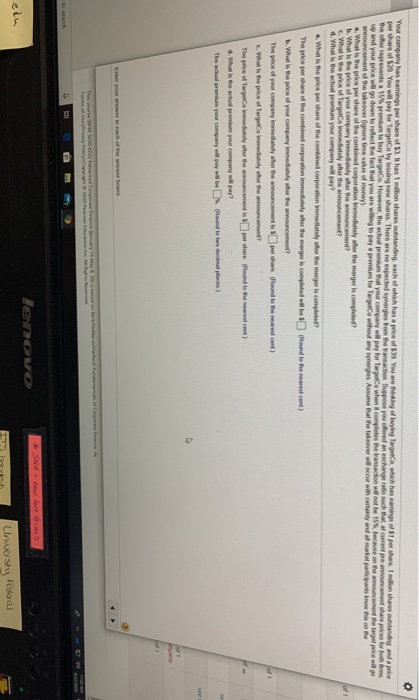

Your company has earnings per share of $3. It has 1 milion shares outstanding, each of which has a price of $99 You are per share of You will pay for king of being target geta by vingnew whares. There are no expected synergies from the transaction Suppose you offered an exchange which has earings of pershareI con share outstanding and price such the offer represents a 15% presum to buy Targu a curent pre u ncement share prices for both However, the actual prokurat your company will pay for larger Co when it comes the transaction will not be up and your price will go down to the lace that you are willing to pay a premium for Cargo without any synergies Assume that the takeover woccur with certy and all mare participants know this on the became one aruncement the target price will go On cement of the takeover grore time value of money) a. What is the price per share of the combined corporation mediately after the merger is completed? b. What the price of your company y er the amouncement? c. What is the price of geo mediately after the announcement? d. What is the actual prom your company will pay! .. What is the price per share of the combined corporation mediately after the merger is completed The price per share of the combined corporation mediately after the merger is completed wil b o und to the nearest cont . What is the price of your company way for the announcement? The price of your company who the announcements where und to the nearest cant) 5. What is the price of larget e d the wouncement? The price of comedy the mountamenti per share end to the nearest.cont) d. What is the actual prom your company will pay? The acharom your company will pay and to two decimal places) lenovo edu FI Universy Federal Your company has earnings per share of $3. It has 1 milion shares outstanding, each of which has a price of $99 You are per share of You will pay for king of being target geta by vingnew whares. There are no expected synergies from the transaction Suppose you offered an exchange which has earings of pershareI con share outstanding and price such the offer represents a 15% presum to buy Targu a curent pre u ncement share prices for both However, the actual prokurat your company will pay for larger Co when it comes the transaction will not be up and your price will go down to the lace that you are willing to pay a premium for Cargo without any synergies Assume that the takeover woccur with certy and all mare participants know this on the became one aruncement the target price will go On cement of the takeover grore time value of money) a. What is the price per share of the combined corporation mediately after the merger is completed? b. What the price of your company y er the amouncement? c. What is the price of geo mediately after the announcement? d. What is the actual prom your company will pay! .. What is the price per share of the combined corporation mediately after the merger is completed The price per share of the combined corporation mediately after the merger is completed wil b o und to the nearest cont . What is the price of your company way for the announcement? The price of your company who the announcements where und to the nearest cant) 5. What is the price of larget e d the wouncement? The price of comedy the mountamenti per share end to the nearest.cont) d. What is the actual prom your company will pay? The acharom your company will pay and to two decimal places) lenovo edu FI Universy Federal