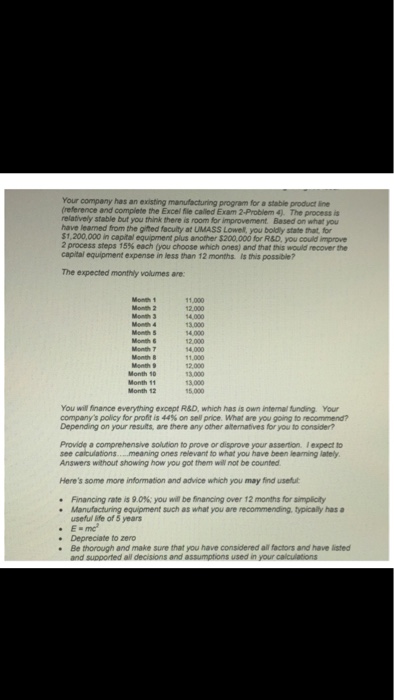

Your company has an existing (reference and complete the Excel file called Exam 2-Problem 4). The process is relatively stable but you think there is room for improvement. Based on what have leamed from the gifted fecuity at UMASS Lowell, you boldly state that, for $1,200,000 in capital equipment plus another $200,000 for R&D, you could improve 2process steps 15% each (you choose which ones) and that this would recover the capital equipment expense in less than 12 months Is this possible? program for a stable product ine you The expected monthly volumes are Month 1 Month 2 Month 3 Month 4 11,000 12,000 14,000 13,000 4,000 12,000 Month & Month 7 Month & 11,000 2,000 13,000 13,000 Month 10 Month 11 Month 12 You will finance everything expept R&D, which has is own internal funding Your company's policy for profit is 44% on sel price. What are you going to recommend? Depending on your resuits, are there any other atermatives for you to consider? Provide a comprehensive solution to prove or disprove your assertion. Iexpect to see calculations....meaning ones relevant to what you have been learning lately Answers without showing how you got them will not be counted Here's some more information and advice which you may find usefut Financing rate is 90%; you will be financing over 12 months for smploty Manufacturing equipment such as what you are recommending. typically has a useful life of 5 years E me * e Depreciate to zero Be thorough and make sure that you have considered all factors and have listed Your company has an existing (reference and complete the Excel file called Exam 2-Problem 4). The process is relatively stable but you think there is room for improvement. Based on what have leamed from the gifted fecuity at UMASS Lowell, you boldly state that, for $1,200,000 in capital equipment plus another $200,000 for R&D, you could improve 2process steps 15% each (you choose which ones) and that this would recover the capital equipment expense in less than 12 months Is this possible? program for a stable product ine you The expected monthly volumes are Month 1 Month 2 Month 3 Month 4 11,000 12,000 14,000 13,000 4,000 12,000 Month & Month 7 Month & 11,000 2,000 13,000 13,000 Month 10 Month 11 Month 12 You will finance everything expept R&D, which has is own internal funding Your company's policy for profit is 44% on sel price. What are you going to recommend? Depending on your resuits, are there any other atermatives for you to consider? Provide a comprehensive solution to prove or disprove your assertion. Iexpect to see calculations....meaning ones relevant to what you have been learning lately Answers without showing how you got them will not be counted Here's some more information and advice which you may find usefut Financing rate is 90%; you will be financing over 12 months for smploty Manufacturing equipment such as what you are recommending. typically has a useful life of 5 years E me * e Depreciate to zero Be thorough and make sure that you have considered all factors and have listed