Answered step by step

Verified Expert Solution

Question

1 Approved Answer

your company environmentally conscius and is considering two heating options for a new research buildng.What you know about each option is below, and your company

your company environmentally conscius and is considering two heating options for a new research buildng.What you know about each option is below, and your company will use an annual interest rate (MARR) %5 for this decision. Which is the lower cost option for the company ?

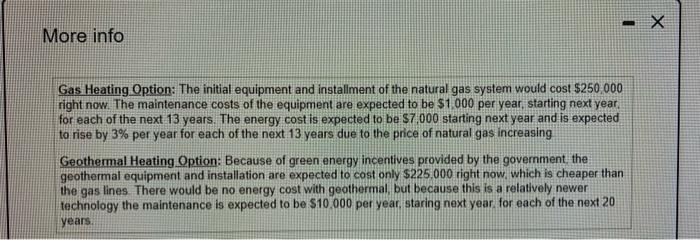

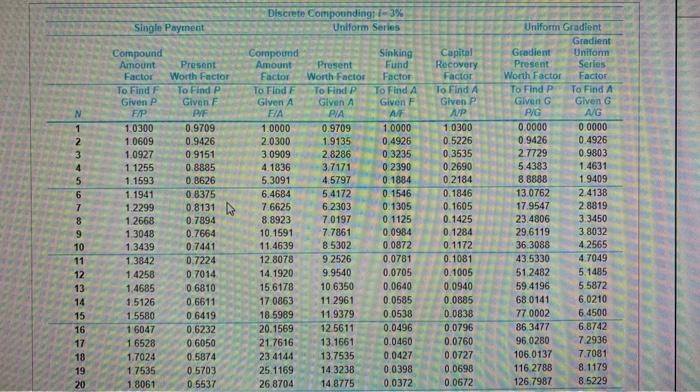

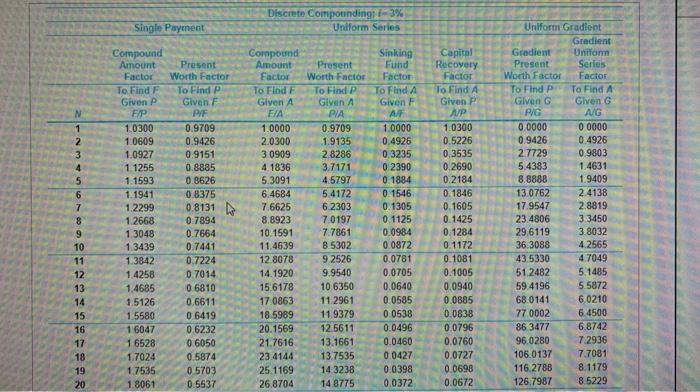

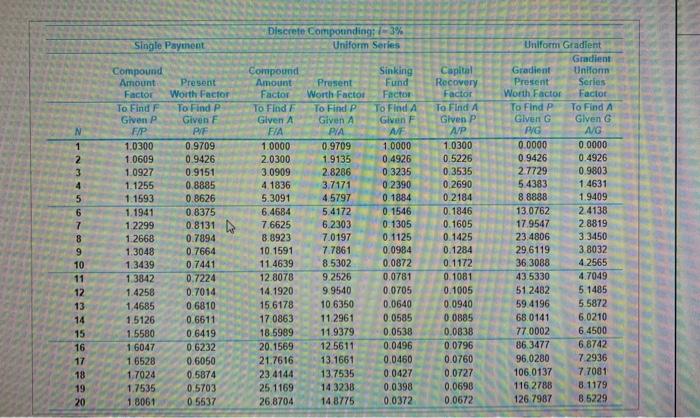

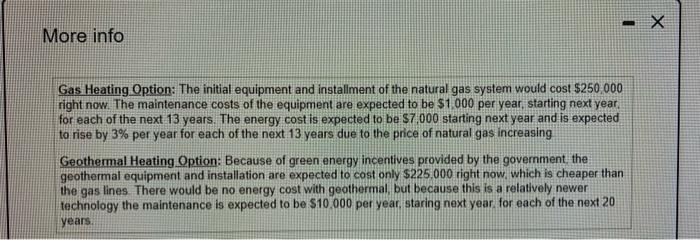

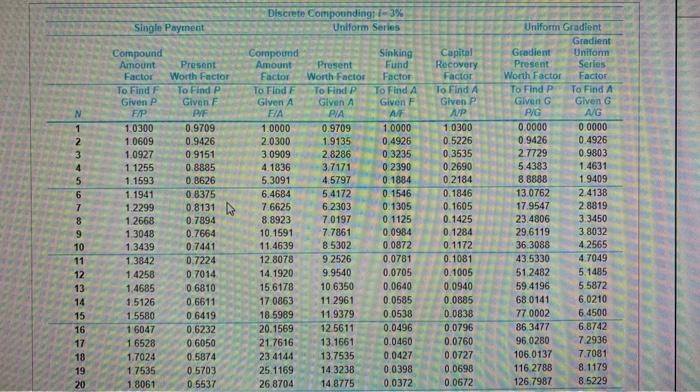

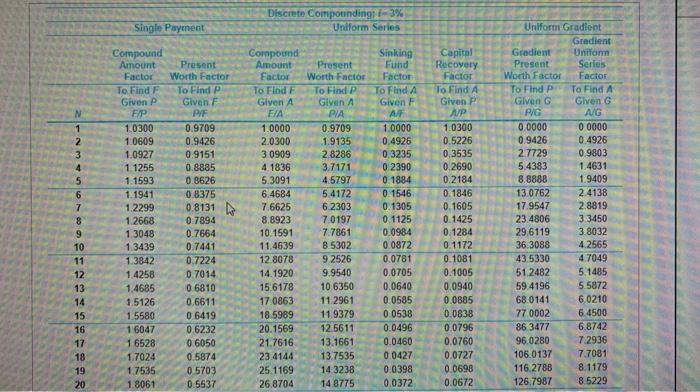

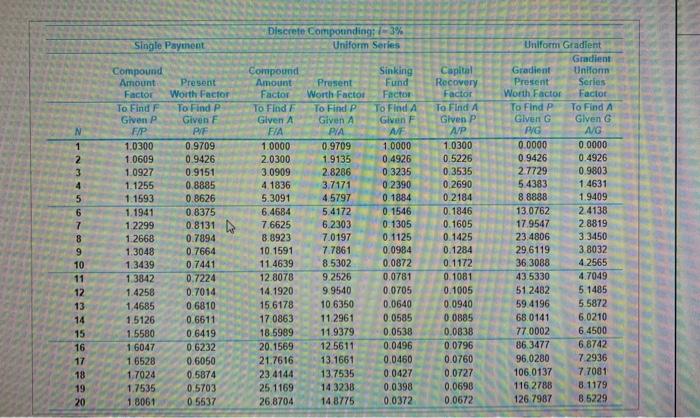

odontologo ang Waar Wante company w MAR wa CL WW na www The The -X More info Gas Heating Option: The initial equipment and installment of the natural gas system would cost $250 000 right now. The maintenance costs of the equipment are expected to be $1.000 per year, starting next year. for each of the next 13 years. The energy cost is expected to be $7,000 starting next year and is expected to rise by 3% per year for each of the next 13 years due to the price of natural gas increasing Geothermal Heating Option: Because of green energy incentives provided by the government, the geothermal equipment and installation are expected to cost only $225.000 right now, which is cheaper than the gas lines. There would be no energy cost with geothermal, but because this is a relatively newer technology the maintenance is expected to be $10.000 per year, staring next year for each of the next 20 years Discrete Compoundings - 3% Uniform Series Single Payment N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Compound Amount Factor To Find F Given P FAP 10300 1.0609 1.0927 1 1255 1.1593 1.1941 1.2299 1.2668 13048 1.3439 13842 1.4258 1,4685 1.5126 1.5580 16047 1 6528 1.7024 1.7535 1.8061 Present Worth Factor To Find P Given F PE 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 08131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6511 0 