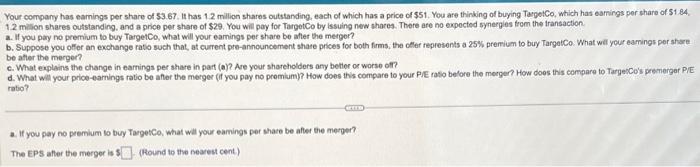

Your company has earnings per share of 53.67 . It has 1.2 million shares outstanding, each of which has a price of 551 . You are thinbing of buying TargeiCo, which has earnings per share of 51.84 . 12 milion shares outstanding, and a price per share of $29. You will pay for TargetCo by issuing new shares. There are no expocted synergies trom the iransaction. a. If you pary no premium to buy TargetCo, what will your eamings per share be aher the mergor? b. Suppose you ofler an exchange ratio such that, at current pre-announcement share prices for both frms, the oller represonts a 25% premium to buy TargaiCo. What will your eamings per ahare be atter the merger? c. What explains the change in earnings per share in part (a)? Are your shareholders any betlor or worso off? d. What will your price-eamings ratio be afher the merger (if you pay no premium)? How does this compare to your PfE raso before the morger? How does this compare to TargedCo's premergar P/E retio? a. If you pay no premium to buy TargetCo, what will your eamings per share be after the merper? The EPS atter the merger is 5 (Round to the nearest cent) Your company has earnings per share of 53.67 . It has 1.2 million shares outstanding, each of which has a price of 551 . You are thinbing of buying TargeiCo, which has earnings per share of 51.84 . 12 milion shares outstanding, and a price per share of $29. You will pay for TargetCo by issuing new shares. There are no expocted synergies trom the iransaction. a. If you pary no premium to buy TargetCo, what will your eamings per share be aher the mergor? b. Suppose you ofler an exchange ratio such that, at current pre-announcement share prices for both frms, the oller represonts a 25% premium to buy TargaiCo. What will your eamings per ahare be atter the merger? c. What explains the change in earnings per share in part (a)? Are your shareholders any betlor or worso off? d. What will your price-eamings ratio be afher the merger (if you pay no premium)? How does this compare to your PfE raso before the morger? How does this compare to TargedCo's premergar P/E retio? a. If you pay no premium to buy TargetCo, what will your eamings per share be after the merper? The EPS atter the merger is 5 (Round to the nearest cent)