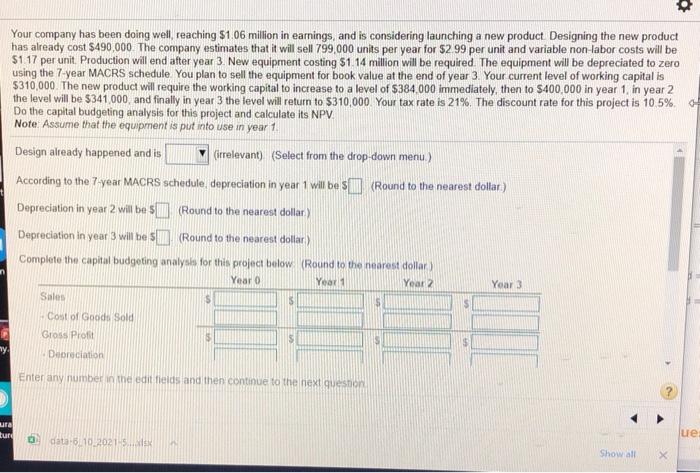

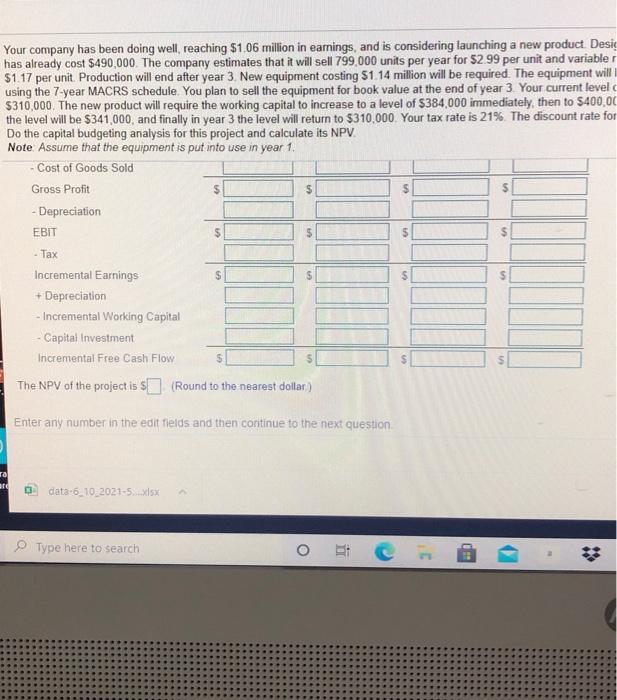

Your company has been doing well, reaching 51.06 million in earnings, and is considering launching a new product Designing the new product has already cost $490,000. The company estimates that it will sell 799,000 units per year for $299 per unit and variable non labor costs will be $117 per unit. Production will end after year 3. New equipment costing $1. 14 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule you plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $310,000. The new product will require the working capital to increase to a level of $384.000 immediately, then to $400,000 in year 1. in year 2 the level will be $341 000, and finally in year 3 the level will return to $310,000 Your tax rate is 21%. The discount rate for this project is 10.5% Do the capital budgeting analysis for this project and calculate its NPV Note Assume that the equipment is put into use in year 1 Design already happened and is (irrelevant) (Select from the drop down menu.) According to the 7-year MACRS schedule, depreciation in year 1 will be(Round to the nearest dollar) Depreciation in year 2 will be $ (Round to the nearest dollar) Depreciation in year 3 will be SIM (Round to the nearest dollar) Complete the capital budgeting analysis for this project below (Round to the nearest dollar Year 0 Year 1 Year 2 Yoar 3 Sales $ Cost of Goods Sold Gross Profit S my Depreciation Enter any number in the edit fields and then continue to the next question ura turd ue data 5.10.20215 Show all Your company has been doing well, reaching $1.06 million in earnings, and is considering launching a new product Desig has already cost $490,000 The company estimates that it will sell 799,000 units per year for $2.99 per unit and variable $1.17 per unit. Production will end after year 3. New equipment costing 51.14 million will be required. The equipment will using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3 Your current level $310,000. The new product will require the working capital to increase to a level of $384.000 immediately, then to 5400,00 the level will be $341,000, and finally in year 3 the level will return to $310,000 Your tax rate is 21%. The discount rate for Do the capital budgeting analysis for this project and calculate its NPV. Note Assume that the equipment is put into use in year 1. -Cost of Goods Sold Gross Profit $ S CA $ - Depreciation EBIT $ $ - Tax Incremental Earnings S S $ $ + Depreciation - Incremental Working Capital - Capital Investment Incremental Free Cash Flow The NPV of the project is $(Round to the nearest dollar) Enter any number in the edit hields and then continue to the next question Ta re 0 data-6_10_2021-5 Type here to search O ) *