6419 0.6232 0.6050 0.5874 0.5703 0.5537 Compound Amount Factor To Find Given A FIA 1.0000 2.0300 30909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12 8078 14.1920 15.6178 17.0863 18.5989 20.1569 21.7616 23.4144 25.1169 26.8704 Present Worth Factor To Find Given A PVA 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 9.2526 9.9540 106350 11 2961 11.9379 12 5611 13.1661 13.7535 14 3238 14.8775 Sinking Fund Factor To Find A Given AF 1.0000 0.4926 0.3235 02390 0.1884 0.1546 0.1305 0 1125 0.0984 0.0872 0.0781 0.0705 0.0640 0.0585 0.0538 0.0496 0.0460 0.0427 00398 0.0372 Capital Recovery Factor To Find A Given P A/P 1.0300 0.5226 0.3535 0.2690 0.2184 0.1846 0.1605 0.1425 0.1284 0.1172 0.1081 0.1005 0.0940 0.0885 0.0838 0.0796 0.0760 0.0727 0.0698 0.0672 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G PG A/G 0.0000 0.0000 0.9426 0.4926 2.7729 0.9803 5.4383 1.4631 8.8888 1.9409 13.0762 2.4138 17.9547 2.8819 23.4806 3.3450 29,6119 3.8032 36.3088 4.2565 43.5330 4.7049 51 2482 5.1485 59.4196 5 5872 68 0141 6.0210 77 0002 6.4500 86.3477 6.8742 96.0280 7.2936 106.0137 7.7081 116.2788 8.1179 126.7987 8.5229 Discrete Compoundings - 3% Uniform Series Single Payment N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Compound Amount Factor To Find F Given P FAP 10300 1.0609 1.0927 1 1255 1.1593 1.1941 1.2299 1.2668 13048 1.3439 13842 1.4258 1,4685 1.5126 1.5580 16047 1 6528 1.7024 1.7535 1.8061 Present Worth Factor To Find P Given F PE 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 08131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6511 0 6419 0.6232 0.6050 0.5874 0.5703 0.5537 Compound Amount Factor To Find Given A FIA 1.0000 2.0300 30909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12 8078 14.1920 15.6178 17.0863 18.5989 20.1569 21.7616 23.4144 25.1169 26.8704 Present Worth Factor To Find Given A PVA 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 9.2526 9.9540 106350 11 2961 11.9379 12 5611 13.1661 13.7535 14 3238 14.8775 Sinking Fund Factor To Find A Given AF 1.0000 0.4926 0.3235 02390 0.1884 0.1546 0.1305 0 1125 0.0984 0.0872 0.0781 0.0705 0.0640 0.0585 0.0538 0.0496 0.0460 0.0427 00398 0.0372 Capital Recovery Factor To Find A Given