Answered step by step

Verified Expert Solution

Question

1 Approved Answer

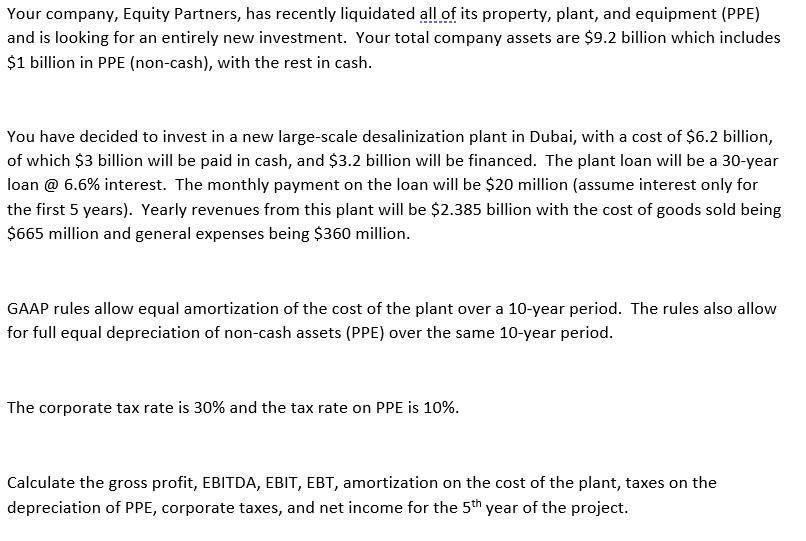

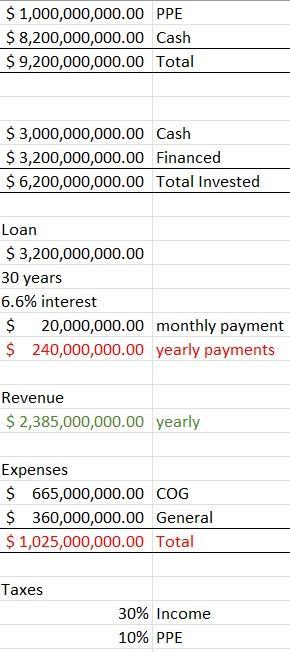

Your company, Equity Partners, has recently liquidated all of its property, plant, and equipment (PPE) and is looking for an entirely new investment. Your

Your company, Equity Partners, has recently liquidated all of its property, plant, and equipment (PPE) and is looking for an entirely new investment. Your total company assets are $9.2 billion which includes $1 billion in PPE (non-cash), with the rest in cash. You have decided to invest in a new large-scale desalinization plant in Dubai, with a cost of $6.2 billion, of which $3 billion will be paid in cash, and $3.2 billion will be financed. The plant loan will be a 30-year loan @ 6.6% interest. The monthly payment on the loan will be $20 million (assume interest only for the first 5 years). Yearly revenues from this plant will be $2.385 billion with the cost of goods sold being $665 million and general expenses being $360 million. GAAP rules allow equal amortization of the cost of the plant over a 10-year period. The rules also allow for full equal depreciation of non-cash assets (PPE) over the same 10-year period. The corporate tax rate is 30% and the tax rate on PPE is 10%. Calculate the gross profit, EBITDA, EBIT, EBT, amortization on the cost of the plant, taxes on the depreciation of PPE, corporate taxes, and net income for the 5th year of the project. $ 1,000,000,000.00 $ 8,200,000,000.00 $ 9,200,000,000.00 $ 3,000,000,000.00 $ 3,200,000,000.00 $ 6,200,000,000.00 Loan $ 3,200,000,000.00 30 years 6.6% interest $ 20,000,000.00 $ PPE Cash Total Cash Financed Total Invested monthly payment 240,000,000.00 yearly payments Revenue $ 2,385,000,000.00 yearly Taxes Expenses $ 665,000,000.00 COG $360,000,000.00 General $ 1,025,000,000.00 Total 30% Income 10% PPE

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started