the mining operation will be as a result of your geological survey, past experience tells you that you really wont know until you begin operations. Your base case assumption of variable production costs of $70/ton is the result of several different scenarios identified by one of your analysts, along with some associated probabilities. These scenarios are:

At the end of the first year of production, you will have a much better sense of what production costs will be for this mine. You are going to assume that whatever variable production costs are realized over the course of the first year of operations will remain constant for the remaining 6 years of operations. In other words, after the first year of operations, you will know for certain which of the above scenarios has come to fruition.

Always one to look ahead and leave your options open, you have purchased what amounts to a put contract for this mine that expires at the end of Year 2. This contract gives you the right, but not the obligation, to sell the mine for $7,500,000 and simply walk away at the end of Year 2. Selling the mine in this manner would also transfer ownership of any and all equipment onsite. It would also transfer the legal obligation and cost of maintaining the mine post-shutdown to the new owner. (For the purposes of this case study, you may assume that the $7,500,000 selling price is an after-tax amount.)

You secured this option because you knew how much uncertainty there is in mining and that there may be a chance that skyrocketing production costs may make the operation uneconomical.

Given the existence of this option to abandon the project, recalculate the projects T=0 NPV, using your base case price/cost assumptions, as well as the additional HSSE maintenance costs outlined in question 4.

Scenario Description Probability Cost of Production ($/ton) A $40 25% Very easy mining. No additional processing required. B 25% Easy mining. Some additional $60 processing required. $80 25% Somewhat difficult and slow mining. Additional processing required D $100 25% Very difficult mining. Significant additional processing required. Scenario Description Probability Cost of Production ($/ton) A $40 25% Very easy mining. No additional processing required. B 25% Easy mining. Some additional $60 processing required. $80 25% Somewhat difficult and slow mining. Additional processing required D $100 25% Very difficult mining. Significant additional processing requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started