P A/P 1.0300 0.5226 0.3535 0.2690 0.2184 0.1846 0.1605 0.1425 0.1284 0.1172 0.1081 0.1005 0.0940 0.0885 0.0838 0.0796 0.0760 0.0727 0.0698 0.0672 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G PG A/G 0.0000 0.0000 0.9426 0.4926 2.7729 0.9803 5.4383 1.4631 8.8888 1.9409 13.0762 2.4138 17.9547 2.8819 23.4806 3.3450 29,6119 3.8032 36.3088 4.2565 43.5330 4.7049 51 2482 5.1485 59.4196 5 5872 68 0141 6.0210 77 0002 6.4500 86.3477 6.8742 96.0280 7.2936 106.0137 7.7081 116.2788 8.1179 126.7987 8.5229 Discreto Compounding 73% Uniform Series Single Payment N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Compound Amount Factor To Find Glen P F/P 1.0300 1.0609 1.0927 1.1255 1.1593 1.1941 1.2299 1.2668 13048 1.3439 1.3842 1.4258 1,4685 1.5126 1.5580 1 6047 1 6528 1.7024 1.7535 1.8061 Present Worth Factor To Find P Given F PE 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0 8131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6511 0.6419 0.6232 0.6050 0.5874 0.5703 0.5637 Compound Amount Factor To Find Given A FIA 1.0000 2.0300 3.0909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12 8078 14.1920 15 6178 17 0863 18.5989 20.1569 21.7616 23 4144 25.1169 26.8704 Present Worth Factor To Find P Given A PA 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 9.2526 9.9540 10.6350 112961 11.9379 12 5611 13.1661 137535 14 3238 14.8775 Sinking Fund Factor To Find A Given F AF 1.0000 0.4926 0.3235 0.2390 0 1884 0 1546 0 1305 0.1125 0.0984 0.0872 0.0781 0.0705 0.0640 0.0585 0.0538 0.0496 0.0460 0.0427 0.0398 0.0372 Capital Recovery Factor To Find A Given P A/P 1.0300 0.5226 0.3535 0.2690 0.2184 0.1846 0.1605 0.1425 0.1284 0.1172 0.1081 0.1005 0.0940 0.0885 0.0838 0.0796 0.0760 0.0727 0.0696 0.0672 Uniform Gradient Gradient Gradient Unifon Present Series Worth Factor Factor To Find P To Find A Given G Given G PVG ANG 0.0000 0.0000 0.9426 0.4926 2.7729 09803 5.4383 1.4631 8 8888 1.9409 13.0762 24138 17.9547 28819 23.4806 3.3450 29.6119 3.8032 36.3088 4.2565 43.5330 4.7049 51 2482 5 1485 59.4196 5 5872 68.0141 6.0210 770002 6 4500 86 3477 6 8742 96.0280 72936 106.0137 7.7081 116 2788 8.1179 126 7987 8.5229

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started