Answered step by step

Verified Expert Solution

Question

1 Approved Answer

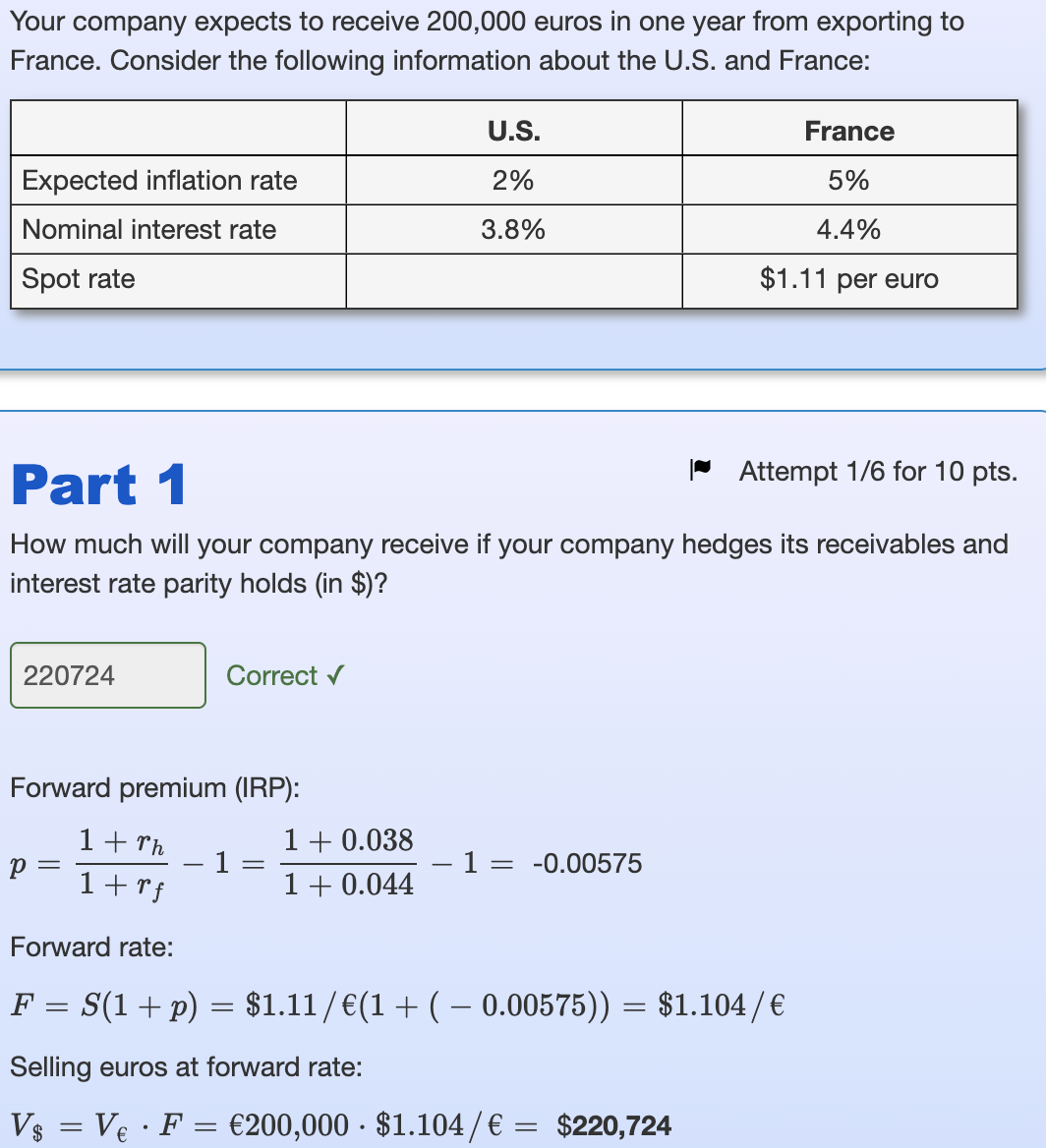

Your company expects to receive 200,000 euros in one year from exporting to France. Consider the following information about the U.S. and France: Part 1

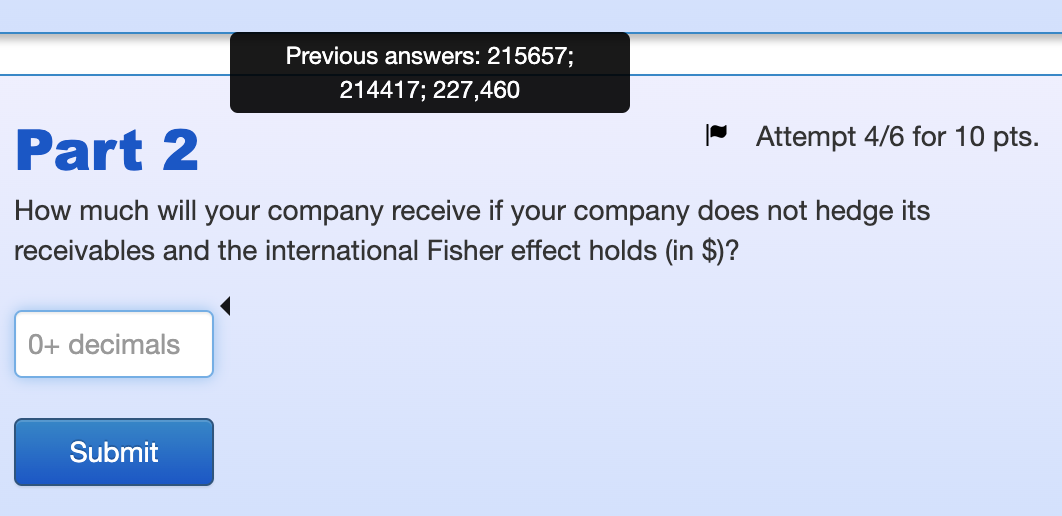

Your company expects to receive 200,000 euros in one year from exporting to France. Consider the following information about the U.S. and France: Part 1 Attempt \\( 1 / 6 \\) for 10 pts. How much will your company receive if your company hedges its receivables and interest rate parity holds (in \\$)? Correct \\( \\checkmark \\) Forward premium (IRP): \\[ p=\\frac{1+r_{h}}{1+r_{f}}-1=\\frac{1+0.038}{1+0.044}-1=-0.00575 \\] Forward rate: \\[ F=S(1+p)=\\$ 1.11 / (1+(-0.00575))=\\$ 1.104 / \\] Selling euros at forward rate: \\[ V_{\\$}=V_{} \\cdot F= 200,000 \\cdot \\$ 1.104 / =\\$ 220,724 \\] How much will your company receive if your company does not hedge its receivables and the international Fisher effect holds (in \\$)

Your company expects to receive 200,000 euros in one year from exporting to France. Consider the following information about the U.S. and France: Part 1 Attempt \\( 1 / 6 \\) for 10 pts. How much will your company receive if your company hedges its receivables and interest rate parity holds (in \\$)? Correct \\( \\checkmark \\) Forward premium (IRP): \\[ p=\\frac{1+r_{h}}{1+r_{f}}-1=\\frac{1+0.038}{1+0.044}-1=-0.00575 \\] Forward rate: \\[ F=S(1+p)=\\$ 1.11 / (1+(-0.00575))=\\$ 1.104 / \\] Selling euros at forward rate: \\[ V_{\\$}=V_{} \\cdot F= 200,000 \\cdot \\$ 1.104 / =\\$ 220,724 \\] How much will your company receive if your company does not hedge its receivables and the international Fisher effect holds (in \\$) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started