Question

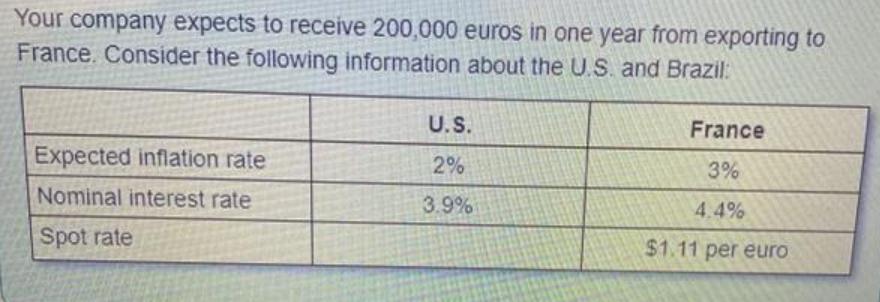

Your company expects to receive 200,000 euros in one year from exporting to France. Consider the following information about the U.S. and Brazil: U.S.

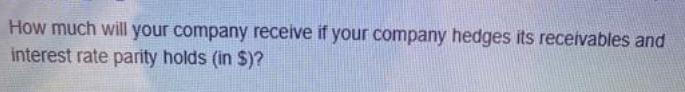

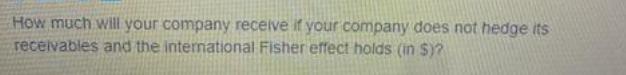

Your company expects to receive 200,000 euros in one year from exporting to France. Consider the following information about the U.S. and Brazil: U.S. France Expected inflation rate 2% 3% Nominal interest rate 3.9% 4.4% Spot rate $1.11 per euro How much will your company receive if your company hedges its receivables and interest rate parity holds (in $)? How much will your company receive if your company does not hedge its receivables and the international Fisher effect holds (in $)?

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution IR Inflation Rate AIR Nominal Interest Rate SK Spot Rate Part I Rec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App